The stock market has been weak the past couple of days. On the day, S&P 500 declined 0.8% to 3,899, while NASDAQ fell 1.0% to 10,852.

The stock market has been weak the past couple of days. On the day, S&P 500 declined 0.8% to 3,899, while NASDAQ fell 1.0% to 10,852.

Last week, we thought a new Bull Market was (probably) here.

Now, investors are concerned about slowing growth, especially with technology stocks.

We are seeing lots of tech companies and consultants lower earnings estimates.

In the past week, we published research reports on tech stocks, and the stories were basically the same: slowing growth. Those include:

- The Trade Desk (TTD)

- Salesforce (CRM)

- CrowdStrike (CRWD)

- Snowflake (SNOW)

- Zscaler (ZS)

- Accenture (ACN)

- Adobe (ADBE)

Tweet of the Day

An update from the #MysteryBroker arrived overnight, including a review of his 2022 calls and a generally cautious outlook for this year…

— Michael Santoli (@michaelsantoli) January 19, 2023

Chart of the Day

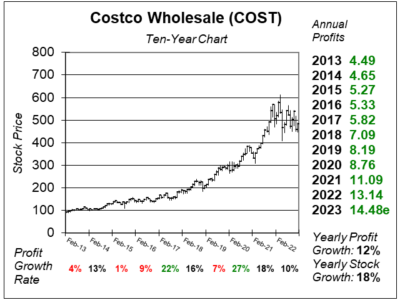

Our chart of the day is the ten-year chart of Costco (COST) as of January 12, 2023, when the stock was at $482.

Our chart of the day is the ten-year chart of Costco (COST) as of January 12, 2023, when the stock was at $482.

Costco is the 2nd largest global retailer with more than 120 million members. The profit Costco makes is mostly made up from the annual membership fees it brings in.

Last qtr, Costco (COST) delivered 4% profit growth, as the company lapped a strong quarter a year ago when profits soared 30%. If it weren’t for the strong US dollar, profit growth would have been 8% last qtr. Now the USD is falling, which could help the company beat estimates in the upcoming quarters. What’s also falling is shipping costs. Now, shipping times have improved dramatically, and shipping and container costs are much lower.

COST has been a steady winner for many decades, thus investors really appreciate the stock. This was an overall good quarter, and once again nothing really stood out as being a headline for this story.

COST is a core holding in the Conservative Growth Portfolio.