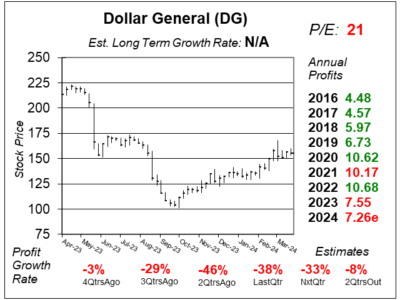

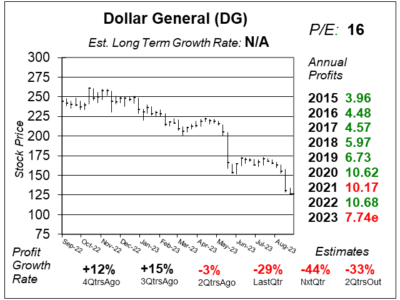

Dollar General (DG) Delivered -38% Profit Growth With Losses From Shoplifting

LIke many brick-and-mortar retailers, Dollar General (DG) is experiencing a lot of shoplifting, which is hurting margins (and profits).

LIke many brick-and-mortar retailers, Dollar General (DG) is experiencing a lot of shoplifting, which is hurting margins (and profits).

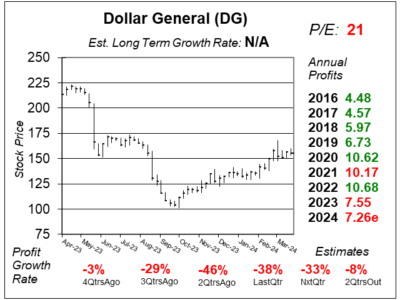

Dollar General’s (DG) profits are way down due to high shoplifting. And management doesn’t seem to have good plans for a fix,

Dollar general (DG) is having trouble with slow sales, high theft, high prices, and not enough labor. This stock is down-and-out.

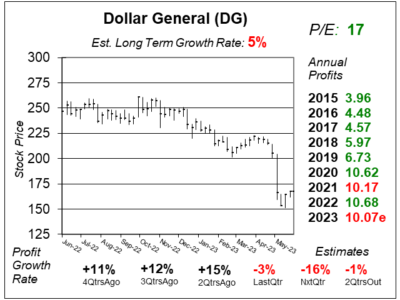

Dollar General (DG) is having some tough times as consumers don’t have much money to spend on things other than necessities.

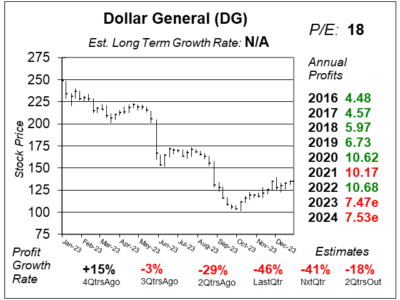

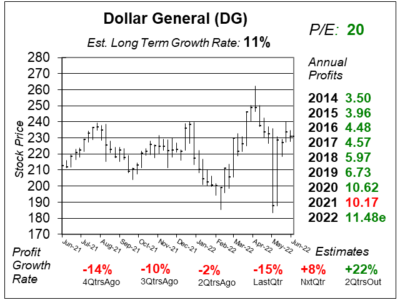

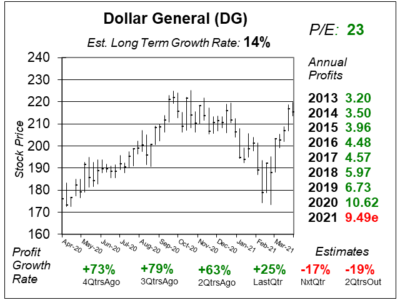

Dollar General (DG) delivered solid results last quarter, but management sees lower profits through the first two quarters of 2023.

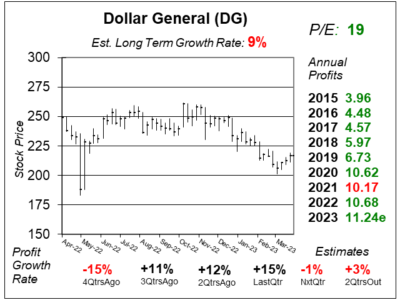

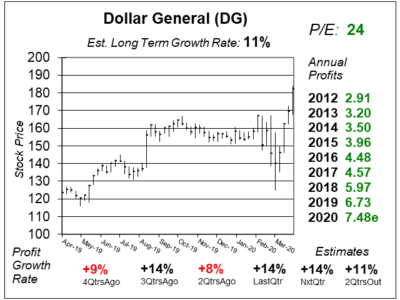

Dollar General (DG) is embracing the budget-focused consumer who are under financial pressures due to high inflation.

Dollar General (DG) is a timely selection for this recession. Low priced goods, lots of food. And a stock that’s holding up well.

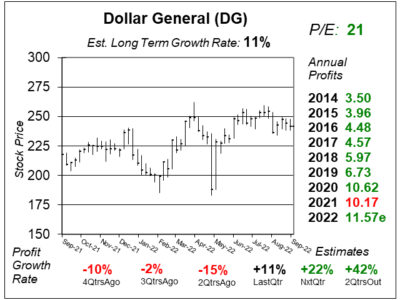

Dollar General (DG) expects stronger same store sales — as well as profit growth — in the 2nd half of 2022. Here’s why.

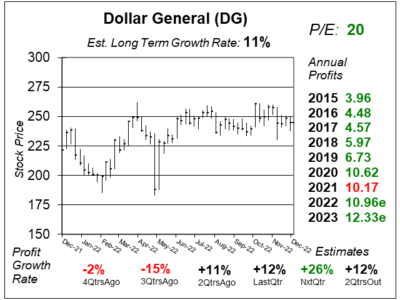

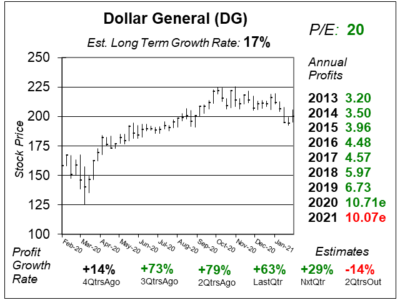

Dollar General (DG) stock is a value with a P/E of 20. And shoppers will likely visit the stores more as high inflation curbs spending.

Dollar General (DG) has a new non-food concept in pOpshelf, which offers home furnishings, seasonal decor, and party supplies.

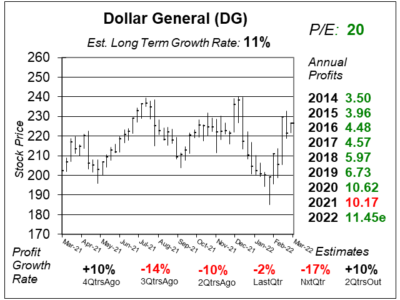

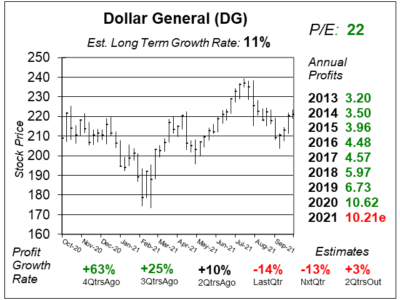

Last qtr, Dollar General (DG) delivered -14% profit growth. That was Ok considering profits were +79% the same qtr a year-ago.

Dollar General (DG) had solid profit margins last qtr, which helped DG beat the street in a big way. Their secret? NCI.

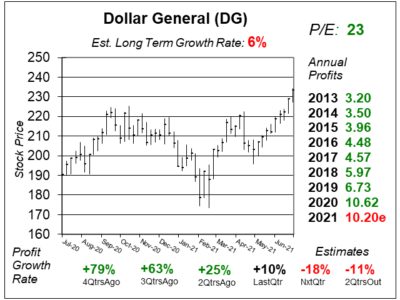

Dollar General (DG) is expected to have profits decline 11% this year. Still, with a P/E of just 23, the stock has good upside.

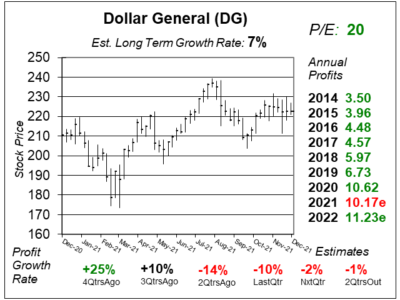

Dollar General (DG) is a bargain as its P/E is only 20. Our Fair Value is a P/E of 30, which is $320 a share for 2021.

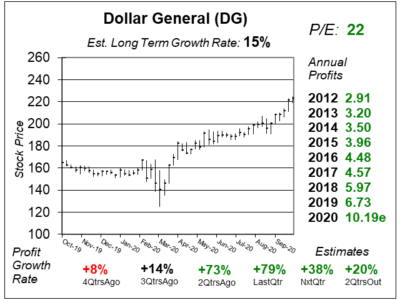

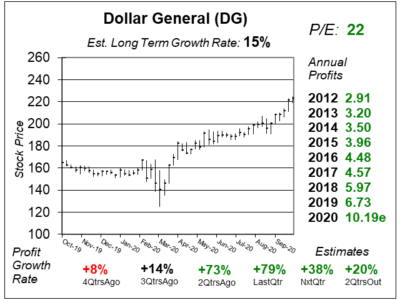

Dollar Generals (DG) grew profits rapidly the past two qtrs as COVID-19 closures hurt competition. Now DG has a NEW catalyst.

Dollar General (DG) has been one of the top retailers in the nation during the Coronavirus pandemic. Expect it to continue.

Dollar General (DG) is the bomb diggity of retailers as profits grew faster than Target, Walmart and Costco combined.

Dollar General (DG) is transforming from a local store to a retail machine, with fresh produce and a speedy checkout.

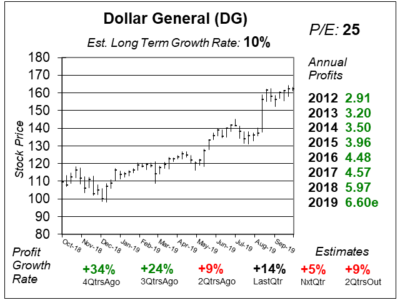

Dollar General (DG) is one of the hottest stocks in the land, and is now in the same league as the retail big-wigs.

Dolalr General (DG) is making waves and molding itself into a modern machine in the dollar store retail space.

Dollar General (DG) is getting on the fast track with two programs, DG Fresh and Fast Track. But these will cost money.

Shares of Dollar General (DG) are within a few dollars of an All-Time high. And I think its because of recession fears.

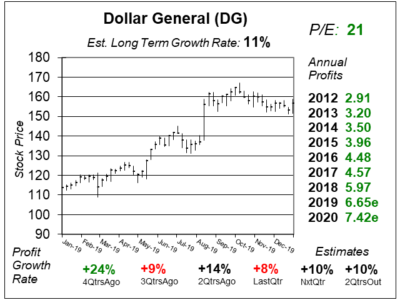

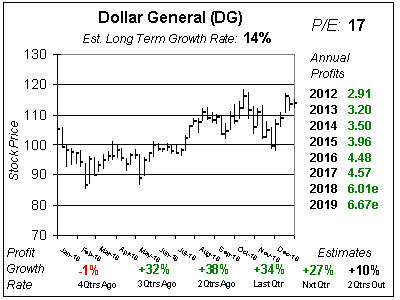

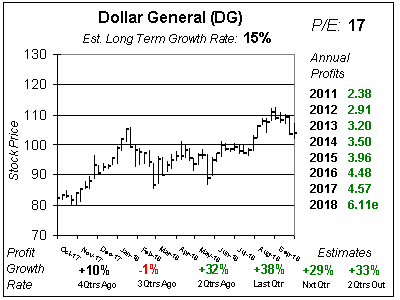

Dollar General (DG) grew profits 38% last qtr, with the help from a lower tax rate and easy comparisons. DG isn’t a bad buy with a 17 P/E.

Dollar General (DG) is experiencing a bounce-back year, as annual profit growth is expected to climb from 2% in 2017 to 32% in 2018.

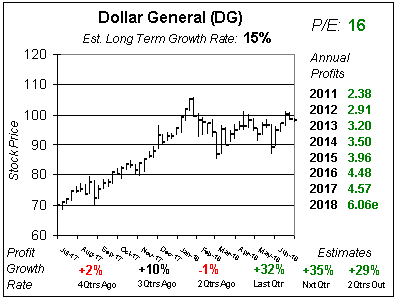

Shares of Dollar General (DG) shot up last qtr, even though profit growth continues to be around 1%. With a P/E of 9, I think a lot of good news is already priced in.

Dollar General (DG) has lost all momentum as profit growth fell to 0% last qtr. But with the stock hitting support at $70, is the stock a bargain right now?

Weakness in retail has made Dollar General (DG) more of a value stock than a growth stock, and with a P/E of 15 the stock is a good value.

Sluggish traffic and lower prices continue to hurt Dollar General (DG). But if you sell now, you could get left behind.

Lower prices from Walmart helped bring down shares of Dollar General (DG). But now Walmart says it will focus on e-commerce and slow store openings.

Dollar General (DG) is executing very well as it grows its store count, remodels older stores, buys back stock, and pays a dividend.

Investors were impressed with Dollar General’s (DG) qtrly results, sending the shares to new highs. But is DG now too high?

Dollar General (DG) has a successful formula of remodeling old stores, building new ones, and buying back stock. I will add DG to the Growth Portfolio today.

Dollar General (DG) is growing in many ways in addition to paying a dividend. With DG down, this is a good time for long-term investors to buy in.

Dollar stores like Dollar General (DG) are looking pretty weak right now. Still, DDD is a good stock for the long term.

With the Dow down around 200 points for the 2nd straight day, let’s look at Dollar General (DG), a stock that can provide a safe haven during turbulent times.

Dollar General (DG) is one of the best dollar stores to invest in. Unfortunately, we missed out on getting DG “on sale” earlier in the year.

Dollar General (DG) has been in a downturn since mid-2012 because dollar stores had a slowdown. I see this as a buying opportunity for DG.

Dollar General (DG) is expected to report qtrly profits (EPS) and revenues:

Profits Estimates: $1.57 vs. $2.34 = -33%

Revenue Est: +6%