Stock (Symbol) |

Tencent Holdings (TCEHY) |

Stock Price |

$78 |

Sector |

| Technology |

Data is as of |

| May 6, 2021 |

Expected to Report |

| May 20 |

Company Description |

Tencent Holdings Limited is an investment holding company. The Company and its subsidiaries are principally engaged in the provision of Internet and mobile value-added services (VAS), online advertising services and eCommerce transactions services to users in the People’s Republic of China. Source: Thomson Financial Tencent Holdings Limited is an investment holding company. The Company and its subsidiaries are principally engaged in the provision of Internet and mobile value-added services (VAS), online advertising services and eCommerce transactions services to users in the People’s Republic of China. Source: Thomson Financial |

Sharek’s Take |

Tencent (TCEHY) stock may be down a bunch from its highs (-21% from $99 to $78), but the company itself keeps delivering solid sales and profit growth. Last qtr, the company delivered 43% profit growth on 26% revenue growth. That’s great profit growth. And now with a P/E of 31, this large conglomerate is amongst the FANG stocks as one of the best values in the stock market. Tencent (TCEHY) stock may be down a bunch from its highs (-21% from $99 to $78), but the company itself keeps delivering solid sales and profit growth. Last qtr, the company delivered 43% profit growth on 26% revenue growth. That’s great profit growth. And now with a P/E of 31, this large conglomerate is amongst the FANG stocks as one of the best values in the stock market.

Tencent has one of the worlds top social network(s) with more than 1.2 billion users. The company has its own versions of Facebook, Google, Netflix and Amazon rolled two apps with Weixin being the app for mainland China and WeChat for people outside China. So from those apps, advertisers can place ads, and users can buy things then pay with Tencent financial apps. Tencent is a technology juggernaut and has grown to encompass everything online in China. Here’s Tencent’s largest 4 divisions:

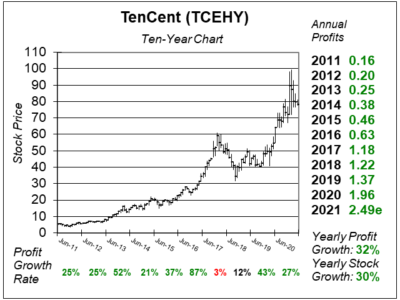

Tencent is a large stable company that’s grown profis 32% a year the past ten years, with record profits each year. In addition, the company has a vast portfolio of other investments in companies such as Pinduoduo, JD, Sea, Epic Games, Snap, Bilibili, Spotify and Nio that totaled ~$187 billion US dollars in 2020. Investing in TCEHY is like getting a company that’s growing nicely on its own, and also having a portfolio of David Sharek-type stocks thrown in. The Estimated Long Term Growth Rate for TCEHY is 28%, which is high for such a large company. Management also pays out an annual dividend, which rose 33% in 2021. And with a P/E of 31, the stock is cheap (this company is growing around 40% right now). TCEHY is part of the Growth Portfolio. Everything is looking good right now — especially the stock. |

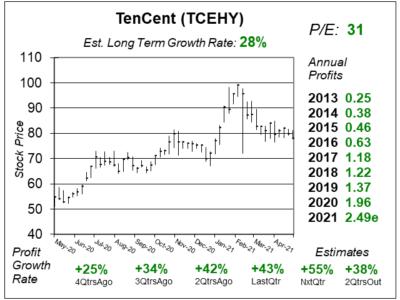

One Year Chart |

Here you can see a dip in the stock price, but the stock is hitting support here around $80. I like that because if we look back 6 months the stock was hitting resistance at $80. Resistance is now support, which is bullish for the stock. Here you can see a dip in the stock price, but the stock is hitting support here around $80. I like that because if we look back 6 months the stock was hitting resistance at $80. Resistance is now support, which is bullish for the stock.

Profit growth has been fabulous. I love the accelerating growth the past 4 qtrs. Next qtr looks even better. The Est. LTG of 28% very high for a big company. I even think profit growth will be 35-40% or more in 2021. Growth like that is deserving of a 40-45 P/E. Since the P/E is currently a 31, the stock is a value. |

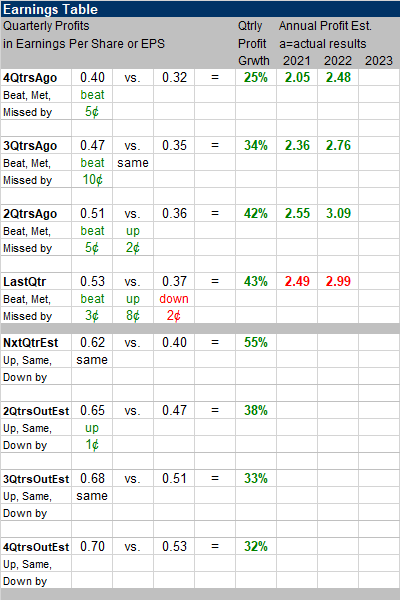

Earnings Table |

Last qtr Tencent delivered 43% profit growth and beat estimates of 35%. Revenue increased 26%, which was a slight deceleration from 29% revenue growth the prior two qtrs. Last qtr Tencent delivered 43% profit growth and beat estimates of 35%. Revenue increased 26%, which was a slight deceleration from 29% revenue growth the prior two qtrs.

Annual Profit Estimates declined slightly. This is dissapointing as the stock Qtrly profit Estimates are for 55%, 38%, 33% and 32% profit growth the next 4 qtrs. Those figures are awe inspiring! |

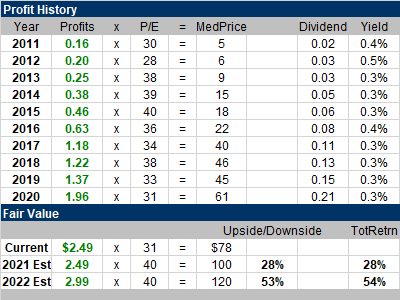

Fair Value |

My Fair Value P/E declines from 45 to 40 due to lower profit estimates and an environment that’s punishing growth stocks. My Fair Value P/E declines from 45 to 40 due to lower profit estimates and an environment that’s punishing growth stocks.

I see 28% upside this year, and 53% upside by the end of 2022. |

Bottom Line |

Tencent (TCEHY) is the true Internet juggernaut of Chinese Internet stocks. I’ve owned the stock since November 2016, and bought it ~$27. TCEHY closed at $95 today, but I’ve sold a lot of my position over the years. Prior to 2018 the ten-year chart was perfect, but a Bear Market in Chinese stocks and a restriction on video games hurt in China hurt revenue and profits, which caused the stock to drop from ~$60 to ~$30. TCEHY recently went on another run to $99, and has since dropped to $78 in a stock market that’s beaten down tech stocks. Tencent (TCEHY) is the true Internet juggernaut of Chinese Internet stocks. I’ve owned the stock since November 2016, and bought it ~$27. TCEHY closed at $95 today, but I’ve sold a lot of my position over the years. Prior to 2018 the ten-year chart was perfect, but a Bear Market in Chinese stocks and a restriction on video games hurt in China hurt revenue and profits, which caused the stock to drop from ~$60 to ~$30. TCEHY recently went on another run to $99, and has since dropped to $78 in a stock market that’s beaten down tech stocks.

When Tencent was at $95, I thought it would push past $100 and head to $115. This qtr with the stock at $78 I think its worth $120. If growth stocks go back into favor, my money is on this stock being a market leader again and shooting for $100 and beyond. TCEHY makes a big move up in the Growth Portfolio Power Rankings, jumping from 26th to 3rd. Last qtr when I had the stock ranked lower, speculative stocks were in favor. Now, investors desire certainty and consistency — which Tencent has an abundance of. I will add to my position in the morning. |

Power Rankings |

Growth Stock Portfolio

3 of 41Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |