Stocks put in a mixed day on Wall Street today as investors are still unsure as to whether high inflation will lead to a recession. The CPI report is due on Friday.

Stocks put in a mixed day on Wall Street today as investors are still unsure as to whether high inflation will lead to a recession. The CPI report is due on Friday.

Today, Wednesday June 8, 2022, the S&P 500 was down 1.1% to close at 4118. The tech-heavy NASDAQ was down 0.8% to clsoe at 12084.

Leaders on the day were Snowflake (SNOW), which rose 3% to $136, and Unity Software (U) which rose 3% to close at $46.

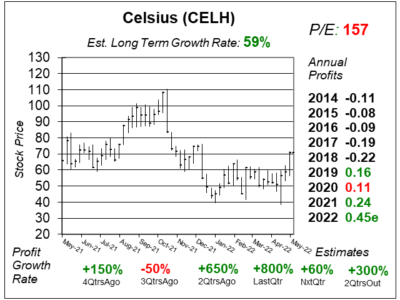

Chart of the Day

Our chart of the day is this one-year chart of Celsius (CELH) from May 28th wit hte shares at $71.

Our chart of the day is this one-year chart of Celsius (CELH) from May 28th wit hte shares at $71.

CELH’s profits jumped 800% last qtr on 167% revenue growth as the company further expanded its store locations. Last qtr, CELH expanded its convenience store locations to 64,000, up 88% from a year ago, as the company already started with the rollout of its products to over 6,000 Circle K locations. CELH grew its vending machines to over 12,000, a 296% increase from a year ago. It also expanded into more Walmart locations, for a total store count of 4,400 stores. In March 2022, CELH began the introduction of its products through Sam’s Club, adding 589 store locations. Its Delivery Store Delivery (DSD) network delivered 395% increase in its distributor revenues. CELH is growing extremely fast.

The only problem with the stock is the valuation. CELH sells for 9x 2022 revenue estimates. That’s the same price-to-sales ratio as industry leader Monster Energy. And Celsius is no Monster. My Fair Value on CELH is 6x revenue, or $47 a share. Celsius is part of our Aggressive Growth Portfolio.