Stocks went into a free-fall today — Friday June 13, 2022 — after inflation came in higher than expected. The Labor Department’s Consumer Price Index (CPI) rose 8.6% in May (for the prior 12 month period), up from 8.3% in April. Investors were hoping for lower inflation than April. Food and energy costs were the culprit of much of the increase.

Stocks went into a free-fall today — Friday June 13, 2022 — after inflation came in higher than expected. The Labor Department’s Consumer Price Index (CPI) rose 8.6% in May (for the prior 12 month period), up from 8.3% in April. Investors were hoping for lower inflation than April. Food and energy costs were the culprit of much of the increase.

For the day, the S&P 500 fell 2.9% on the day as the NASDAQ declined 3.5%. Overall, it seems we are either in a recession or going to be in one, as inflation looks like a runaway train. Analysts predict the S&P will decline from 3900 to 3400-3500 if we do indeed see a recession (which seems likely).

Some of the hardest hit stocks this year have been restaurant stocks, which are facing a double-whammy of higher labor costs (to get people to work) and higher ingredient and packaging costs.

Chart of the Day

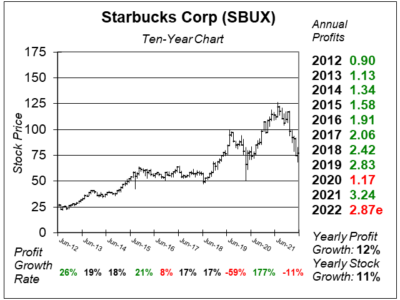

Our chart of the day is this ten-year chart of Starbucks (SBUX).

Starbucks grew revenue a solid 15% last qtr, but COVID-19 closures in China, higher inflation, and labor costs cut into profits, and profit growth clocked in at -5%.

Profits were negatively impacted by inflationary pressures across its supply chain (i.e. wages, freight and commodities) and new mobility restrictions imposed in China due to its strict zero-COVID policy.

SBUX has a fiscal year end on September 30th, so we will be looking ahead to 2023 starting next qtr. The stock currently sells for 22x 2023 profit estimates of $3.45. A P/E of 22 makes this stock a value, so even though things seem bleak, I feel it’s too good of a value to sell now. My 2022 and 2023 Fair Values are $86 and $104 with upsides of 12% and 35%, respectively.

Demand is strong at SBUX locations, but the company has a slew of issues related to COVID-19 closures, inflation, and labor. But with the stock selling for 22x next year’s profit estimates, I think this is a god time to accumulate shares.