The stock market grew on Monday as investors shook off tariff threats by President Donald Trump on more countries over the weekend. Despite the renewed tensions, they looked ahead to a key inflation report and a busy week of earnings.

The stock market grew on Monday as investors shook off tariff threats by President Donald Trump on more countries over the weekend. Despite the renewed tensions, they looked ahead to a key inflation report and a busy week of earnings.

Overall, S&P 500 rose 0.1% to 6,269, while NASDAQ increased 0.3% to 20,640.

Tweet of the Day

Atour Lifestyle $ATAT is Breaking Out to New Highs After Getting Attention

— SchoolofHardStocks (@SchoolHardStock) July 14, 2025

Chart of the Day

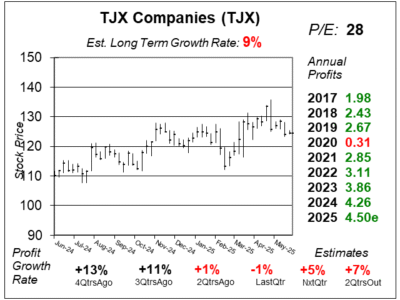

Here is the one-year chart of TJX Companies (TJX) as of June 16, 2025, when the stock was at $124.

Here is the one-year chart of TJX Companies (TJX) as of June 16, 2025, when the stock was at $124.

In terms of divisions, HomeGoods and TJX International led the way with 8% sales growth, while Marmaxx (which consists of TJ Maxx and Marshall’s) grew 4%. TJX Canada was the weakest division with 3% sales growth.

Demand remained strong in home, apparel, and e-commerce.

To manage tariffs, TJX Companies is buying closer to need, adjusting prices, and working with vendors. With under 10% of products directly imported, it has sourcing flexibility. Inventories rose 15% as the company capitalized on strong buying opportunities.

Management remains confident in maintaining value and fresh assortments, continuing to attract a broad customer base, especially lower-income shoppers, through diverse products and targeted marketing.

TJX is part of our Conservative Growth Portfolio.