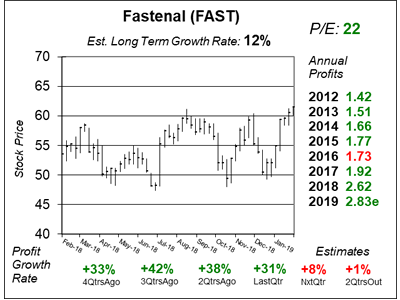

Fastenal (FAST) Faced a Challenging Quarter as Manufacturing Activities Soften

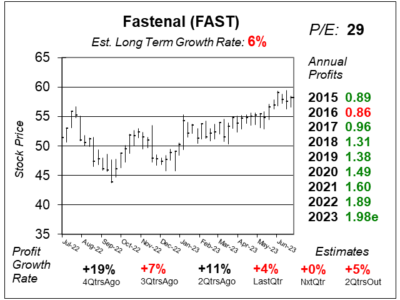

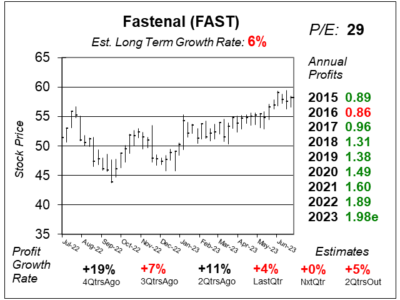

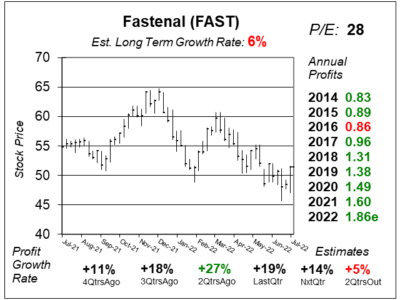

Fastenal (FAST) delivered only 4% profit growth on 6% sales growth as the company faced a challenging qtr due to soft manufacturing.

Fastenal (FAST) delivered only 4% profit growth on 6% sales growth as the company faced a challenging qtr due to soft manufacturing.

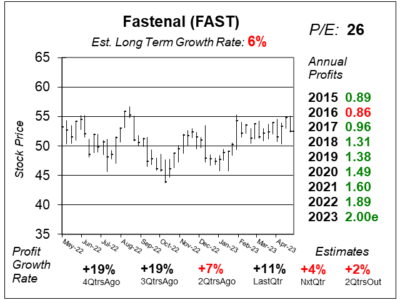

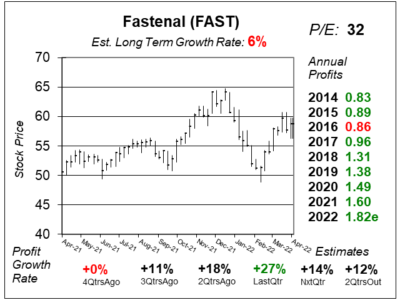

Fastenal (FAST) delivered solid results last quarter even though there was a modest contraction in demand for construction supplies.

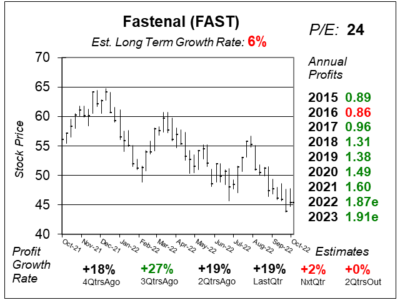

Fastenal (FAST) management sees softening demand into 2023. And the numbers show the same, as profit growth is expected to slow,

Fastenal (FAST) stock has been weak after management said there was softening demand in May & June. The numbers still look great.

Fastenal (FAST) is showing surprising strength as commercial construction is strong. Also, this company is benefiting from inflation.

Fastenal (FAST) is growing sales in the low-single digits right now. And that means slow profit growth as well.

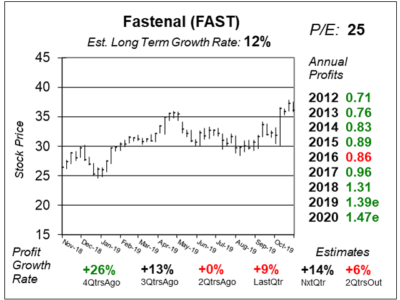

Nuts-and-bolts wholesaler Fastenal (FAST) hit an All-Time high qtrly profit growth accelerated from 0% to 9%.

Although the economy is growing good, construction spending is slow, which is hurting supply store Fastenal (FAST).

Fastenal (FAST) is in the fastener business, such as screws and nuts. Business is good with the economy humming/low rates.

Fastenal (FAST) provides industrial supplies — including tools, nuts and bolts — across America with company branded retail stores, onsite locations, and vending machines.