The stock market climbed on Thursday as investors digested a new round of corporate earnings reports. Meanwhile, Treasury Secretary Scott Bessent confirmed a long-awaited meeting with China to discuss trade regulations. Reports also indicated that the U.S. is weighing potential restrictions on U.S. software exports to China.

The stock market climbed on Thursday as investors digested a new round of corporate earnings reports. Meanwhile, Treasury Secretary Scott Bessent confirmed a long-awaited meeting with China to discuss trade regulations. Reports also indicated that the U.S. is weighing potential restrictions on U.S. software exports to China.

Overall, S&P 500 was up 0.6% to 6,738, while NASDAQ increased 0.9% to 22,942.

Tweet of the Day

— David Sharek (@GrowthStockGuy) October 23, 2025

Chart of the Day

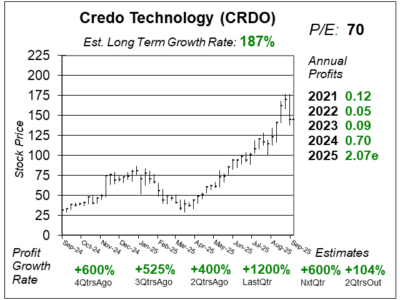

Here is the one-year chart of Credo Technology (CRDO) as of September 25, 2025, when the stock was at $145.

Here is the one-year chart of Credo Technology (CRDO) as of September 25, 2025, when the stock was at $145.

Last quarter, the company managed to deliver 1200% profit growth on 274% revenue growth – both astounding numbers. A big driver is Credo Technology’s Active Electrical Cables (AECs), which are 1000x more reliable than traditional optical solutions. They also use about the half power, making them perfect for the massive AI clusters being built. Old, thick, black copper cables take a lot of space on the rack that they block air flow, making it harder to cool the rack. Credo Technology’s purple HiWire AEC’s are thinner, with 1/4 the volume and weight of traditional cables.

Major cloud providers are already big customers and customer adoption is broadening quickly, with three hyperscalers each contributing over 10% of revenue, and a fourth on the way. Management stated this growing demand puts the company in a strong position to power the next wave of AI data centers across both cable and chip solutions.

CRDO is part of our Growth Portfolio and Aggressive Growth Portfolio.