The stock market closed lower on Friday as the Labor Department’s July jobs report beat expectations significantly. The job gains could strengthen the Federal Reserve’s stance on aggressive tightening policy.

The stock market closed lower on Friday as the Labor Department’s July jobs report beat expectations significantly. The job gains could strengthen the Federal Reserve’s stance on aggressive tightening policy.

Overall, S&P500 fell 0.2% to 4,145, while NASDAQ declined 0.5% to 12,658.

Meanwhile, Tesla (TSLA) delivered a quarter-of-a-million vehicles last qtr.

Tweet of the Day

NEWS: Adro Inc has introduced their prepreg (dry carbon) aero kit for the Tesla Model 3 for $5,500. pic.twitter.com/CuQ62Z1vfC

— Sawyer Merritt (@SawyerMerritt) August 5, 2022

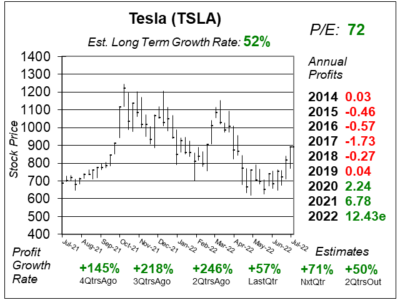

Chart of the Day

Our chart of the day is the one-year chart of TSLA as of July 30, 2022 when the stock was at $891.

Our chart of the day is the one-year chart of TSLA as of July 30, 2022 when the stock was at $891.

TSLA designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation, and energy storage systems. Products are generally sold directly to consumer, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships.

TSLA shrugged off factory shutdowns and supply chain challenges to deliver a quarter-of-a-million electronic vehicles last qtr (254,695 to be exact). That was a good quarter considering TSLA’s Shanghai plant was shutdown fully than partially during most of the quarter. The last month in the qtr was the highest production month in company history, and this was done in a profitable way as TSLA’s 14.6% operating margin is among the highest in the industry. Still, deliveries were higher the prior two qtrs, at ~305,000 each.

TSLA is part of my Growth Portfolio and Aggressive Growth Portfolio. My Fair Value moves down again from 100 to 80 this qtr, as stocks are getting lower valuations from investors with interest rates and inflation rates high.