Stock (Symbol) |

Sea (SE) |

Stock Price |

$151 |

Sector |

| Technology |

Data is as of |

| September 24, 2020 |

Expected to Report |

| December 4 |

Company Description |

Sea Limited, formerly Garena Interactive Holding Limited, is an Internet company. The Company operates through three segments: digital entertainment, e-commerce and digital financial services. The Company has developed an integrated platform consisting of digital entertainment focused on online games, e-commerce, and digital financial services focused on e-wallet services. Its platforms include Garena, Shopee, and AirPay. Garena provides access to engaging mobile and personal computer (PC) online games, live streaming game play, as well as social features such as user chat and online forums. Shopee is an e-commerce marketplace where users come together to browse, shop and sell on-the-go, anytime, anywhere. AirPay App is the Company’s digital financial services business that provides e-wallet services to consumers through the AirPay App and to small businesses through the AirPay counter application. Source: Thomson Financial Sea Limited, formerly Garena Interactive Holding Limited, is an Internet company. The Company operates through three segments: digital entertainment, e-commerce and digital financial services. The Company has developed an integrated platform consisting of digital entertainment focused on online games, e-commerce, and digital financial services focused on e-wallet services. Its platforms include Garena, Shopee, and AirPay. Garena provides access to engaging mobile and personal computer (PC) online games, live streaming game play, as well as social features such as user chat and online forums. Shopee is an e-commerce marketplace where users come together to browse, shop and sell on-the-go, anytime, anywhere. AirPay App is the Company’s digital financial services business that provides e-wallet services to consumers through the AirPay App and to small businesses through the AirPay counter application. Source: Thomson Financial |

Sharek’s Take |

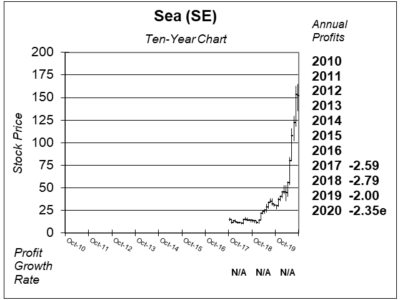

Sea (SE) is devouring Southeast Asia’s e-Commerce and Video Game markets as the company is on its way to being a new-economy heavyweight with the likes of Tencent, Alibaba and Amazon. Sea is an Internet company based out of Singapore that is composed of a video game platform, an e-commerce store, and an e-wallet service. The company’s an affiliate of Tencent. Tencent is China’s largest and most used internet service portal as well as the leading video game company in China. Sea is basically like Tencent outside of China. Sea’s market is Greater Southeast Asia, which includes Vietnam, Thailand, Malaysia, Singapore, Taiwan, the Philippines, and Indonesia. Here’s a quick video of Sea. Sea (SE) is devouring Southeast Asia’s e-Commerce and Video Game markets as the company is on its way to being a new-economy heavyweight with the likes of Tencent, Alibaba and Amazon. Sea is an Internet company based out of Singapore that is composed of a video game platform, an e-commerce store, and an e-wallet service. The company’s an affiliate of Tencent. Tencent is China’s largest and most used internet service portal as well as the leading video game company in China. Sea is basically like Tencent outside of China. Sea’s market is Greater Southeast Asia, which includes Vietnam, Thailand, Malaysia, Singapore, Taiwan, the Philippines, and Indonesia. Here’s a quick video of Sea.

Sea has three brands: Digital Entertainment (gaming) has positive EBITA, while E-commerce and Digital Financial Services lose money: Digital Entertainment

E-commerce

Digital Financial Services

As you saw in the data above, Sea’s growth accelerated last qtr. In addition, the company is blowing past its e-commerce competitors in Indonesia, Vietnam, Thailand, Singapore, Malaysia and the Philippines. Growth has been great, and the company is in the hot areas to compound its business rapidly. Management is determined to grow rapidly, and doesn’t mind sacrificing profits to do so. Losses are expected to continue for years to come, so an investment in this company would fall under the category of “dominant franchise that’s spending to grow”. Sea is part of the Growth Portfolio and Aggressive Growth Portfolio. I think this company is similar to Amazon in its infancy. |

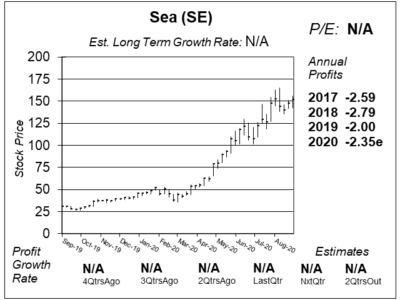

One Year Chart |

SE broke out on November 12, 2019 when it jumped from $31 to $37. I bought in on December 23, 2019 at ~$39 and increased my position January 22, 2020 at ~$45. The stock has moved up into being a top-three holding for me, and I have since sold some shares. SE broke out on November 12, 2019 when it jumped from $31 to $37. I bought in on December 23, 2019 at ~$39 and increased my position January 22, 2020 at ~$45. The stock has moved up into being a top-three holding for me, and I have since sold some shares.

There’s not much in this one-year chart. The stock is basing here, and my guess is it will break out and go to new highs in the near future. |

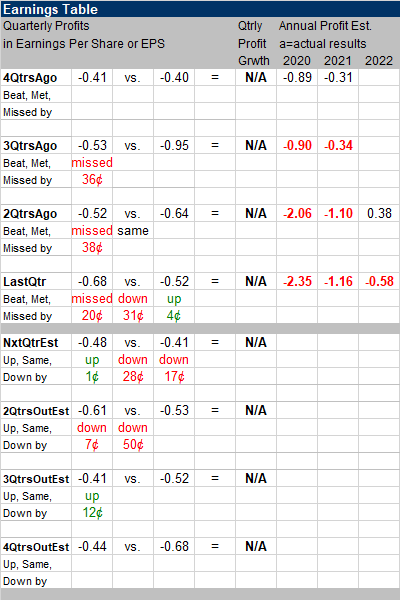

Earnings Table |

Last qtr Sea lost $0.68 and that missed estimates by 20 cents. But revenue surged 94%. Fr comparisons, sales grew 58%. That’s HUGE acceleration. Last qtr Sea lost $0.68 and that missed estimates by 20 cents. But revenue surged 94%. Fr comparisons, sales grew 58%. That’s HUGE acceleration.

Annual Profit Estimates declined, but investors don’t seem to mind. Qtrly profit Estimates are for losses to continue. |

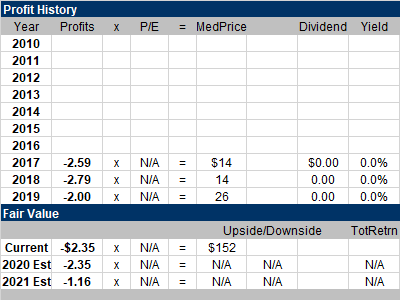

Fair Value |

No profits, so I value this stock on a price to sales basis. Revenue has gone from around $500 million in 2017 to $1 billion in 2018 , ~$3 billion in 2019 and perhaps $5 billion this year with estimates of $7 billion next year. No profits, so I value this stock on a price to sales basis. Revenue has gone from around $500 million in 2017 to $1 billion in 2018 , ~$3 billion in 2019 and perhaps $5 billion this year with estimates of $7 billion next year.

My Fair Value is 15x 2020’s revenue estimate of $5.1 billion, or $77 billion. The market cap right now is $75 billion, so there’s not much upside to 2020’s Fair Value. 2021’s sales estimates are $7.1 billion, and 15x that would be $107 billion. $107 billion marker cap / 488 million shares outstanding is a $219 stock price (my 2021 Fair Value). |

Bottom Line |

Sea (SE) is basing after a parabolic run higher. The company is executing so well that it’s quickly becoming a juggernaut in Southeast Asia. This stock is similar to Amazon, Alibaba and Tencent. Sea (SE) is basing after a parabolic run higher. The company is executing so well that it’s quickly becoming a juggernaut in Southeast Asia. This stock is similar to Amazon, Alibaba and Tencent.

Seeing that growth accelerated in every category last qtr, I imagine the next move for this stock will be up. Sea moves up from 2nd to 1st in the Growth Portfolio and Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

1 of 49Aggressive Growth Portfolio 1 of 22Conservative Stock Portfolio N/A |