Stock (Symbol) |

Unity Software (U) |

Stock Price |

$146 |

Sector |

| Technology |

Data is as of |

| October 18, 2021 |

Expected to Report |

| November 9 |

Company Description |

Unity Software Inc. (Unity) is a platform for creating and operating interactive, real-time three-dimensional content. The platform provides a set of software solutions to create, run and monetize interactive, real-time two-dimensional (2D) and three-dimensional (3D) content for mobile phones, tablets, personal computers, consoles, and augmented and virtual reality devices. Content made with Unity is real-time, allowing it to instantly adapt to user’s behavior and feedback. Unity’s Create Solutions are used by content creators, developers, artists, designers, engineers, and architects to create interactive, real-time 2D and 3D content. The Company’s Operate Solutions offers customers the ability to engage their end-user base, as well as run and monetize their content. Unity Software Inc. (Unity) is a platform for creating and operating interactive, real-time three-dimensional content. The platform provides a set of software solutions to create, run and monetize interactive, real-time two-dimensional (2D) and three-dimensional (3D) content for mobile phones, tablets, personal computers, consoles, and augmented and virtual reality devices. Content made with Unity is real-time, allowing it to instantly adapt to user’s behavior and feedback. Unity’s Create Solutions are used by content creators, developers, artists, designers, engineers, and architects to create interactive, real-time 2D and 3D content. The Company’s Operate Solutions offers customers the ability to engage their end-user base, as well as run and monetize their content. |

Sharek’s Take |

Unity Software (U), the leading platform for creating and operating interactive, real-time 3D content, is a key component to the metaverse. The metaverse is term used to describe an online world with people being avatars, similar to a video game. And in gaming, Unity’s market share exceeding 50% in 2020. Facebook posted earnings last night, and the highlight was that the company was going to spend wildly on engineers for its Metaverse. I take that as a bullish sign for Unity. Unity Software (U), the leading platform for creating and operating interactive, real-time 3D content, is a key component to the metaverse. The metaverse is term used to describe an online world with people being avatars, similar to a video game. And in gaming, Unity’s market share exceeding 50% in 2020. Facebook posted earnings last night, and the highlight was that the company was going to spend wildly on engineers for its Metaverse. I take that as a bullish sign for Unity.

Unity’s platform consists of software solutions to create, run, and monetize interactive real-time 2D and 3D content for mobile phones, tablets, PCs and virtual reality devices such as Facebook’s Oculus Quest. The software is primarily used to create video gamers, but Unity also serves creators including artists, architects, auto designers, and filmmakers. And there is vast opportunity for the company in industries that build such as construction to show what it looks like to walk through a home, auto to show what the options or colors of the car really look like, film to bring a more life-like entertaining experience, and retail to display apparel on the consumer. Plans include Personal (Free), Plus ($399/y per seat), Pro ($1800/yr per seat) and Enterprise ($2000/mo per 10 seats). Unity has a community of 1.4 million monthly active creators that developed over 8000 games and apps per month during 2020, with Unity Pro platform customers spending 5.2 hours a day on the platform. The company derives revenue from three operating segments:

Here are some stats and recent business highlights from last qtr:

I believe this company is currently the leader in 3D image and video creation, but think other companies such as Epic Games, Electronic Arts, and even Snap also have the ability to lead the 3D race. Unity is losing money, but investors are Ok with this as the company is growing rapidly. Unity has been a rapid grower revenue-wise with sales during the past three years of $381 million, $542 million, and $772 million. This year, the company is expected to do $1.1 billion in revenue. U stock sold for 30x revenue last qtr, which I felt was fair. This qtr the stock’s jumped and it now sells for 39x revenue. But a qtr ago, investors were concerned about competition, this qtr they aren’t. So I think the stock shoudl be worth more than it used to. Unity is part of the Aggressive Growth Portfolio. |

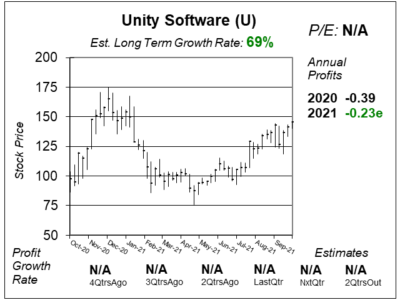

One Year Chart |

U was pummeled earlier in the year when speculative (no profit) stocks declined. The stock then based around $90-$110 and broke out with a move above $120 the day U reported last qtr’s earnings. This stock is not in an uptrend, and since the move hasn’t been real swift, I think this is a new trend. U was pummeled earlier in the year when speculative (no profit) stocks declined. The stock then based around $90-$110 and broke out with a move above $120 the day U reported last qtr’s earnings. This stock is not in an uptrend, and since the move hasn’t been real swift, I think this is a new trend.

There are no profits and P/E to show. Est. LTG is 69%. That’s excellent. |

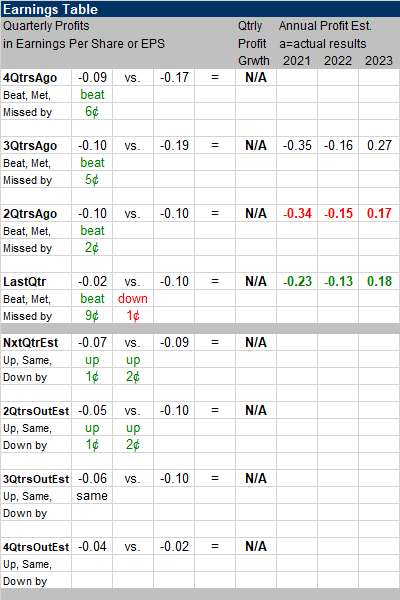

Earnings Table |

Last qtr, Unity reported profits of -$0.02 per share and exceeded estimates of -$0.11. Revenue grew 48%. Unity is seeing accelerated revenue growth. Revenue has been above 30% for 11 consecutive qtrs, and 30% growth is the sweet-spot for speculative growth stocks to strive for. Last qtr’s 48% revenue growth, which was much better than the 41% delivered two qtrs ago. Revenue climbed 39% 3QtrsAgo, and 53% 4QtrsAgo. Last qtr, Unity reported profits of -$0.02 per share and exceeded estimates of -$0.11. Revenue grew 48%. Unity is seeing accelerated revenue growth. Revenue has been above 30% for 11 consecutive qtrs, and 30% growth is the sweet-spot for speculative growth stocks to strive for. Last qtr’s 48% revenue growth, which was much better than the 41% delivered two qtrs ago. Revenue climbed 39% 3QtrsAgo, and 53% 4QtrsAgo.

Annual Profit Estimates show the company is expected to start making profits in 2023. There’s not much to see in the qtrly Estimates. |

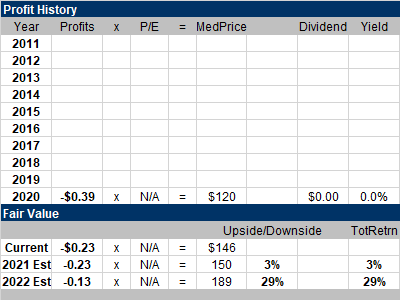

Fair Value |

My Fair Value was 30x annual revenue estimates. But I’m moving that up to 40x as (1) competition isn’t much of a concern anymore and (2) the metaverse will be a catalyst for the stock: My Fair Value was 30x annual revenue estimates. But I’m moving that up to 40x as (1) competition isn’t much of a concern anymore and (2) the metaverse will be a catalyst for the stock:

Current: 2021 Fair Value: 2022 Fair Value: |

Bottom Line |

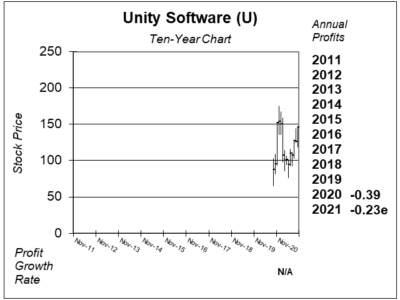

Unity Software (U) has had a choppy history since the stock went public in September 2020. After its IPO, the stock soared from an opening price of $75 to a high of $175, then cooled off as speculative stocks went out of favor. U spent a lot of time in the $90 – $110 range, then broke out in August after it reported earnigns and jumped from $107 to $121. Unity Software (U) has had a choppy history since the stock went public in September 2020. After its IPO, the stock soared from an opening price of $75 to a high of $175, then cooled off as speculative stocks went out of favor. U spent a lot of time in the $90 – $110 range, then broke out in August after it reported earnigns and jumped from $107 to $121.

Now the stock is in an uptrend, and with Facbook throwing money at the Metaverse, that will mean more engineers at Facebook, and hopefully they will be utilizing Unity software. There’s also other companies making their own metaverses. U stays at 17th in the Aggressive Growth Portfolio Power Rankings. There’s around 30% upside to next year’s Fair Value right now, and revenue estimates have been increasing. This stock might have the ability to climb 40% by the end of 2022. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 17 of 36Conservative Stock Portfolio N/A |