Stocks tumbled on Tuesday as investors prepared for another large rate hike from the Federal Reserve to fight against inflation. The rate hike is expected to be announced on Wednesday.

Stocks tumbled on Tuesday as investors prepared for another large rate hike from the Federal Reserve to fight against inflation. The rate hike is expected to be announced on Wednesday.

Overall, S&P 500 was down 1.1% to 3,856, while NASDAQ declined 1.0% to 11,425.

In other news, Datadog (DDOG) was a risky investment with big potential.

Tweet of the Day

$JNK High Yield Bonds is a chart I will be paying attention to this week. Treasuries have been making new yearly lows but not high yield bonds. A break of the important $90 support will be a big "risk-off" signal and vice-versa if it holds. pic.twitter.com/QGZzVuBeiF

— Victor Riesco, CMT (@Global_Trader) September 19, 2022

Chart of the Day

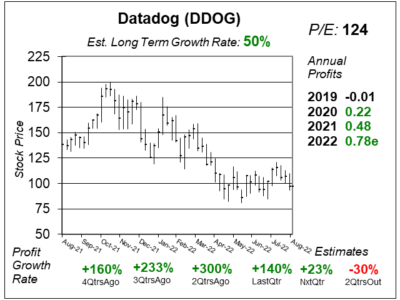

Our chart of the day is the one-year chart of DDOG as of September 5, 2022, when the stock was at $97.

Datadog helps organization monitor their websites and application. Its dashboards allow users to customize their views and see data by different hosts or devices.

DDOG seemed to be the best company in data analysis, but the stock was richly-valued. According to David Sharek, DDOG is a young company that’s growing extremely fast, so its P/E is high at 124.

But, there’s big opporunity ahead, as his 2023 Fair Value is $142, suggesting 46% upside.

With a high P/E of 124 and profit growth expected to slow to 23% next qtr, Datadog stock could fall as interest rates continue to rise. Rising rate have been hurting speculative stocks for almost a year now.

– David Sharek, Founder of The School of Hard Stocks

DDOG is on the radar for the Aggressive Growth Portfolio.