Stocks closed higher after swinging between gains and losses on Thursday, amid remarks from Federal Reserve Chair Jerome Powell on the central bank’s commitment to fighting inflation.

Stocks closed higher after swinging between gains and losses on Thursday, amid remarks from Federal Reserve Chair Jerome Powell on the central bank’s commitment to fighting inflation.

Overall, S&P 500 was up 0.7% to 4,006, while NASDAQ increased 0.6% to 11,862.

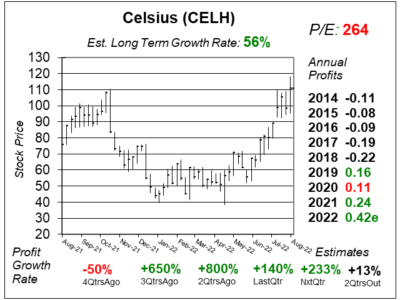

Meanwhile, Celsius (CELH) continued to surge with triple-digit growth and a stock near all-time highs.

Tweet of the Day

81 full LNG ships headed to western Europe. The modern day energy equivalent of the calvary and a new record amount for this time of year. #LNG #TTF #Energy #NaturalGas pic.twitter.com/4gGXAtO1Ga

— NATGAS (@USAEnergyNatGas) September 7, 2022

Quote of the Day

Inflation in America is coming down big time. Oil, Gas, Used Car Prices, Housing, etc.

What has investors worried is extremely high energy prices in Europe. S&P 500 companies sell in Europe, and if Europeans don’t have money to spend, that would worsen the recession here in the states.

If Europe can get energy, and the Ukraine/Russia situation can get resolved, then the stock market will see better times ahead.

– David Sharek, Founder of The School of Hard Stocks

Chart of the Day

Our chart of the day is the one-year chart of CELH as of August 26, 2022, when the stock was at $111.

CELH is an energy drink that has a calorie-burning mechanism that burns 100 to 140 calories by increasing a consumer’s resting metabolism.

It is the second largest energy drink on Amazon, and now PepsiCo (PEP) invested in the company and will distribute the drinks in the US and internationally.

CELH is the #1 ranked stock in the Aggressive Growth Portfolio. David Sharek’s Fair Value jumps from 6x annual revenue estimates back to 10x, which is what he had it at 3QtrsAgo.