Stock (Symbol) |

Broadcom (AVGO) |

Stock Price |

$162 |

Sector |

| Technology |

Data is as of |

| March 31, 2025 |

Expected to Report |

| June 10 |

Company Description |

Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions. Broadcom designs, develops and supplies a range of semiconductor and infrastructure software solutions.

It operates through two segments: semiconductor solutions and infrastructure software. Its semiconductor solutions segment includes semiconductor solution product lines, as well as its Internet protocol (IP) licensing. It provides semiconductor solutions for managing the movement of data in data center, telecom, enterprise and embedded networking applications. It also provides a variety of radio frequency (RF) semiconductor devices, wireless connectivity solutions and custom touch controllers for the wireless market. Its infrastructure software segment includes its mainframe, distributed and cyber security solutions, and its fiber channel storage area networking (FC SAN) business. Its mainframe software provides DevOps, AIOps, Security and Data Management Systems solutions. Source: Refinitiv |

Sharek’s Take |

Broadcom’s (AVGO) Artificial Intelligence (AI) revenue is growing rapidly. Last quarter, AI revenue jumped 77% year-over-year (yoy) as hyperscalers ramped up AI networking orders. AVGO currently works with with big hyperscale customers in making customer AI chips. The company is deeply engaged with two other hyperscalers to create their own customized AI accelerators. In addition, two additional hyperscalers have also selected Broadcom to develop custom accelerators. These “new four” are not included in AVGO’s long-term projections. Next quarter, AI revenue is expected to grow another 44% yoy. Note that for the rest of Broadcom’s semiconductor business—including wireless, networking, broadband, industrial, and server chips—the company did not provide specific figures, leaving the exact impact unclear. So AVGO is growing its big hyperscale AI clients from three to seven. That’s big news. Broadcom is a semiconductor and software company that designs thousands of products for home connectivity, cloud data centers, and enterprise businesses. It is a conglomerate that was formed over 50 years of mergers and acquisitions including old-school tech companies AT&T/Bell Labs, Lucent, Hewlett-Packard and its semiconductor division, and younger industry leaders (including Broadcom, LSI, Broadcom Corporation, Brocade, CA Technologies and Symantec). The majority of AVGO’s silicon wafer manufacturing operations are designed in North America or Europe, then outsourced by the company to external foundries in Asia, such as Taiwan Semiconductor. Broadcom’s method for building AI infrastructure is different, as its building a general product that fits everyone’s needs, with hardware from different manufacturers used in the datacenter:

AVGO has two business segments:

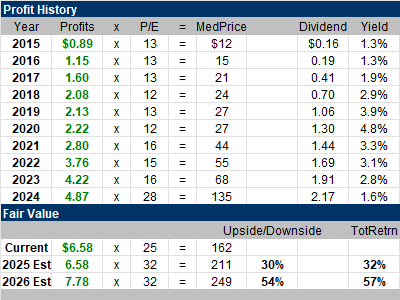

AVGO stock has an Estimated Long-Term-Growth (LTG) Rate of 19%, but the P/E of 25 makes the stock overvalued by 13%, in my opinion. AVGO also pays a nice dividend of 2%, and management buys back stock. The company has a dividend policy of pacing 50% of the prior-year’s free cash flow to investors. Since 2016, AVGO’s dividend has grown around 20% a year. AVGO is part of the Growth Portfolio and Aggressive Growth Portfolio. |

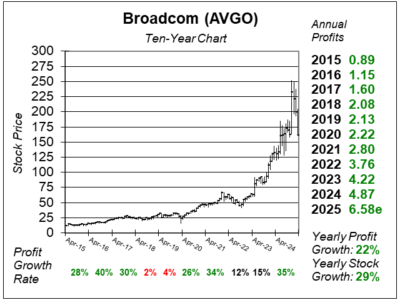

One Year Chart |

Note these charts and tables are from 3/31 when AVGO was $162. Today, 4/25, the stock is $189. Note these charts and tables are from 3/31 when AVGO was $162. Today, 4/25, the stock is $189.

This stock has a 25 P/E this quarter. The P/E was 40 last quarter as its gone from overvalued to undervalued (in my opinion). The Est. LTG is 19%, down from 20% last qtr. Qtrly profit growth was poor around a year ago as AVGO swallowed up the big VMware acquisition. Now profits are flowing at a good rate. |

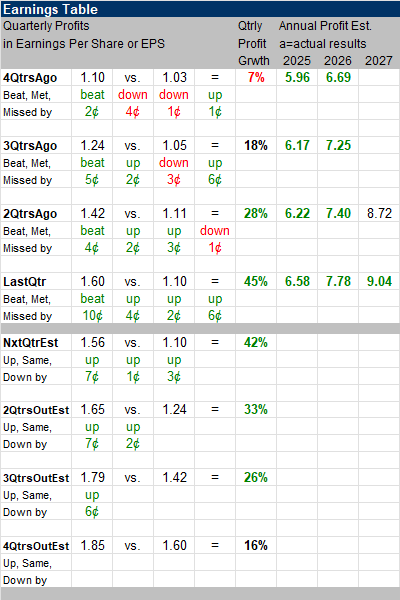

Earnings Table |

Last qtr, Broadcom posted 45% profit growth and beat expectations of 36% growth. Revenue increased 25% from a year ago, a beat from analysts estimates of 22%. Last qtr, Broadcom posted 45% profit growth and beat expectations of 36% growth. Revenue increased 25% from a year ago, a beat from analysts estimates of 22%.

Annual Profit Estimates increased this qtr. Qtrly Profit Estimates for the next 4 qtrs are 42%, 33%, 26%, and 16%. These are excellent numbers! For next qtr, analysts expect revenue to grow 25%. |

Fair Value |

AVGO stock has been undervalued for a decade now. I bought it for clients in March 2022 around $60 when the P/E was 17. AVGO stock has been undervalued for a decade now. I bought it for clients in March 2022 around $60 when the P/E was 17.

My Fair Value on AVGO is a P/E of 32. The stock has a P/E of 25. At $162 this quarter, the stock is 30% below my 2025 Fair Value of $211 a share. |

Bottom Line |

Broadcom (AVGO) has a great looking ten-year chart. Recent success made the shares go parabolic, but the stock has since digested its gains. Broadcom (AVGO) has a great looking ten-year chart. Recent success made the shares go parabolic, but the stock has since digested its gains.

Broadcom offers customized AI solutions that big hyperscalers are liking. AI revenue was up a whopping 77% last qtr. In addition, more hyperscale business is coming. And the stock is a pretty good deal after the recent pullback. AVGO moves up from 10th to 7th in the Growth Portfolio Power Rankings. The stock jumps from 12th to 3rd in the Aggressive Growth Portfolio Power Rankings. 2025 upside has gone from -13% last qtr to +30% this qtr. |

Power Rankings |

Growth Stock Portfolio

7 of 29Aggressive Growth Portfolio 3 of 13Conservative Stock Portfolio N/A |