The stock market slid on Tuesday after Iran launched missiles in Israel resulting in a spike in oil prices. This fueled investors’ geopolitical concerns.

The stock market slid on Tuesday after Iran launched missiles in Israel resulting in a spike in oil prices. This fueled investors’ geopolitical concerns.

Overall, S&P 500 dropped 0.9% to 5,709, while NASDAQ fell 1.5% to 17,910.

Tweet of the Day

I like Intuit $INTU stock, but didn't dive in to do the research as I felt it was expensive.

Here's a firm shorting the stock, @sprucepointcap . Key points: He thinks its expensive at 11x revenue for a 10% grower. https://t.co/z9HHlxqrBO

— David Sharek (@GrowthStockGuy) September 20, 2024

Chart of the Day

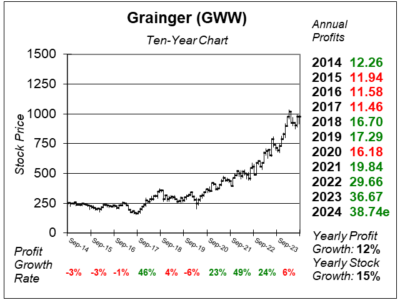

Here is the ten-year chart of Grainger (GWW) as of August 26, 2024, when the stock was at $974.

Here is the ten-year chart of Grainger (GWW) as of August 26, 2024, when the stock was at $974.

Grainger has been seeing slower growth lately, even though demand has been pretty steady. For the past three years, the maintenance supply company had been raking in profits, with earnings growing by 25% each year from 2021 to 2023. However, in the past two quarters, profit growth has been 0% and most recently 5%. Grainger had tough comparisons from the year ago periods when profits jumped 36% and 29% respectively. Management called that the demand backdrop is slow but stable. Looking ahead, profits are expected to grow in the mid- to high-single digits, which is a bit disappointing compared to the 12% to 15% growth David Sharek thinks they should be hitting.

GWW is part the Conservative Growth Portfolio.