Autodesk’s (ADSK) Shift to Annual Payments to Multi-Year Contracts Hurts Sales

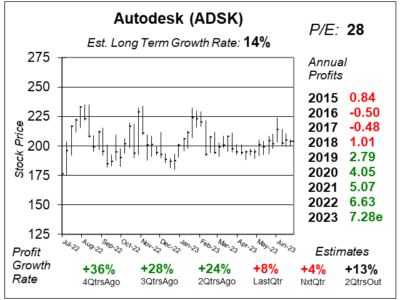

Autodesk’s (ADSK) growing slower than it used to because of its shift to long-term contracts and a weak economic environment.

Autodesk’s (ADSK) growing slower than it used to because of its shift to long-term contracts and a weak economic environment.

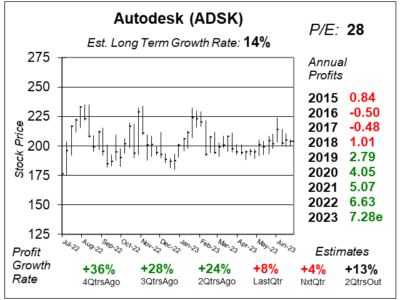

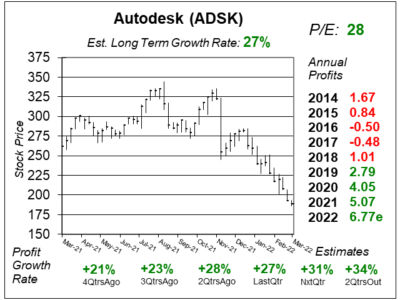

Autodesk (ADSK) has had its 2023 profit estimates decline for six consecutive quarters. Let’s see if the stock’s worth holding.

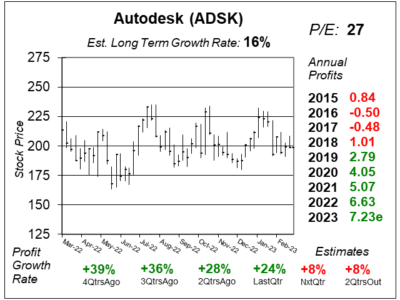

Autodesk (ADSK) continues to see strong demand for its design software, with North America demand strong while China & Russia lag.

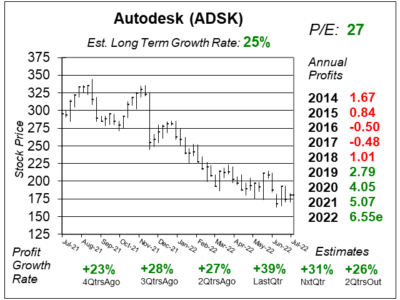

Autodesk (ADSK) continues to see robust demand for its architecture software. We think the stock is a 20% grower long-term.

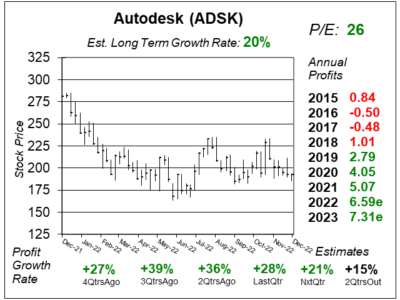

Autodesk (ADSK) stock has been falling due to recession fears. But maybe this architecture software isn’t a cyclical business anymore?

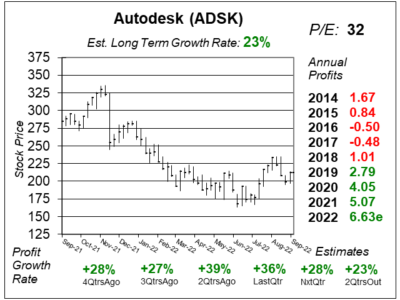

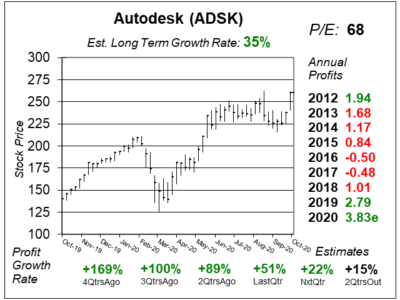

When you look at the Autodesk (ADSK) chart, the stock looks terrible. But when you look at the numbers, business is quite strong.

Autodesk (ADSK) is expected to grow profits a solid 36% in 2022, and with a P/E of just 34, this growth stock has good upside.

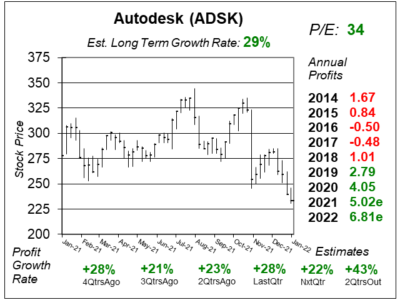

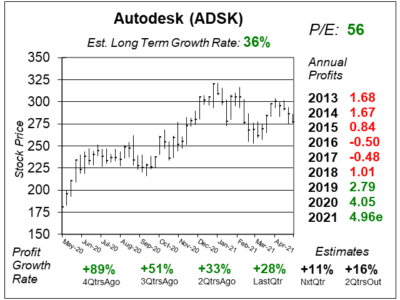

Autodesk (ADSK) is expected to have profit growth accelerate to more than 40% a qtr next year, with infrastructure spending.

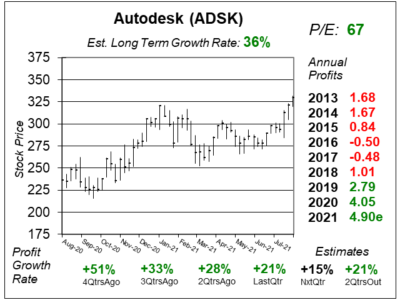

Autodesk (ADSK) just turned the corner as new business accelerated last qtr. Construction spending could be a catalyst.

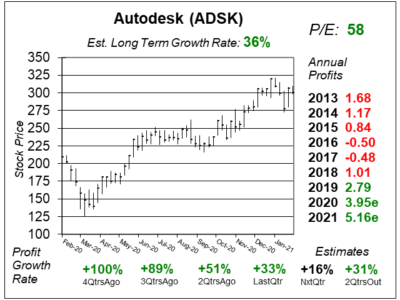

The big picture with Autodesk (ADSK) is profits are expected to double from $4.05 last year to $8.17 in 2023.

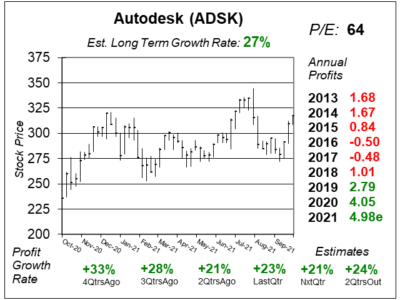

Autodesk (ADSK) is growing profits at a nice rate — 33% last qtr — and manageemnt expects business to improve.

Autodesk’s (ADSK) cloud-based 3D computer aided design software is perfect for this work-at-home economy.