Stock (Symbol) |

Pinduoduo (PDD) |

Stock Price |

$98 |

Sector |

| Retail & Travel |

Data is as of |

| November 3, 2020 |

Expected to Report |

| November 12 |

Company Description |

Pinduoduo Inc. is an e-commerce platform operator. It offers Pinduoduo, a mobile e-commerce platform. The Company’s platform provides value-for-money merchandise and interactive shopping options. The platform is built to resemble a virtual bazaar of a broad spectrum of products. It offers both individual and team purchase options. It offers a suite of product categories that include apparel, shoes, bags, childcare products, food and beverage, fresh produce, electronic appliances, furniture, household goods, cosmetics, sports and fitness goods, and auto accessories. The platform provides a range of online payment options that include Weixin Pay, QQ Wallet, Alipay and Apple Pay. Source: Thomson Reuters. Pinduoduo Inc. is an e-commerce platform operator. It offers Pinduoduo, a mobile e-commerce platform. The Company’s platform provides value-for-money merchandise and interactive shopping options. The platform is built to resemble a virtual bazaar of a broad spectrum of products. It offers both individual and team purchase options. It offers a suite of product categories that include apparel, shoes, bags, childcare products, food and beverage, fresh produce, electronic appliances, furniture, household goods, cosmetics, sports and fitness goods, and auto accessories. The platform provides a range of online payment options that include Weixin Pay, QQ Wallet, Alipay and Apple Pay. Source: Thomson Reuters. |

Sharek’s Take |

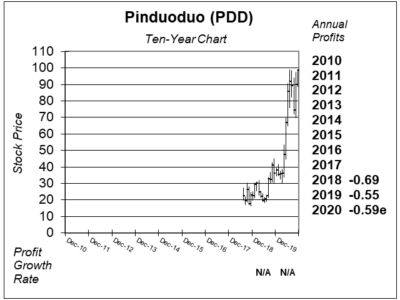

Pinduoduo (PDD) is another e-commerce company that’s showing strength right before this COVID-19 Holiday season. Pinduoduo is an e-commerce service in China that traces its roots back to 2015 as a group-buying service for produce. Pinduoduo (PDD) is another e-commerce company that’s showing strength right before this COVID-19 Holiday season. Pinduoduo is an e-commerce service in China that traces its roots back to 2015 as a group-buying service for produce.

The Pinduoduo app opens up with a personalized feed with personal recommended products within categories such as produce, cosmetics, apparel, groceries, electronics and more. When you purchase, you can join an existing team that the app “pins” you with, or start one by inviting your friends. Group buying creates discounts on the products. For example, an item might cost $36.80 if purchased individually but could be discounted to $29.90 if purchased as a team. Orders are then shipped within 48 hrs. Fruits and vegetables remain a key category, as more than 240 million or 38% of its annual active users bought farm produce via its marketplace in 2019. (source:TechCrunch). Here’s some stats from 2019:

PDD hasn’t made a profits since it’s IPO in 2018. But last qtr the company was expected to lose $0.21 and beat the street by $0.20. That’s almost profits. Could profits be coming? Analysts predict the company will make $0.46 in 2021, then $1.51 in 2022 and $2.96 in 2023. So HUGE profits are expected in the coming years. And with PDD around its All-Time highs today, the stock is attempting to break out. Pinduoduo will be added to the Growth Portfolio today. |

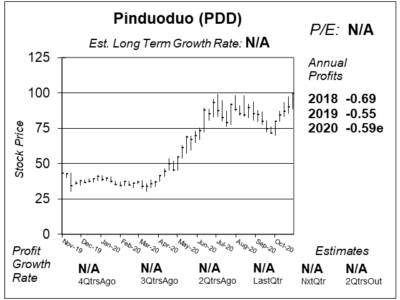

One Year Chart |

Nice looking one-year chart. The stock might break out today, but we won’t know until the close. With the stock expected to deliver earnings on November 12, some people might be aware of some good news coming. Nice looking one-year chart. The stock might break out today, but we won’t know until the close. With the stock expected to deliver earnings on November 12, some people might be aware of some good news coming.

There are no profits here, and none on the immediate horizon. I don’t have an Est. LTG. |

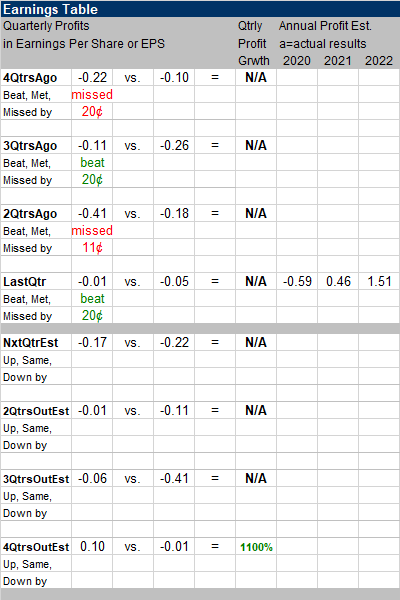

Earnings Table |

Last qtr, Pinduoduo lost a penny a share but beat estimates by a solid 20 cents. Revenue increased 67%. The value of goods sold increased 79% as active buyers increased 41%. Last qtr, Pinduoduo lost a penny a share but beat estimates by a solid 20 cents. Revenue increased 67%. The value of goods sold increased 79% as active buyers increased 41%.

Annual Profit Estimates are for profits to start next year, with excellent profitability in the years to come. Annual estimates are as follows:

Qtrly profit Estimates are for losses the next three qtrs, but there is a chance a profit could be had if PDD beats the street like it did last qtr. Notice profits are expected 4QtrsOut. |

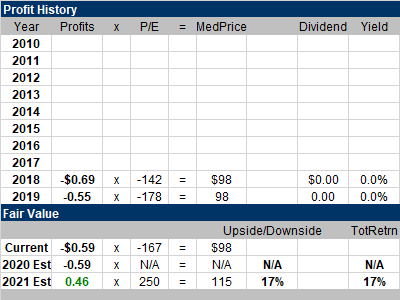

Fair Value |

I have a Fair Value P/E of 250 which equates to 17% upside for 2021. But this valuation is merely a guess. I have a Fair Value P/E of 250 which equates to 17% upside for 2021. But this valuation is merely a guess.

A fair valuation might be 75x profits when profits start to crank up. With 2023 estimates of around $3, that might be a $$225 stock three years from now. But this is really a wild guess at this stage. |

Bottom Line |

Pinduoduo (PDD) ran higher during April – July of this year, then corrected, and is poised to break out to a new All-Time high today. It’s currently within $1 of doing so. Pinduoduo (PDD) ran higher during April – July of this year, then corrected, and is poised to break out to a new All-Time high today. It’s currently within $1 of doing so.

I think with COVID-19 keeping people at home, e-commerce stocks are the place to be this Holiday Season. And China has three of the best. My favorite Chinese e-commerce stocks are (in this order) JD, Alibaba, and now Pinduoduo. PDD will be added to the Growth Portfolio today. The stock will rank 41st in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

41 of 51Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |