Tencent Crashes As Media Says Games are Spiritual Opium

Shares of Tencent (TCEHY) are beaten and battered due to political uncertainty in China. Will big investors ever return?

Shares of Tencent (TCEHY) are beaten and battered due to political uncertainty in China. Will big investors ever return?

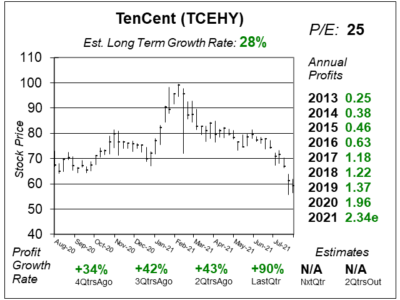

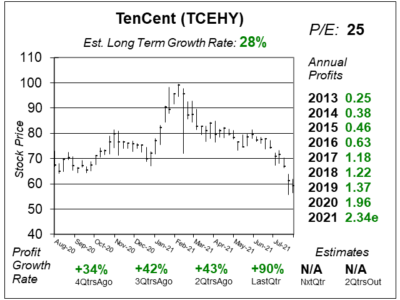

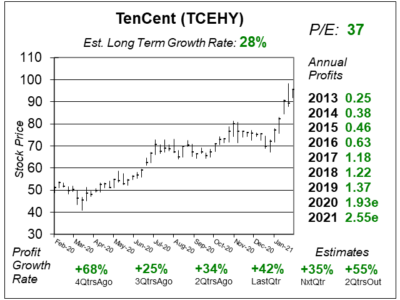

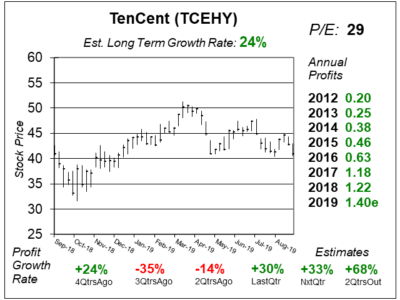

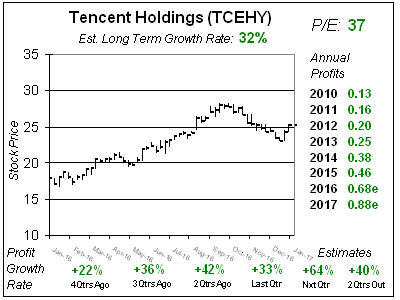

Tencent (TCEHY) stock is down around 20% from its high. But the company keeps delivering the profits (+43% last qtr).

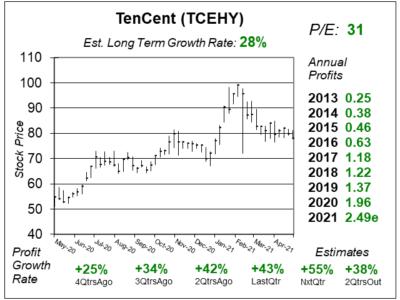

Tencent’s (TCEHY) long-term growth rate has doubled in my opinion. This now looks to be a 35%-40% grower. That’s big.

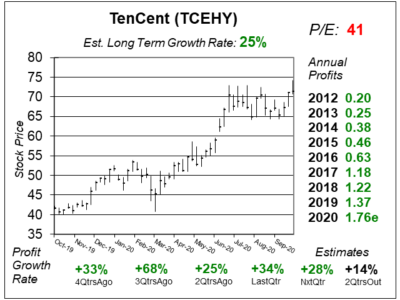

Tencent’s (TCEHY) gaming revenue jumped 40% last qtr as people staying at home boosted cell phone game revenue.

Tencent (TCEHY) is a hot-stock once again as stay-at-home has lead to more time spent on online games and social networks.

Tencent (TCEHY) has a blended array of online businesses that continue to thrive in China — and beyond.

Tencent (TCEHY) used to get most of its revenue from online games, and is now more well-rounded with cloud computing.

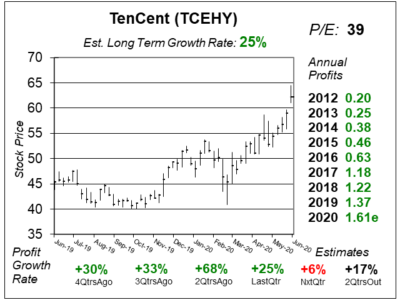

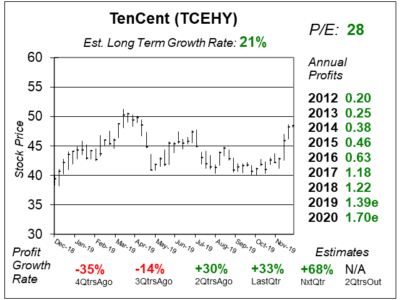

Tencent (TCEHY) delivered pretty good profit growth of 30% last qtr. But the stock isn’t responding the way it should be.

Tencent (TCEHY) operates the largest mobile payment platform in China. TCEHY’s FinTech revenue grew 44% last qtr.

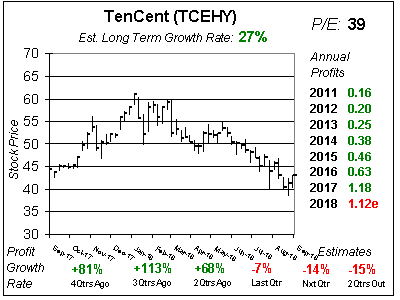

Tencent (TCEHY) is back as video games are being approved in China again. But I lost a little trust with last year’s stock decline.

China’s approving video games again, which is good news for Tencent (TCEHY), China’s leading game company. Meanwhile, and advertising revenue continues to shine.

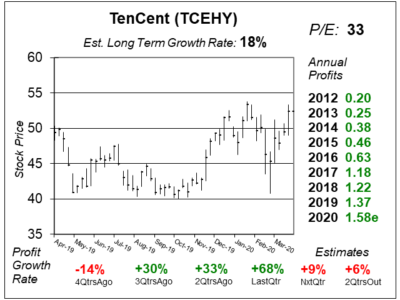

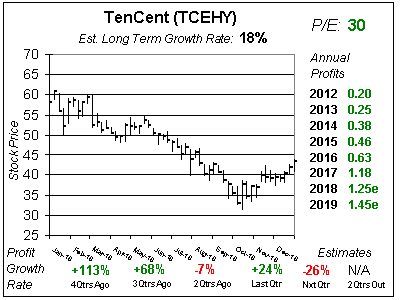

Tencent (TCEHY) has gone from $60 to $40 as (1) Chinese stocks are down 15% this year and (2) China isn’t approving video games.

Tencent’s (TCEHY) earnings estimates got cut this qtr, like many of the Chinese Internet stocks. Now at $49, the stock is 20% off its highs.

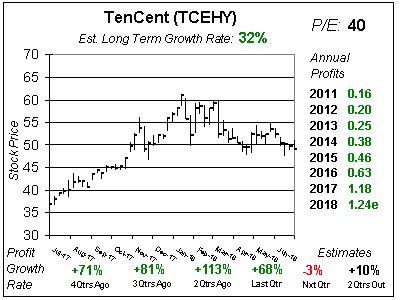

TenCent (TCEHY) stock was on fire last year — it went parabolic. Now the stock could be starting a downtrend as the profit outlook isn’t so perfect.

TenCent (TCEHY) operates the popular WeChat, a version of Whatsapp that’s big in China and the Asian Pacific region. TCEHY went from $24 to $51 in 2017 and is in rapid growth mode.

TenCent’s (TCEHY) up 10% in the last week alone — taking its 2017 gain to more than 100%. But now the question is: does the stock have upside in 2018?

TenCent (TCEHY) is taking the world by storm — starting with China. The company’s WeChat is an “all in one” application that people use all day.

Tencent (TCEHY) is an “all in one” Internet stock as it provides people in China with online chat, social networking, payment services and a whole lot more.

Tencent (TCEHY) is one of China’s largest Internet companies, with online games, online ads, movies & music as well as electronic payments and cloud services.

Tencent (TCEHY) is a name most investors aren’t aware of, but owns some of China’s best Internet brands including WeChat.