Stock (Symbol) |

Tesla (TSLA) |

Stock Price |

$998 |

Sector |

| Industrials & Energy |

Data is as of |

| April 26, 2022 |

Expected to Report |

| July 25 |

Company Description |

Tesla, Inc. designs, develops, manufactures, sells and leases fully electric vehicles and energy generation and storage systems, and offer services related to its products. The Company’s automotive segment includes the design, development, manufacturing, sales, and leasing of electric vehicles as well as sales of automotive regulatory credits. Additionally, the automotive segment is also comprised of services and other, which includes non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, sales by its acquired subsidiaries to third party customers, and vehicle insurance. Its energy generation and storage segment includes the design, manufacture, installation, sales and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives. Its automotive products include Model 3, Model Y, Model S and Model X. Powerwall and Megapack are its lithium-ion battery energy storage products. Source: Refinitiv Tesla, Inc. designs, develops, manufactures, sells and leases fully electric vehicles and energy generation and storage systems, and offer services related to its products. The Company’s automotive segment includes the design, development, manufacturing, sales, and leasing of electric vehicles as well as sales of automotive regulatory credits. Additionally, the automotive segment is also comprised of services and other, which includes non-warranty after-sales vehicle services, sales of used vehicles, retail merchandise, sales by its acquired subsidiaries to third party customers, and vehicle insurance. Its energy generation and storage segment includes the design, manufacture, installation, sales and leasing of solar energy generation and energy storage products and related services and sales of solar energy systems incentives. Its automotive products include Model 3, Model Y, Model S and Model X. Powerwall and Megapack are its lithium-ion battery energy storage products. Source: Refinitiv |

Sharek’s Take |

Teslas’ (TSLA) profits are soaring while the company takes capacity from two to four plants overall. Last qtr, revenue jumped 81% while profits soared 246%. Those are fantastic numbers, and the company wasn’t even running at full capacity last qtr due to challenges in its supply chain, transportation, labor and other manufacturing. Meanwhile the stock is selling for around 55x potential 2022 profits (what I think it can make in profits this year). Overall, I think this stock has huge potential and I will add to my position today. Teslas’ (TSLA) profits are soaring while the company takes capacity from two to four plants overall. Last qtr, revenue jumped 81% while profits soared 246%. Those are fantastic numbers, and the company wasn’t even running at full capacity last qtr due to challenges in its supply chain, transportation, labor and other manufacturing. Meanwhile the stock is selling for around 55x potential 2022 profits (what I think it can make in profits this year). Overall, I think this stock has huge potential and I will add to my position today.

Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation, and energy storage systems. Products are generally sold directly to consumer, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships. You can literally order a car in less than 5 minutes on your phone and have it delivered to your doorstep with all the paperwork done. This Full Self-Driving (FSD) autopilot system will revolutionize travel because the car will have the ability to travel without a person inside. Management believes it will be the most important source of profitability for Tesla. Tesla is aiming to release FSD Beta to U.S. customers by the end of 2022. Once FSD is available, Robotaxi’s could be a huge catalyst for the company. The company is expected to make a car specifically for this use, a vehicle without a steering wheel or pedals, with volume production in 2024. Full Self Driving makes it so the car can drop you off at work, then go out and be a Robotaxi in a driving service, and earn money for the car’s owner. Solar roofs on homes can (1) charge the car (2) provide electricity to the home and (3) be sold back to electric companies. I think someday these cars will have those solar roofs that can produce its own energy source so fueling-up should become a thing of the past. Tesla’s current and expected (*) lineup includes:

Supply chain issues could affect the stock in the short-term. There are approximately 10,000 unique parts and processes that have to work for a car to be produced, and production goes as fast as having those 10,000 things in place, but some of it is out of Tesla’s control. Here’s a run-down of Tesla’s models and plants:

Elon Musk said Tesla will not introduce any new models this year focused on production and that should mean a slew of new cars hitting the road this year. Here’s Tesla’s annual delivery history:

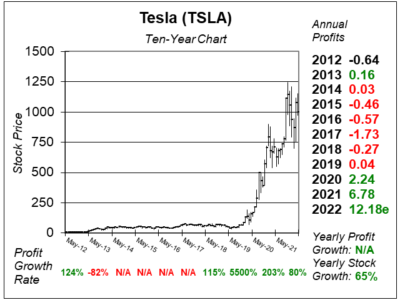

Tesla is expected to have vehicle delivery growth of 50% on average for multiple years. Looking at TSLA’s numbers, analysts predict the company will make a profit of ~$12 this year, but this figure is trending towards ~$18. The stock has an Est. LTG of 40%, which is exceptional. TSLA is part of my Growth Portfolio. I will add to my position today, and also put the stock into my Aggressive Growth Portfolio as well. TSLA seems like the best stock in the stock market at this time. Future growth could come via vehicle insurance (which the company already offers in some states), and the Optimus robot program. Elon Musk thinks Optimus will ultimately be worth more than the car business and Full Self Driving combined. |

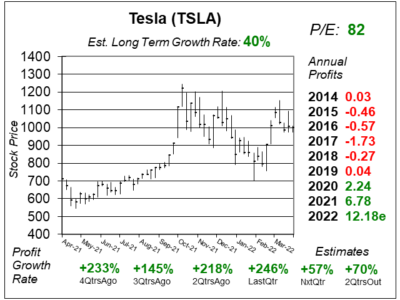

One Year Chart |

TSLA could be building a cup-and-handle chart pattern. I did these charts & tables this morning before the market opened. The shares were $998 at the time. TSLA could be building a cup-and-handle chart pattern. I did these charts & tables this morning before the market opened. The shares were $998 at the time.

The P/E of 82 is below the 92 P/E the stock had last qtr. The Est. LTG went up from 22% last qtr to 40% this qtr. Qtrly profit growth has been great, and that’s expected to continue. We could see profit growth to slow down to double-digits starting next qtr. |

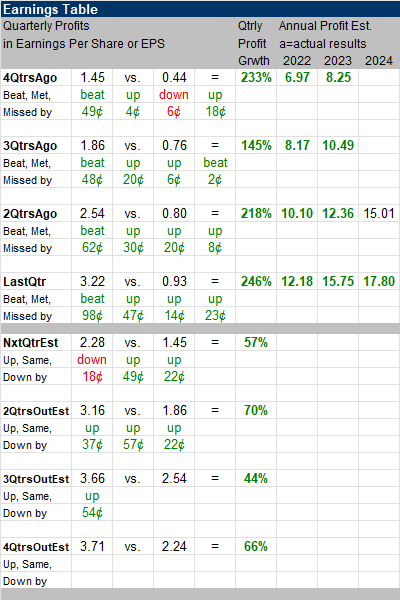

Earnings Table |

Last qtr, Tesla recorded 246% profit growth and surpassed expectations of 141% growth. Revenue increased 81%. Total electric vehicle production grew 69% while deliveries grew 68%, as Texas and Berlin plants are ramping up production. Energy storage deployed increased 90% as demand remained higher than supply due to supply chain problems. Solar deployments fell 48% due to import delays but cash and loan sales represented majority of deployments. Last qtr, Tesla recorded 246% profit growth and surpassed expectations of 141% growth. Revenue increased 81%. Total electric vehicle production grew 69% while deliveries grew 68%, as Texas and Berlin plants are ramping up production. Energy storage deployed increased 90% as demand remained higher than supply due to supply chain problems. Solar deployments fell 48% due to import delays but cash and loan sales represented majority of deployments.

Sales outperformance was highlighted by growth in production and delivery of model 3 and Y electric vehicles, increase in average selling price, cost reductions, and energy storage deployments, last qtr. Sales was adversely affected by supply chain disruptions, higher commodity prices, and factory shutdowns due to COVID-19 outbreaks. Annual Profit Estimates increased across the board, this qtr. Management expects annual EV deliveries to grow an average of 50%. In the lastest earnings call, Elon Musk said the company will likely produce over 1.5 million EV cars this year. Here’s EPS estimates for the coming years: Qtrly Profit Estimates are for 57%, 70%, 44%, and 66% profit growth the next 4 qtrs. Due to recent factory shutdown in Shanghai caused by COVID-19 outbreak, the company lost a month of production volume and this will affect delivery volume and sales next qtr. |

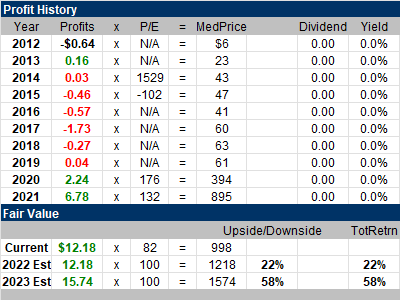

Fair Value |

My TSLA Fair Value moves down again from 125 to 100 this qtr, as stocks are getting lower valuations from investors with interest rates and inflation rates high. My TSLA Fair Value moves down again from 125 to 100 this qtr, as stocks are getting lower valuations from investors with interest rates and inflation rates high.

Note, in the Earnings Table (above) that 2022 profit estimates just rose from ~$10 to ~$12. We are just now entering 2022 Q2. 3 qtrs to go. I think $18 in profits is possible this year. With the stock ~$998, if it made $18 this year its really selling for 55x earnings (hypothetically). That’s very reasonable. |

Bottom Line |

Tesla (TSLA) just gone through a parabolic run higher, and is now digesting its prior gains. Years ago, I called the run higher in TSLA stock. Then, in early 2021 I stated I thought the monster run is done. Those calls were on point. Last qtr I said “TSLA has the ability to push past $1000 a share” and that was money too. Tesla (TSLA) just gone through a parabolic run higher, and is now digesting its prior gains. Years ago, I called the run higher in TSLA stock. Then, in early 2021 I stated I thought the monster run is done. Those calls were on point. Last qtr I said “TSLA has the ability to push past $1000 a share” and that was money too.

Tesla continues to deliver the profits beyond analyst estimates. And with the stock stuck in this growth stock Bear Market, I think it will push higher when the selling subsides. A 50% move higher within two years seems reasonable. Full Self Driving and Optimus are potential catalysts that could be enormous. TSLA stays at #1 in the Growth Portfolio Power Rankings. I will increase my position today, and also purchase the stock in the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

1 of 29Aggressive Growth Portfolio 1 of 17Conservative Stock Portfolio N/A |