Stock (Symbol)

|

Sherwin-Williams (SHW)

|

Stock Price

|

$269

|

Sector

|

| Retail & Travel |

Data is as of

|

| January 2, 2017 |

Expected to Report

|

| Jan 26 – 30 |

Company Description

|

SHW is engaged in the development, manufacture, distribution and sale of paint, coatings and related products. SHW’s segments include Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, and OEM product finishes, among others. The Latin America Coatings Group develops, manufactures, distributes and sells architectural paint and coatings, finishes, among others. Source: Thomson Financial SHW is engaged in the development, manufacture, distribution and sale of paint, coatings and related products. SHW’s segments include Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, and OEM product finishes, among others. The Latin America Coatings Group develops, manufactures, distributes and sells architectural paint and coatings, finishes, among others. Source: Thomson Financial

|

Sharek’s Take

|

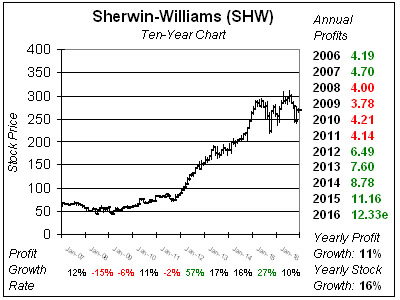

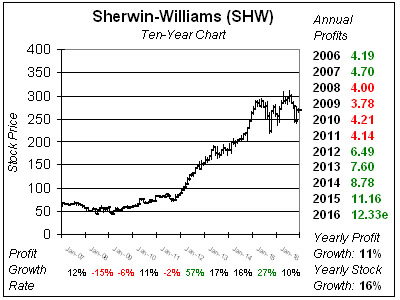

Sherwin-Williams’ (SHW) is experiencing more normalized growth. but Trump as President could mean better business ahead. This stock had been hot since breaking out at $90 in December 2011. A growing U.S. housing (remodeling) market helped push profits up an average of 29% a year from 2012-2015 as SHW stock soared from $90 in December 2011 to $270 in December 2015. Then in 2016 the stock made it to $300 as profit growth simmered down to around 10%, which is what the stock’s Estimated Long-Term Growth Rate is. Founded in 1886, the company has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray pain (Krylon), auto paint (Dupli-Color) and water sealer (Thompson’s). It’s has a marvelous end-to-end supply chain with 62 manufacturing sites, 14 distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and 4000 company stores. The company has strong cash flow due to little capital investment needs, thus management makes acquisitions in addition to stock buybacks that have reduced its share count 30% since 2007. Right now, SHW sells for 20x earnings, which I feel is the right price for this stock. Sherwin-Williams gets a top safety rating, and has an Est. LTG of 10% per year in addition to a yield of 1%. Management has raised its dividend every year since 1979, from a penny to $2.68 (wait, scratch that, $3.66 now). In 2016, the company agreed to acquire Valspar, and this should boost results past expectations as SHW is paying all cash for the fifth largest North American manufacturer of paints and coatings . Sherwin-Williams’ (SHW) is experiencing more normalized growth. but Trump as President could mean better business ahead. This stock had been hot since breaking out at $90 in December 2011. A growing U.S. housing (remodeling) market helped push profits up an average of 29% a year from 2012-2015 as SHW stock soared from $90 in December 2011 to $270 in December 2015. Then in 2016 the stock made it to $300 as profit growth simmered down to around 10%, which is what the stock’s Estimated Long-Term Growth Rate is. Founded in 1886, the company has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray pain (Krylon), auto paint (Dupli-Color) and water sealer (Thompson’s). It’s has a marvelous end-to-end supply chain with 62 manufacturing sites, 14 distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and 4000 company stores. The company has strong cash flow due to little capital investment needs, thus management makes acquisitions in addition to stock buybacks that have reduced its share count 30% since 2007. Right now, SHW sells for 20x earnings, which I feel is the right price for this stock. Sherwin-Williams gets a top safety rating, and has an Est. LTG of 10% per year in addition to a yield of 1%. Management has raised its dividend every year since 1979, from a penny to $2.68 (wait, scratch that, $3.66 now). In 2016, the company agreed to acquire Valspar, and this should boost results past expectations as SHW is paying all cash for the fifth largest North American manufacturer of paints and coatings . |

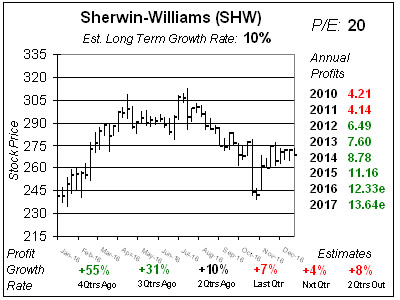

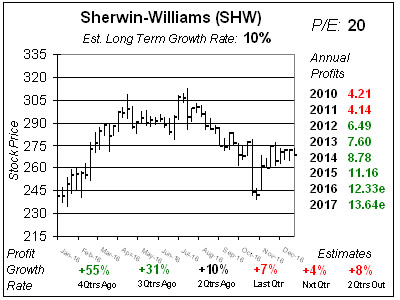

One Year Chart

|

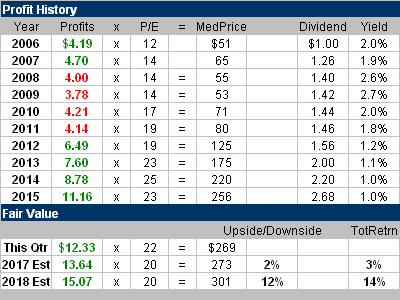

Last qtr SHW posted profit growth of 7% on a 4% gain in sales. Profits came in below the 9% estimate. Business is good across all levels outside a modest decline in DIY. Management raised prices 4% in December 2016. Since SHW reported, analysts have reduced profit estimates. 2016’s fell from $12.63 to $12.33, 2017’s from $14.06 to $13.64, and 2018’s from $15.67 to $15.07. Qtrly Estimates also fell, with qtrly profit growth now estimated at 4%, 8%, 10% and 7%. Protective & Marine sales have been hampered by a slow oil drilling industry, and it looks like that segment has since bottomed. Last qtr SHW posted profit growth of 7% on a 4% gain in sales. Profits came in below the 9% estimate. Business is good across all levels outside a modest decline in DIY. Management raised prices 4% in December 2016. Since SHW reported, analysts have reduced profit estimates. 2016’s fell from $12.63 to $12.33, 2017’s from $14.06 to $13.64, and 2018’s from $15.67 to $15.07. Qtrly Estimates also fell, with qtrly profit growth now estimated at 4%, 8%, 10% and 7%. Protective & Marine sales have been hampered by a slow oil drilling industry, and it looks like that segment has since bottomed. |

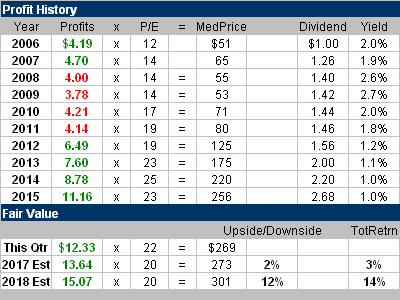

Fair Value

|

The P/E was higher than normal the past few years, which was much deserved with profits growing as briskly as they were. Now more normalized growth should reduce the P/E ratio. But with Trump bullish on oil and industrial growth, business could be better than expected. But my current Fair Value for 2017 is 20x earnings or $273 a share which doesn’t give the stock much upside. The P/E was higher than normal the past few years, which was much deserved with profits growing as briskly as they were. Now more normalized growth should reduce the P/E ratio. But with Trump bullish on oil and industrial growth, business could be better than expected. But my current Fair Value for 2017 is 20x earnings or $273 a share which doesn’t give the stock much upside. |

Bottom Line

|

Sherwin-Williams is a 150 year old juggernaut that is vertically integrated, buys back stock, makes acquisitions and pays a dividend. Profit growth has settled back down to the 10% area, but Valspar should boost profit growth once the deal closes. Also, Trump’s initiatives could bring a boost to the Global Finishes division, which is around 20% of sales and includes Protective & Marine (oil drilling plants), Automotive Finishes (build here or pay a tariff) and Product Finishes (like kitchen cabinets). SHW ranks 18th in the 38 stock Conservative Growth Portfolio Power Rankings. Sherwin-Williams is a 150 year old juggernaut that is vertically integrated, buys back stock, makes acquisitions and pays a dividend. Profit growth has settled back down to the 10% area, but Valspar should boost profit growth once the deal closes. Also, Trump’s initiatives could bring a boost to the Global Finishes division, which is around 20% of sales and includes Protective & Marine (oil drilling plants), Automotive Finishes (build here or pay a tariff) and Product Finishes (like kitchen cabinets). SHW ranks 18th in the 38 stock Conservative Growth Portfolio Power Rankings. |

Power Rankings

|

Growth Stock Portfolio

N/A

Aggressive Growth Portfolio

N/A

Conservative Stock Portfolio

18 of 38

|

SHW is engaged in the development, manufacture, distribution and sale of paint, coatings and related products. SHW’s segments include Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, and OEM product finishes, among others. The Latin America Coatings Group develops, manufactures, distributes and sells architectural paint and coatings, finishes, among others. Source: Thomson Financial

SHW is engaged in the development, manufacture, distribution and sale of paint, coatings and related products. SHW’s segments include Paint Stores Group, Consumer Group, Global Finishes Group and Latin America Coatings Group. The Paint Stores Group markets and sells architectural paint and coatings, protective and marine products, original equipment manufacturer (OEM) product finishes. The Consumer Group develops, manufactures and distributes a range of paint, coatings and related products to third party customers. The Global Finishes Group develops, licenses, manufactures, distributes and sells a range of protective and marine products, automotive finishes and refinished products, and OEM product finishes, among others. The Latin America Coatings Group develops, manufactures, distributes and sells architectural paint and coatings, finishes, among others. Source: Thomson Financial Sherwin-Williams’ (SHW) is experiencing more normalized growth. but Trump as President could mean better business ahead. This stock had been hot since breaking out at $90 in December 2011. A growing U.S. housing (remodeling) market helped push profits up an average of 29% a year from 2012-2015 as SHW stock soared from $90 in December 2011 to $270 in December 2015. Then in 2016 the stock made it to $300 as profit growth simmered down to around 10%, which is what the stock’s Estimated Long-Term Growth Rate is. Founded in 1886, the company has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray pain (Krylon), auto paint (Dupli-Color) and water sealer (Thompson’s). It’s has a marvelous end-to-end supply chain with 62 manufacturing sites, 14 distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and 4000 company stores. The company

Sherwin-Williams’ (SHW) is experiencing more normalized growth. but Trump as President could mean better business ahead. This stock had been hot since breaking out at $90 in December 2011. A growing U.S. housing (remodeling) market helped push profits up an average of 29% a year from 2012-2015 as SHW stock soared from $90 in December 2011 to $270 in December 2015. Then in 2016 the stock made it to $300 as profit growth simmered down to around 10%, which is what the stock’s Estimated Long-Term Growth Rate is. Founded in 1886, the company has the #1 brand in paint (Sherwin-Williams), stain (Minwax), spray pain (Krylon), auto paint (Dupli-Color) and water sealer (Thompson’s). It’s has a marvelous end-to-end supply chain with 62 manufacturing sites, 14 distribution centers, 400 trucks and 1200 trailers to get paint and other goods to home improvement centers and 4000 company stores. The company