The stock market closed mixed on Tuesday, with S&P 500 closing flat at 6,725. NASDAQ slipped 0.2% due to some weakness in major tech stocks.

The stock market closed mixed on Tuesday, with S&P 500 closing flat at 6,725. NASDAQ slipped 0.2% due to some weakness in major tech stocks.

Investors are keeping a close eye on the upcoming week as key third-quarter earnings reports are set to be released.

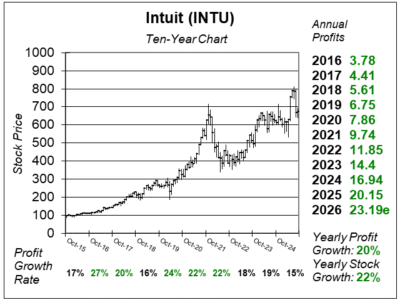

Chart of the Day

Here is the ten-year chart of Intuit (INTU) as of September 18, 2025, when the stock was at $675.

Here is the ten-year chart of Intuit (INTU) as of September 18, 2025, when the stock was at $675.

Intuit is transforming into an AI-powered business platform, combining its software with AI agents and human experts. The company has launched a transformative all-in-one business platform with a virtual team of AI agents and AI-enabled human experts to deliver “done-for-you” experiences across tax, accounting, and financial management. Intuit’s “done-for-you” experiences are reducing manual work by up to 50% for customers when setting up projects.

Meanwhile, INTU stock has been weak lately, but when David Sharek, Founder of School of Hard Stocks, reviewed the numbers, they looked fine to him. Last quarter, the company delivered 38% profit growth on 20% revenue growth, which was great for this 14% long-term grower.

Looking ahead, analysts expect 24% profit growth next quarter. The stock is also undervalued in our opinion with a P/E of 29.

INTU is part of our Conservative Growth Portfolio.