The stock market posted gains on Thursday, as investors dissected the minutes from the latest Fed meeting, which indicated that the central bank remains committed to mitigating inflation. Furthermore, initial jobless claims fell for the week ended August 13, while home sales dropped in July.

The stock market posted gains on Thursday, as investors dissected the minutes from the latest Fed meeting, which indicated that the central bank remains committed to mitigating inflation. Furthermore, initial jobless claims fell for the week ended August 13, while home sales dropped in July.

Overall, S&P 500 and NASDAQ went up 0.2% to 4,284 and 12,965, respectively.

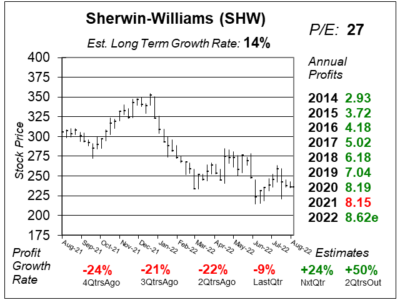

In other news, Sherwin-Williams’ (SHW) profit growth is seen to accelerate next qtr.

Tweet of the Day

Morgan Stanley's Mike Wilson:

🚫 "Woopsie?"

🚫 Rally has caught us by surprise

🚫 Valuation to Fundamental disconnnect

🚫 What drives next leg lower in markets?$SPY $NYA $QQQ $SPX pic.twitter.com/tuxK0GRr9C— Seth Golden (@SethCL) August 18, 2022

According to David Sharek,

Morgan Stanley has been the best source for where the market is headed. If they are saying the risk/reward is unattractive, then I believe it.

Chart of the Day

Our chart of the day is the one-year chart of SHW as of August 9, 2022, when the stock was at $236.

Our chart of the day is the one-year chart of SHW as of August 9, 2022, when the stock was at $236.

Founded in 1886, SHW has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray paint (Krylon), auto paint (Dupli-Color), and water sealer (Thompson’s).

SHW is making a bottom. The issue is with a P/E of 27, the stock isn’t selling for much of a discount. However, notice that profit growth is expected to come back next qtr. Management expects low double-digit to mid-teens revenue growth for the remainder of the year (two qtrs). That would be accelerated revenue growth, and that’s a positive. SHW will also raise prices 10% in the Americas Group on September 6.

SHW is part of the Conservative Growth Portfolio. David Sharek’s Fair Value P/E remains at 28. This stock is selling for around its fair value.