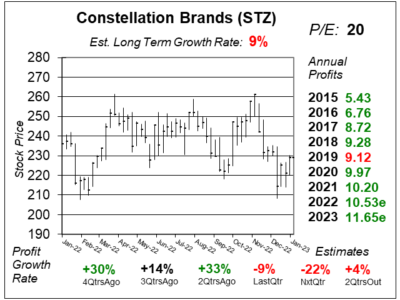

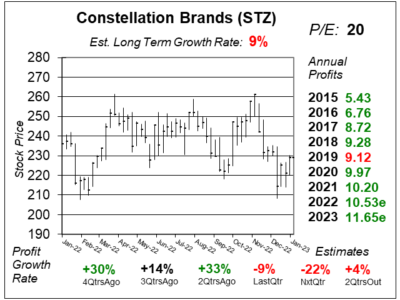

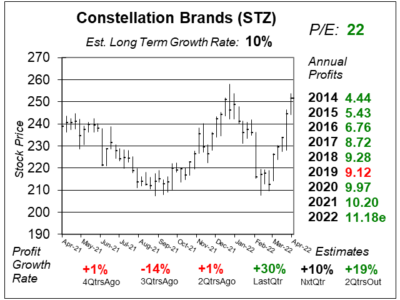

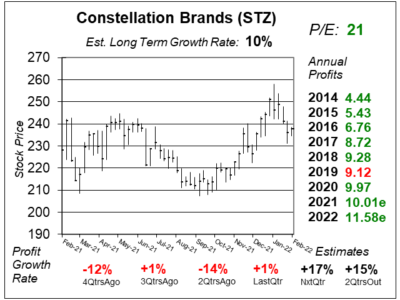

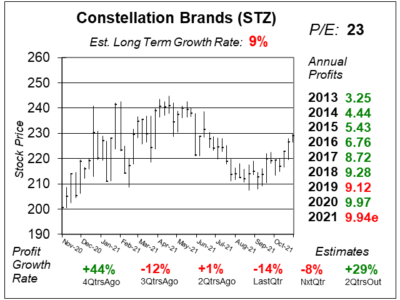

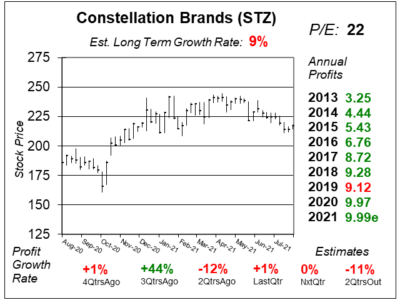

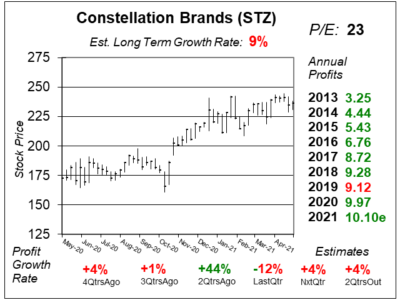

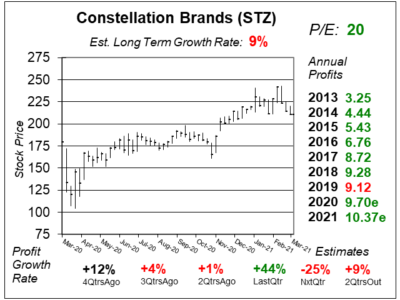

Constellation Brands (STZ) Isn’t Growing Profits as Fast as it Used To

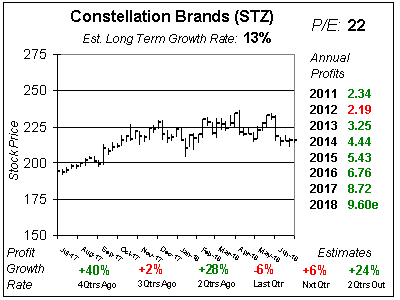

Constellation Brands (STZ) has had profit growth below 10% in what’s going on a fifth year. And lackluster growth has hurt the stock.

Constellation Brands (STZ) has had profit growth below 10% in what’s going on a fifth year. And lackluster growth has hurt the stock.

Constellation Brands (STZ) continues to see people upgrading to premium beers, including Modelo Especial and Modelo Chelada.

Constellation Brands (STZ) has catalysts in its Modelo brand, as Modelo Especial and Modelo Chelada are #1 in their categories.

Constellation brands (STZ) expects significant growth in flavored drinks like beer, seltzer, ready to drink spirits, & Modelo Chelada.

Constellation Brands’ (STZ) beer business helps the company recover from a slowdown in production caused by the pandemic.

Modelo Espacial and Corona Extra are two catalysts for Constellation Brands (STZ), but hard seltzer sales are fading fast.

Constellation Brands (STZ) has a catalyst in the high-end Modelo beer brand, But profits are still saggy due to slow bar sales.

Constellation Brands’ (STZ) Casa Modelo brands (Modelo Especial, Modelo Negra and Modelo Chelada) are en fuego.

Constellation Brands (STZ) just launched its Quatreau CBD-infused drink in the U.S., and that could be a catalyst for the stock.

Constellation Brands (STZ) is experiencing weakness in its wine and spirit business, while spending on beer & cannabis.

Constellation Brands (STZ) is a producer of beer, wine, spirits and now cannabis. But wine is weak. Can marijuana sales (and profits) fill the void?

Mid-term elections were yesterday, and the big winner wasn’t Democrat or Republican. It was Constellation Brands (STZ).

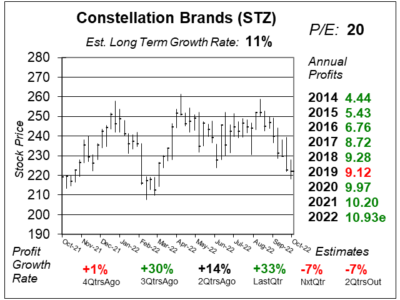

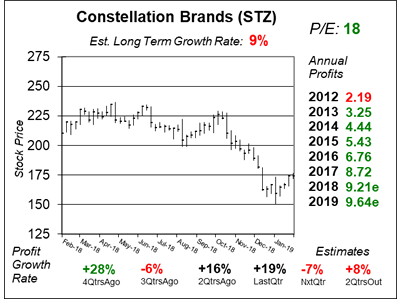

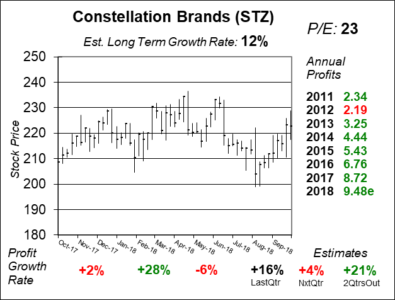

Well that was quick. Constellation Brands (STZ) just went from being a 20% grower to delivering -6% profit growth. Is it time to sell STZ?

I’m not as impressed with Consellation Brands (STZ) as I used to be, and I really don’t know why. This is one of my favorite companies.

Bacardi just bought Patron for $5.1 billion. That makes Constellation Brand’s (STZ) 2014 acquisition of Casa Noble for less than $30 million seem like a bargain — for faster growth.

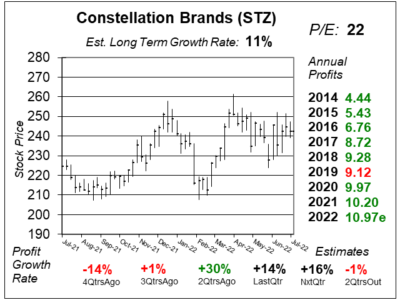

Constellation BRands (STZ) is having a perfect 2017. But qtrly profit estimates don’t look that great, and with a perfect chart pattern the stock could use some rest.

Constellation Brands (STZ) shot to an All-TIme high after it crushed profit estimates. Profit margins surged to 35%, well above the 29% STZ had a year ago.

Constellation BRands (STZ) continues to deliver excellent results. With 2017 profit estimates jumping, the stock has momentum to continue higher.

Trump could put a tariff on Mexican imports, which could affect Constellation Brands (STZ) as it imports Corona, Pacifico and Modelo to the US.

Constellation Brands (STZ) continues to be a premium spirit — both in execution and its high P/E ratio. Here’s where I’m looking to buy this hot stock.

Constellation Brands (STZ) is the world’s largest premium wine company, but import and craft beer sales are fueling STZ’s growth.