The stock market rallied on Friday, breaking a three-weak losing streak. S&P 500 rose 1.5% to 4,067, while NASDAQ grew 2.1% to 12,112.

The stock market rallied on Friday, breaking a three-weak losing streak. S&P 500 rose 1.5% to 4,067, while NASDAQ grew 2.1% to 12,112.

In other news, Ball Corp (BALL) stock fell due to deceleration in volume growth in the US.

Tweet of the Day

Speira is the latest European aluminum producer to cut production in response to soaring energy costs that the industry says are an “existential threat” to its survival https://t.co/isRCzOvIgD via @mburtonmetals pic.twitter.com/pzxAVQqPJw

— Zoe Schneeweiss (@ZSchneeweiss) September 7, 2022

Quote of the Day

Over 90% of the volume on the NYSE was in stocks that traded higher on the day.

This is a bullish indicator, and a sign the Bear Market could be ending.

– David Sharek, Founder of The School of Hard Stocks

Chart of the Day

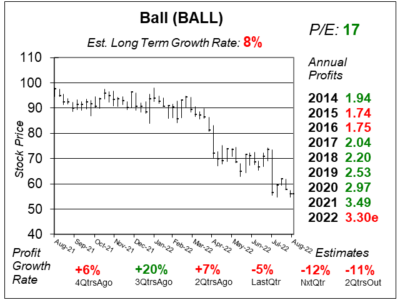

Our chart of the day is the one-year chart of BALL as of September 5, 2022, when the stock was at $56.

Our chart of the day is the one-year chart of BALL as of September 5, 2022, when the stock was at $56.

Founded in 1880, BALL is one of world’s largest manufacturers of aluminum packaging for beverages, aerosol packaging for personal care items, and aerospace services for aerospace customers.

BALL is seeing sluggish demand in North America that’s hurting profits and causing management to slow production. The drop in demand was seen in domestic beer, hard seltzers, and sparkling water.

Last qtr, revenue jumped 20% but cost of sales increased 25% as profits declined 5%

BALL is part of the Conservative Growth Portfolio. David Sharek’s Fair Value P/E is still 23, and that gives the stock modest upside from here. He thinks this stock has a huge upside long-term, but in the short-term the stock has little momentum.