About The Author

David Sharek

David Sharek is stock portfolio manager at Shareks Stock Portfolios and the founder of The School of Hard Stocks.

Sharek's Growth Stock Portfolio has delivered its investors an average return of 18% per year since inception vs. the S&P 500's 10% during that time (2003-2020).

David's delivered five years of +40% returns in his 18 year career, including 106% during 2020.

David Sharek's book The School of Hard Stocks can be found on Amazon.com.

Salesforce.com, inc. is a provider of enterprise cloud computing solutions that include apps and platform services, as well as professional services. The Company focuses on customer relationship management (CRM). The Company offers six core cloud services that include sales force automation, customer service and support, marketing automation, community management, analytics and a cloud platform for building custom applications. The Company offers consulting, deployment, training, implementation and integration services to its customers to facilitate the adoption of its cloud solutions. The Company delivers its solutions as a service through all the Internet browsers and on mobile devices, on a subscription basis, primarily through its direct sales efforts and indirectly through partners. Source: Thomson Financial

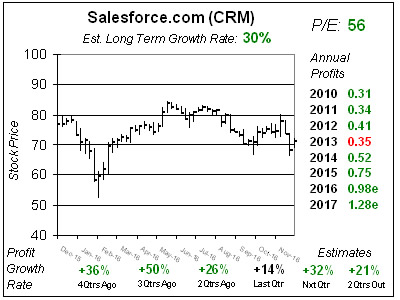

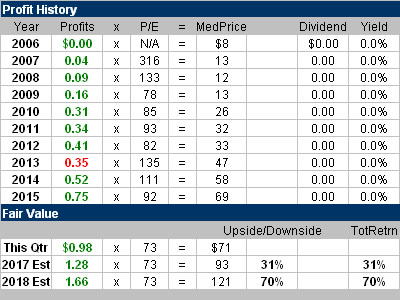

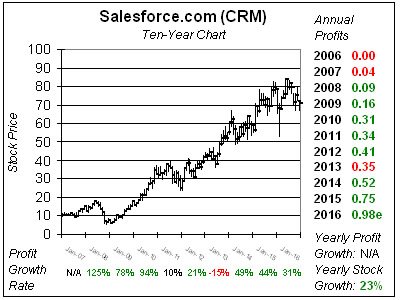

Salesforce.com, inc. is a provider of enterprise cloud computing solutions that include apps and platform services, as well as professional services. The Company focuses on customer relationship management (CRM). The Company offers six core cloud services that include sales force automation, customer service and support, marketing automation, community management, analytics and a cloud platform for building custom applications. The Company offers consulting, deployment, training, implementation and integration services to its customers to facilitate the adoption of its cloud solutions. The Company delivers its solutions as a service through all the Internet browsers and on mobile devices, on a subscription basis, primarily through its direct sales efforts and indirectly through partners. Source: Thomson Financial Salesforce.com (CRM) has some of the best software available, and that’s why its P/E is always so high. Salesforce is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud. Salesforce is state of the art and in my opinion head-and-shoulders above its competitors. I attended a salesforce conference at the Javits Center in New York City yesterday. The place was swarming with clients and potential customers. Not only does Salesforce tackle things like having your clients in a program that has details of when you spoke last and when you need to call them next, it goes way beyond that to address issues like working with a team on projects, or in my instance how much money a client has under management with you and how has the ballance grown (or declined) over time. And all the data is stored at Salesforce (the cloud). This company — and the stock — es exceptional. Just look at the ten-year chart. But everyone knows this, and that’s why the median annual P/E has been 78 or higher the last ten years. It was 72 just last qtr! But now after a back-and-forth year CRM has a P/E of just 56 (on 2017 profit estimates). I will purchase the stock for the

Salesforce.com (CRM) has some of the best software available, and that’s why its P/E is always so high. Salesforce is the world’s leader in customer relationship management (CRM) software and connects more than 150,000 clients to their customers via the internet and stores this customer information in the cloud. Salesforce is state of the art and in my opinion head-and-shoulders above its competitors. I attended a salesforce conference at the Javits Center in New York City yesterday. The place was swarming with clients and potential customers. Not only does Salesforce tackle things like having your clients in a program that has details of when you spoke last and when you need to call them next, it goes way beyond that to address issues like working with a team on projects, or in my instance how much money a client has under management with you and how has the ballance grown (or declined) over time. And all the data is stored at Salesforce (the cloud). This company — and the stock — es exceptional. Just look at the ten-year chart. But everyone knows this, and that’s why the median annual P/E has been 78 or higher the last ten years. It was 72 just last qtr! But now after a back-and-forth year CRM has a P/E of just 56 (on 2017 profit estimates). I will purchase the stock for the