The stock market rallied on Friday, but finished the week lower, as investors assessed mixed jobs figures and what it could mean for the Federal Reserve’s future rate hikes.

The stock market rallied on Friday, but finished the week lower, as investors assessed mixed jobs figures and what it could mean for the Federal Reserve’s future rate hikes.

The U.S. economy added 261,000 jobs in October against the expected 210,000. However, unemployment rate rose to 3.7%, an increase from 3.5% in September.

Overall, S&P 500 increased 1.4% to 3,771, while NASDAQ was up 1.3% to 10,475.

Tweet of the Day

Baron: “let’s make just simple math … “ $TSLApic.twitter.com/etSHVSHH5J

— 𝒰𝓂𝒷𝒾𝓈𝒶𝓂 (@Umbisam) November 4, 2022

Chart of the Day

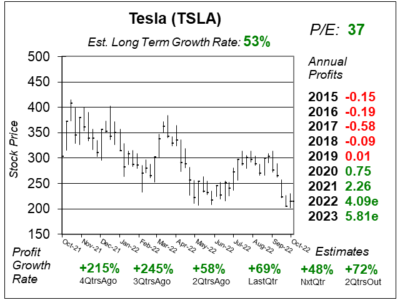

Our chart of the day is the one-year chart of Tesla (TSLA) as of October 22, 2022, when the stock was at $214.

Our chart of the day is the one-year chart of Tesla (TSLA) as of October 22, 2022, when the stock was at $214.

Tesla designs, develops, manufactures, sells, and leases high-performance fully electric vehicles, energy generation, and energy storage systems. Products are generally sold directly to consumer, which gives the company a great edge in auto manufacturing that it doesn’t have the overhead of dealerships.

TSLA’s chart has been wild the past year. The stock has been down during the past month, but maybe that was because Elon Musk sold TSLA stock to close on the Twitter deal.

Based on the qtrly profit growth, TSLA is a legit growth stock. Estimates were solid as well.

TSLA is part of the Growth Portfolio and Aggressive Growth Portfolio. David Sharek’s Fair Value moves down again from 80 to 75 this qtr. However, the P/E of 37 is well below the 72 P/E the stock had last qtr. This stock seems like a steal!