Today in the stock market, stocks rallied as the Federal Reserve took a harder stance against inflation as it raised the fed funds rate 0.75% to 1.5%. The S&P 500 rose 1.5% to close at 3789 while the NASDAQ was up 2.5% to 11099. Other notes include:

Today in the stock market, stocks rallied as the Federal Reserve took a harder stance against inflation as it raised the fed funds rate 0.75% to 1.5%. The S&P 500 rose 1.5% to close at 3789 while the NASDAQ was up 2.5% to 11099. Other notes include:

- The Federal Reserve increased he federal funds rate from 0.75% to 1.5%.

- The Fed had the rate at 0% from March of 2020 to February 2022, then raised it 0.25% in March and 0.5% in May of this year.

- This was the highest hike since 1994.

- Fed Chariman Jerome Powell expects July’s increase to be 50 to 75 basis points (0.5% to 0.75%).

- Fed officials reduced their 2022 economic growth outlook (GDP) from 2.8% in March to 1.7%.

Although this doesn’t signal an end to the Bear Market, other signs of a deflating market are promising.

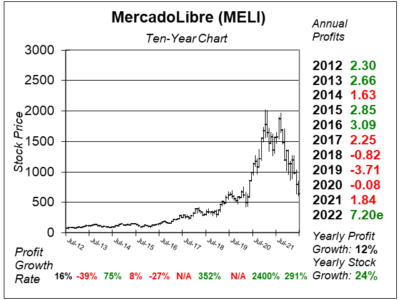

Chart of the Day

Our chart of the day is a ten year chart of MercadoLibre (MELI). MercadoLibre is the largest online commerce platform in Latin America based on visitors and page views, is designed to give users a portfolio of services to do commercial transactions. MELI is like South America’s combination of eBay, PayPal, and Shopify rolled into one. Company segments include:

Our chart of the day is a ten year chart of MercadoLibre (MELI). MercadoLibre is the largest online commerce platform in Latin America based on visitors and page views, is designed to give users a portfolio of services to do commercial transactions. MELI is like South America’s combination of eBay, PayPal, and Shopify rolled into one. Company segments include:

- Marketplace — Mercado Libre: an eBay type platform that allows retailers to sell products online and matches buyers to sellers. Gross Merchandise Volume (GMV) was up 27% last qtr (USD).

- Logistics — Mercado Envios: logistic service that provides integration with third-party carriers as well as order fulfillment and warehouse services so sellers can have a a seamless shipping experience at competitive prices. Total items shipped increased 22% to 254 million last qtr.

- Payments — Mercado Pago: an online payment platform that facilitates transactions on and off the marketplace (like PayPal is to Ebay). By providing a one-stop shop for financial services, the company serves as a first mover in many markets. Last qtr, Total Payment Volume (TPV) jumped 72%.