The stock market ended mixed on Thursday, as oil prices dropped below $90 per barrel and jobless claims increased 260,000 (the highest in nine months).

The stock market ended mixed on Thursday, as oil prices dropped below $90 per barrel and jobless claims increased 260,000 (the highest in nine months).

Overall, S&P500 fell 0.1% to 4,152, while NASDAQ rose 0.4% to 12,721.

Meanwhile, PepsiCo (PEP) invested in Celsius Energy (CELH), a new set of drinks to distribute. This transaction is seen to boost PEP’s sales.

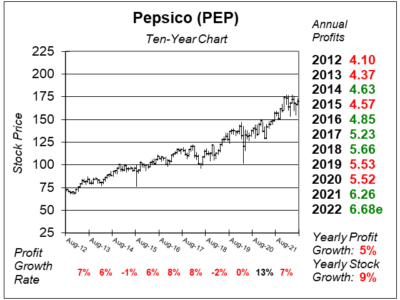

Chart of the Day

Our chart of the day is the ten-year chart of PEP.

Our chart of the day is the ten-year chart of PEP.

Founded in 1919, PEP is one of the world’s largest food and beverage companies with more than $70 billion in annual sales. PEP’s great worldwide brands include Pepsi, Frito-Lay, Tropicana, Quaker, and Gatorade, with each generating more than $1 billion in annual sales.

The company is growing faster than I’ve ever seen it. Last qtr, the company delivered 13% organic revenue growth. Meanwhile, two qtrs ago, it did 14% organic growth. Wow! People are really liking these brands. Now, the company has a new brand to appreciate, as PEP just invested $550 million in CELH. The investment is investing in preferred stock that will pay a 5% annual dividend, and can convert into regular stock down the road. This gives PEP 8.5% of CELH.

Looking ahead, the company looks to expand its sports drinks with Gatorade Zero and Bolt24. The company also acquired sports drink brand, Rockstar, last year.

PEP is a core holding in the Conservative Growth Portfolio. My Fair Value P/E remains at 26x earnings this qtr.