The stock market closed mixed on Monday, with S&P 500 and NASDAQ recording gains fueled by tech stocks, particularly Amazon (AMZN). The tech giant’s shares rose after it announced a new $38 billion, seven-year cloud computing partnership with OpenAI.

The stock market closed mixed on Monday, with S&P 500 and NASDAQ recording gains fueled by tech stocks, particularly Amazon (AMZN). The tech giant’s shares rose after it announced a new $38 billion, seven-year cloud computing partnership with OpenAI.

Under the agreement, OpenAI will gain access to Amazon Web Services’ extensive bank of NVIDIA (NVDA) chips.

Overall, S&P 500 was up 0.2% to 6,852, while NASDAQ increased 0.5% to 23,835.

Tweet of the Day

Interesting take on $IREN, the stock of the day. https://t.co/iVAlmDXIBQ

— David Sharek (@GrowthStockGuy) November 3, 2025

Chart of the Day

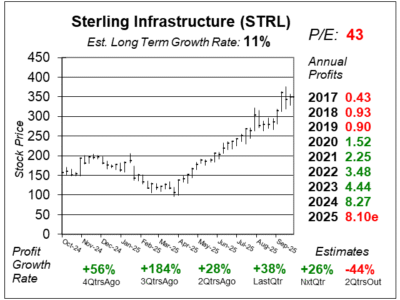

Here is the one-year chart of Sterling Infrastructure (STRL) as of October 3, 2025, when the stock was at $349.

Here is the one-year chart of Sterling Infrastructure (STRL) as of October 3, 2025, when the stock was at $349.

Sterling Construction stock is rolling as the company is making big money designing and building datacenters. The stock jumped from $210 to $350 since last quarter, and as of this writing is now at $393.

The company blew past expectations and posted 38% profit and 21% revenue growths versus the 21% and 10% prediction, respectively.

E-Infrastructure Solutions remained the biggest growth driver, accounting for half of the company’s total sales. This segment revenue climbed 29% year-on-year (YoY), driven by demand from hyperscale data center clients and new e-commerce distribution projects. Backlog increased 44% from a year earlier to roughly $1.2 billion. Management is confident in accelerating growth as it builds a strong backlog and active customer demand. E-Infrastructure Solutions leads the charge with surging data center projects and expansion into Texas, while the CEC acquisition is set to boost scale and capabilities.

The manufacturing market remains steady, with large semiconductor projects expected to ramp up in 2026–2027. Strong e-commerce construction continues to drive near-term activity.

Sterling Infrastructure expects E-Infrastructure revenue to grow 18%–20% in 2025, with margins in the mid- to high-20% range.

STRL is on our radar for our Growth Portfolio.