Stocks staged a furious rally today, in what seems to be the beginning of a Bear Market rally. I think the stock market went from correction to uptrend today as the S&P 500 jumped 3.0% and the NASDAQ did even better with a 3.3% gain.

Stocks staged a furious rally today, in what seems to be the beginning of a Bear Market rally. I think the stock market went from correction to uptrend today as the S&P 500 jumped 3.0% and the NASDAQ did even better with a 3.3% gain.

Leaders on the day include:

- Cloudflare (NET) +8% to $52

- Crowdstrike (CRWD) +6% to $185

- DataDog (DDOG) +7% to $107

- NVIDIA (NVDA) +6% to $171

The big news today was Zendesk (ZEN) getting bought out by private equity investors for $10.2 billion. Zendesk is expected to do 1.7 billion in revenue this year, thus the stock sold for 6x 2022 revenue estimates.

ZEN had annual profits (and estimates) of:

2017 -$0.13

2018 $0.21

2019 $0.31

2020 $0.52

2021 $0.63

2022 $0.72e (estimate)

2023 $1.06e

2024 $1.62e

Those are good profit numbers. ZEN has an Estimated Long-Term Growth Rate of 33%. That’s a solid growth rate. So overall, this was a great buy for 6x revenue. Meanwhile, I’m thinking this software company is worth 12x revenue — and that may be too much.

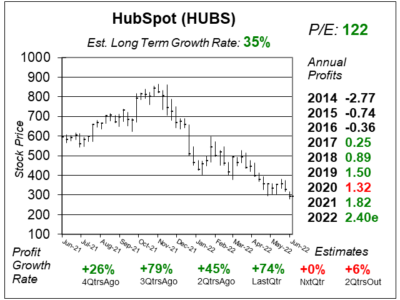

Chart of the Day

Our Chart of the Day is this one-year of Hubspot (HUBS). Hubspot has been free-falling as the stock sold for too high of a valuation last year. In 2021 Q3 HUBS sold for 29x revenue (2021 est) when the stock was $478.

Our Chart of the Day is this one-year of Hubspot (HUBS). Hubspot has been free-falling as the stock sold for too high of a valuation last year. In 2021 Q3 HUBS sold for 29x revenue (2021 est) when the stock was $478.

This qtr HUBS was $293 and sold for 10x revenue. My Fair Value is 12x revenue or $436 a share. But now that I see ZEN getting bought for 6x revenue, I may have to lower my Fair Value on HUBS next qtr.