Stock (Symbol) |

The Trade Desk (TTD) |

Stock Price |

$71 |

Sector |

| Technology |

Data is as of |

| October 11, 2021 |

Expected to Report |

| October 3 |

Company Description |

The Trade Desk, Inc. is a technology company. The Company provides a self-service platform that enables clients to purchase and manage digital advertising campaigns across various advertising formats, including display, video and social, and on a range of devices, including computers, mobile devices, and connected television. Source: Thomson Financial The Trade Desk, Inc. is a technology company. The Company provides a self-service platform that enables clients to purchase and manage digital advertising campaigns across various advertising formats, including display, video and social, and on a range of devices, including computers, mobile devices, and connected television. Source: Thomson Financial |

Sharek’s Take |

The Trade Desk (TTD), a digital ad platform, looks like a winner in the online ad space, as the world moves from third-party cookies. Last week, one of my favorite social media stocks, Snap (SNAP) crashed 25% after the company reported earnings as Apple’s new operating system is blocking a lot of Snapchat’s revenue. Advertisers are operating in an evolving field, and The Trade Desk is on the cutting-edge of ad technology. Connected TV ads are driving ad revenue, and that’s going to be a catalyst for years to come. The Trade Desk (TTD), a digital ad platform, looks like a winner in the online ad space, as the world moves from third-party cookies. Last week, one of my favorite social media stocks, Snap (SNAP) crashed 25% after the company reported earnings as Apple’s new operating system is blocking a lot of Snapchat’s revenue. Advertisers are operating in an evolving field, and The Trade Desk is on the cutting-edge of ad technology. Connected TV ads are driving ad revenue, and that’s going to be a catalyst for years to come.

The Trade Desk is a cloud-based software platform which allows advertising executives to manage digital ad campaigns across different spectrums — such as TV or the Internet — utilizing real-time data. The company specializes in programmatic advertising, which uses computer programs to purchase ads geared to people who might be interested in buying a product. Programmatic ads are growing 20% per year, which is 5x the rate of total ad growth (source: Magna Global) and I think this company will hit its tipping point in 2021 when Connected TV is expected to flourish. What makes The Trade Desk unique is that it pushes ads without a conflict of interest. The company doesn’t own media itself, nor does it keep names, phone numbers, social security numbers or email addresses. The Trade Desk has partnerships with Roku, TikTok, Google, Alibaba, DIRECTV, AT&T, and Spotify. The Trade Desk conforms to Chinese law and launched operations there in March 2019. In Asia, trade partners include Baidu, Alibaba, and Tencent. You can also get Connected TV ads for the Superbowl, NFL Playoffs, the World Cup, the NBA playoffs, and the World Series. The company has a few catalysts going for it:

Here are some additional facts and stats:

The Trade Desk is one of the fastest growing and most profitable software companies in the world and this stock has growth opportunity comparable to what Google had years ago. But we are now in a time when Apple’s operating system is taking a chunk out of ad revenue for some companies. Thus, I think this stock has a chance of declining after the company reports earnings. People are doing more outdoor activities compared to a year-ago, when the COVID-19 pandemic kept them indoors. TTD is a top holding in my Growth Portfolio. I’m bullish on the company long-term. |

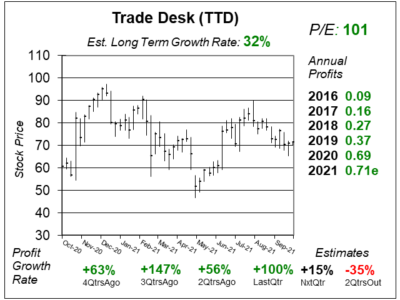

One Year Chart |

This stock has formed a choppy pattern in the one-year chart. This isn’t a bullish look. This stock has formed a choppy pattern in the one-year chart. This isn’t a bullish look.

Qtrly profit growth has been great the past four qtrs, and now Estimates for the next two qtrs are tough because of this. The P/E of 101 is below my Fair Value P/E of 125. The stock’s P/E was 122, 126, 163, and 181 the past four qtrs. The Est. LTG of 32% a year increased from 29% last qtr, but I still continue to believe this Est. LTG should be 50% to 65%. |

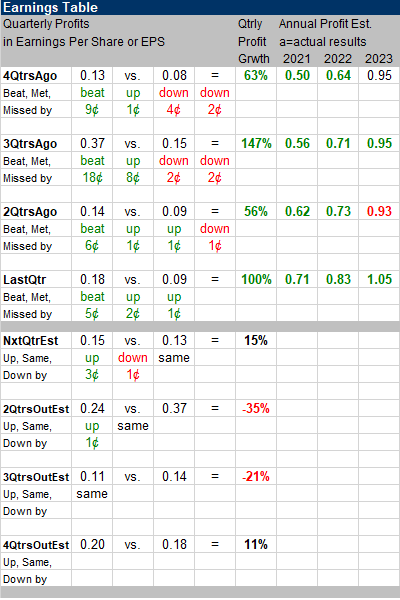

Earnings Table |

Last qtr, The Trade Desk achieved 100% profit growth and whipped analysts’ estimates of 44%. This was 100% profit growth on a 101% revenue increase, year-over-year. The revenue growth was driven by strong demand in CTV and premium video from advertisers and agencies in all regions. The company is benefiting from the continued shift of customers from broadcast or cable TV to digital content over the Internet. CTV is 50% more precise in reaching target viewers than traditional TV. Mobile is currently the company’s largest channel with around 40% of sales. Video represented high 30% of sales. Display was 15% of business, and audio was 5%. Last qtr, The Trade Desk achieved 100% profit growth and whipped analysts’ estimates of 44%. This was 100% profit growth on a 101% revenue increase, year-over-year. The revenue growth was driven by strong demand in CTV and premium video from advertisers and agencies in all regions. The company is benefiting from the continued shift of customers from broadcast or cable TV to digital content over the Internet. CTV is 50% more precise in reaching target viewers than traditional TV. Mobile is currently the company’s largest channel with around 40% of sales. Video represented high 30% of sales. Display was 15% of business, and audio was 5%.

Annual Profit Estimates all increased with good profit growth expected in the coming years: Qtrly Profit Estimates are for 15%, -35% , -21%, and 11% the next four qtrs. the 2QtrsOut estimate is tough as the company made record high $0.37 per share that qtr, which broke the previous record of $0.15 set one year earlier. |

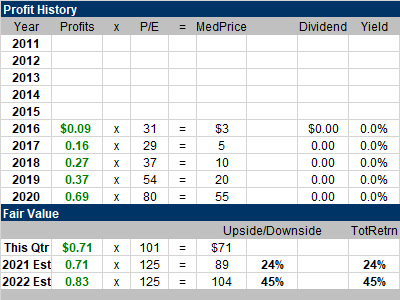

Fair Value |

My Fair Value for both 2021 and 2022 is a P/E of 125 which gives the stock 24% upside this year and 45% by next year. My Fair Value for both 2021 and 2022 is a P/E of 125 which gives the stock 24% upside this year and 45% by next year. |

Bottom Line |

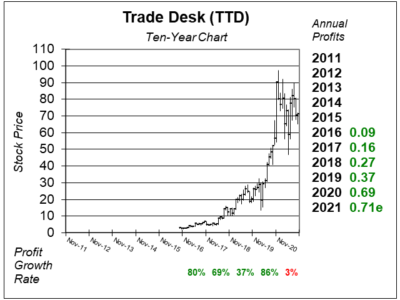

I originally purchased Trade Desk (TTD) for the Growth Portfolio at $5 on May 15, 2017 when the stock was soaring after the company beat the street. It’s been a ten-bagger for us. I originally purchased Trade Desk (TTD) for the Growth Portfolio at $5 on May 15, 2017 when the stock was soaring after the company beat the street. It’s been a ten-bagger for us.

The Trade Desk’s been flat this year, but the stock had a fantastic 2020 as the stock rose from $26 to $80. Now, its digesting some stock gains. Also, the social media platforms are underperforming expectations as people are getting outside more than they did a year-ago, when the pandemic was keeping people indoors. TTD moves down from 9th to 11th in the Growth Portfolio Power Rankings. I think the softness in the social media space may be a factor in next qtr’s earnings report. |

Power Rankings |

Growth Stock Portfolio

11 of 33Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |