My Top Ten growth stocks for 2025 has some nice diversity this year, with a handful of well-known names and a few new stocks investorts might not be aware of.

My Top Ten growth stocks for 2025 has some nice diversity this year, with a handful of well-known names and a few new stocks investorts might not be aware of.

I wasn’t looking for “big names” when setting up this list. I searched the list of stocks in my Growth Portfolio for good upside potential.

First on the list is the current leader of the Artificial Intelligence rally in NVIDIA (NVDA).

Next up is Tesla (TSLA) which could release Robotaxis as well as robots in 2025.

We have two online retailers in Amazon (AMZN) and Mercardolibre (MELI) as well as tech giants Alphabet (GOOGL) and Meta (META).

Here’s my Top Ten growth stocks for 2025…

Charts are one-year charts showing qtrly profit growth along the bottom. Note the charts and tables are from the latest quarter (2024 Q4). The stocks have moved in price since these images were made.

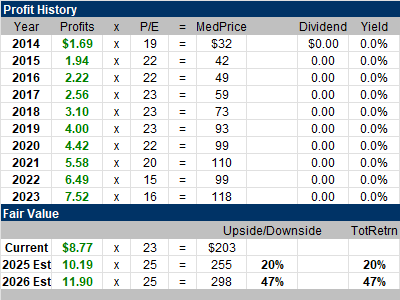

NVIDIA (NVDA) is the #1 manufacturer of AI hardware. The company makes the brains behind AI, and has a substantial lead in the hardware space. It’s new next-generation Blackwell GPUs are launching any day now and will be a catalyst for profits.

NVIDIA (NVDA) is the #1 manufacturer of AI hardware. The company makes the brains behind AI, and has a substantial lead in the hardware space. It’s new next-generation Blackwell GPUs are launching any day now and will be a catalyst for profits.

NVDA stock has been hot the past year, but I think its still cheap.

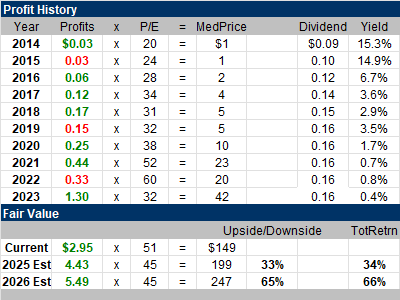

Notice in the Profit History table the Current line is info as of when the table was made (analyst’s 2024 profit estimates, current P/E, and stock price at the time).

The 2025 Est. line uses 2025’s profit estimates along with the P/E I think the stock should have, and this is how the price target is derived.

Note, my Fair Value is a P/E of 45. When we combine that with 2025 profit estimates this gives me a Fair Value of $199 with upside of 33%.

NVIDIA is the top holding in my Growth Portfolio and Aggressive Growth Portfolio. The P/E of 34 is very reasonable. My analysis shows the stock going from around $150 to $200 by the end of 2025.

Tesla (TSLA) designs, develops, manufactures, sells, and leases high-performance fully electric vehicles (EVs), energy generation, and energy storage systems. Its Full Self-Driving autopilot system for autos is expected to become a catalyst for the company.

Tesla (TSLA) designs, develops, manufactures, sells, and leases high-performance fully electric vehicles (EVs), energy generation, and energy storage systems. Its Full Self-Driving autopilot system for autos is expected to become a catalyst for the company.

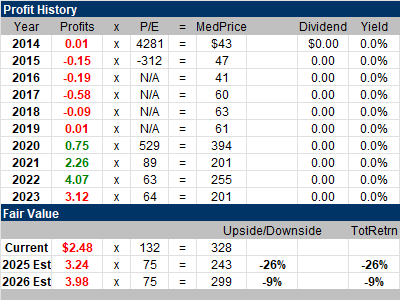

Tesla has a couple catalysts that could push profits higher in Robotaxi’s and the Optimus robot. But analysts haven’t figured in what these will do for profits. So these estimates could be low. Thus, my math shows TSLA stock to be undervalued even though I believe it could be one of the big winners of 2025.

TSLA is part of my Growth Portfolio. and Aggressive Growth Portfolio.

MercadoLibre (MELI) is the largest online commerce platform in Latin America and gives users a portfolio of services to do commercial transactions.

MercadoLibre (MELI) is the largest online commerce platform in Latin America and gives users a portfolio of services to do commercial transactions.

This company looks a lot like Amazon (AMZN) did when its profits began rolling in.

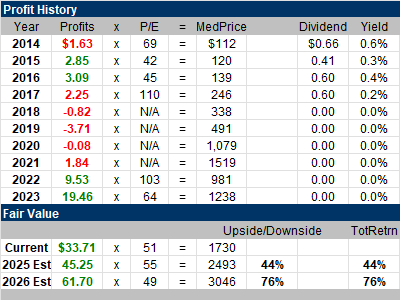

MELI’s numbers are exceptional, especially profit estimates for the years ahead.

Analysts estimate MELI’s profits to grow from to around $100 in 2028. A 45 P/E on $100 in profits would get this stock to $4500.

MELI is a top holding in the Aggressive Growth Portfolio and Growth Portfolio.

Amazon (AMZN) is rolling in the profits due to better delivery efficiencies. Most notably is the company went from utilizing one big warehouse to utilizing eight. This sped up deliveries and boosted profit margins as well.

Amazon (AMZN) is rolling in the profits due to better delivery efficiencies. Most notably is the company went from utilizing one big warehouse to utilizing eight. This sped up deliveries and boosted profit margins as well.

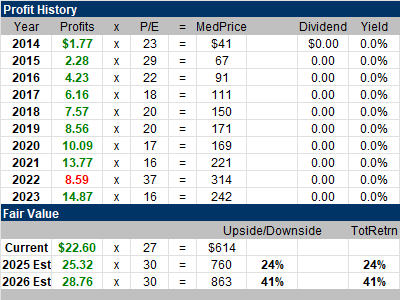

Profits jumped 52% last quarter and analysts estimate growth of 47% and 40% the next two quarters.

My Fair Value is a P/E of 50. That gives the stock around 50% upside to my 2025 Fair Value of $303 a share.

AMZN is part of the Growth Portfolio and Aggressive Growth Portfolio.

Alphabet (GOOGL) delivered impressive growth last quarter, dropping 37% profit growth on 15% revenue growth.

Alphabet (GOOGL) delivered impressive growth last quarter, dropping 37% profit growth on 15% revenue growth.

The highlight was its Google Cloud segment’s 35% revenue growth. The Google Other segment (Play Store, YouTube subscriptions, Pixel) grew sales 28%.

I think the stock is currently undervalued. My Fair Value is a P/E of 27. I believe this stock has 42% upside for 2025 and 62% for 2026.

GOOGL is part of my Growth Portfolio, Conservative Growth Portfolio, and Aggressive Growth Portfolio.

Meta Platforms (META) delivered impressive performance last quarter as profit grew 37% on 19% revenue growth.

Meta Platforms (META) delivered impressive performance last quarter as profit grew 37% on 19% revenue growth.

The key to Meta’s success is AI implementation. It has been a big help in improving ad revenue by providing advertisers with better conversions.

My Fair Value P/E is 30. This stock has 24% upside to my $760 Fair Value for 2025.

META is part of the Growth Portfolio and Aggressive Growth Portfolio.

Clover and Zelle remained catalysts for Financial technology company Fiserv (FI).

Clover and Zelle remained catalysts for Financial technology company Fiserv (FI).

Point-of-sale system Clover had 28% revenue growth last quarter driven by new restaurant products such as self-ordering kiosks and smaller handheld checkout devices for wait staff that fit right in your back pocket.

Money transfer app Zelle had 35% transaction growth during the quarter, driven by strong demand from clients for digital payments.

And with a P/E of only 20, I believe this stock still has potential to climb. I could see FI reaching a P/E of 25. That would be $250 or so for 2025.

FI is part of the Conservative Growth Portfolio, Growth Portfolio, Aggressive Growth Portfolio. It’s a safe stock with a high-teens growth rate and a low P/E.

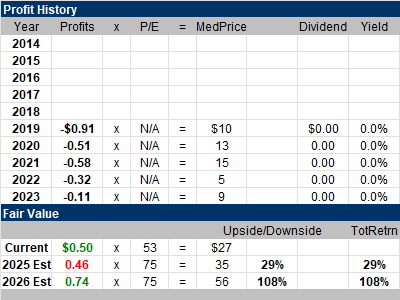

Dutch Bros (BROS) is a quick-service drive-thru coffee shop chain that serves up iced coffee, energy drinks, and a few snacks.

Dutch Bros (BROS) is a quick-service drive-thru coffee shop chain that serves up iced coffee, energy drinks, and a few snacks.

The company had its first franchise in 2000 and has since grown into an operation with 831 coffee shops, as of December 31, 2023. BROS is on pace for 150 new shops in 2024.

In the future, expect a more robust food offering with an expanded bakery and hot food options.

This is too young of a company to price the stock on a P/E basis, so I will use price-to-sales. This quarter, the stock sells for 7x 2024 revenue estimates. My Fair Value is also 7x revenue. When I do the math I feel the stock can make its way towards $70 in 2025.

BROS is in my Growth Portfolio.

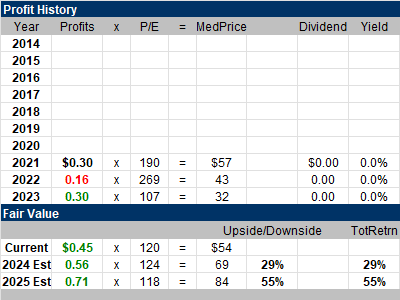

Founded in 2017, Hims & Hers (HIMS) is an online platform that gives users access to treatments to conditions including sexual health, hair loss, skin care, mental health, and weight loss.

Founded in 2017, Hims & Hers (HIMS) is an online platform that gives users access to treatments to conditions including sexual health, hair loss, skin care, mental health, and weight loss.

HIMS recently become a stock market leader after the company released news introducing a weight loss drug to compete with Eli Lilly’s Mounjaro weight loss drug.

I think the stock should have a P/E of 75. Revenue is growing rapidly and accelerating.

HIMS is part of the Growth Portfolio. It’s a high risk, high reward stock.

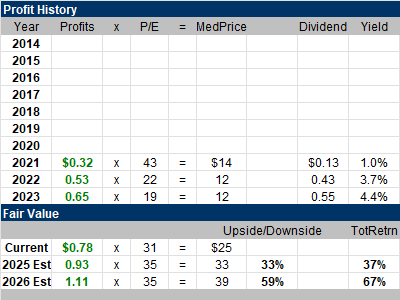

Blue Owl Capital (OWL) is a specialty finance company providing lending to US middle-market companies, large alternative asset managers, and corporate real estate owners. Its an alternative asset management firm that grows rapidly by making acquisitions to grow fees and revenue.

Blue Owl Capital (OWL) is a specialty finance company providing lending to US middle-market companies, large alternative asset managers, and corporate real estate owners. Its an alternative asset management firm that grows rapidly by making acquisitions to grow fees and revenue.

Last quarter, profits increased 25% on a 32% gain in revenue as management fees increased 26%. That was the 14th consecutive quarter of management fee increased.

My Fair Value is a P/E of 35, or $33 a share, giving the stock upside of 33% from the recent quote.

I just added OWL to the Growth Portfolio.