So by now everyone knows we’re in a recession. Copper and wheat prices are coming down, and oil stocks are no longer market leaders.

So by now everyone knows we’re in a recession. Copper and wheat prices are coming down, and oil stocks are no longer market leaders.

Today the stock market rallied on “news of a recession” as the combination of lower home sales, lower home prices, lower used car prices, lower truck transportation prices, and lower raw goods prices. The S&P 500 rose 1.0% to 3796 while the NASDAQ jumped 1.6%. Speculative stocks were the leaders, including:

- Celsius (CELH) +15% to $64

- Datadog (DDOG) +10% to $101

- Unity Software (U) +14% to $44

- Bill.com (BILL) +10% to $125

- Gitlab (GTLB) +11% to $53

Overall, it seems like we are in the recession, and this quarter we should see a confirmation of that, as GDP was already down 1.5% in the first qtr of 2022. So if we get lower GDP this quarter then its a recession.

And since the stock market thinks 6-9 months in advance, we are probably already in the recession, and now is the time to be looking at investing in future market leaders.

Tweet of the Day

Our tweet of the day is:

The S&P Global mfg PMI dove to 52.4 in June from 57.0 & services were even weaker. Recession risks have started to trump the inflation narrative — the stock market figured it out first & now the bond market is catching up. The Fed has one more hike left in July & then it’s over.

— David Rosenberg (@EconguyRosie) June 23, 2022

Chart of the Day

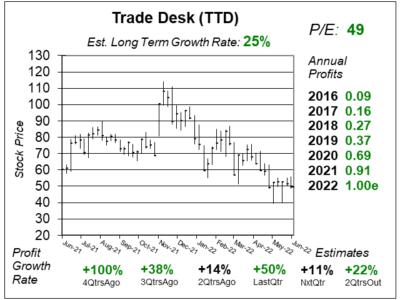

Our chart of the day is of The Trade Desk (TTD), which rose 5% today to close at $47. This one year chart is as of June 11 when the stock was $49.

Our chart of the day is of The Trade Desk (TTD), which rose 5% today to close at $47. This one year chart is as of June 11 when the stock was $49.

I was about to increase my position in this stock this week, but chickened out as (1) my original cost basis is $5 and (2) I don’t know if this is the bottom for this stock or the market.

TTD is a cloud-based software platform which allows advertising executives to manage digital ad campaigns across different spectrums, such as TV or the Internet, utilizing real-time data. The company specializes in programmatic advertising, which uses computer programs to purchase ads geared to people who might be interested in buying a product. Programmatic ads are growing 20% per year, which is 5x the rate of total ad growth (Source: Magna Global).

My 2022 Fair Value on TTD is 65x earnings, or $65 in 2022 and $77 in 2023.