The stock market closed mixed on Monday, although S&P 500 and NASDAQ climbed to new record highs once again. The former grew 0.1% to 5,573, while the latter rose 0.3% to 18,404. This rally was supported by investors’ expectations that Federal Reserve could cut its interest rates.

The stock market closed mixed on Monday, although S&P 500 and NASDAQ climbed to new record highs once again. The former grew 0.1% to 5,573, while the latter rose 0.3% to 18,404. This rally was supported by investors’ expectations that Federal Reserve could cut its interest rates.

This week, Fed Chair Jerome Powell is set to attend the Congressional committee for a semiannual testimony on Tuesday. June inflation will also be released on Thursday.

Tweet of the Day

Dollar General $DG is still a mess, as shoplifting is its most significant headwind.

Look how profit growth was -29% a year ago, and is expected to be -15% next qtr. So qtrly EPS might go from $2.98 to $2.13 and perhaps $1.80 in 3 years. pic.twitter.com/mA14bVBdkl

— David Sharek (@GrowthStockGuy) July 8, 2024

Chart of the Day

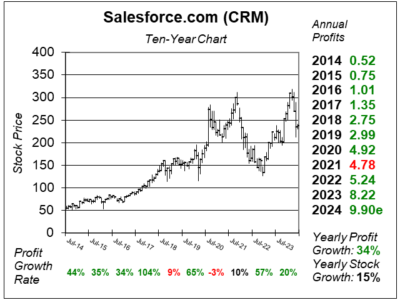

Here is the ten-year chart of Salesforce (CRM) as of June 3, 2024, when the stock was at $237.

Here is the ten-year chart of Salesforce (CRM) as of June 3, 2024, when the stock was at $237.

Salesforce stock tumbled lower after the company released last quarter’s results. The company actually did fine by our metrics, as it beat profit and revenue estimates by a little. Investors got spooked by the cautious guidance of management about the slow spending environment that is throughout the software industry. Now what? CRM is a slower grower than it was last quarter, but it is cheaper too.

CRM is part of our Growth Portfolio. It was, however, sold from the Aggressive Growth Portfolio because the stock is not expected to be a fast grower moving forward and it is not timely after the recent drop.