Stock (Symbol) |

Paycom Software (PAYC) |

Stock Price |

$310 |

Sector |

| Technology |

Data is as of |

| June 27, 2022 |

Expected to Report |

| August 1 |

Company Description |

Paycom Software is a provider of cloud-based human capital management (HCM) software solution. The Company provides functionality and data analytics that businesses need to manage the complete employment life cycle from recruitment to retirement. Source: Thomson Financial Paycom Software is a provider of cloud-based human capital management (HCM) software solution. The Company provides functionality and data analytics that businesses need to manage the complete employment life cycle from recruitment to retirement. Source: Thomson Financial |

Sharek’s Take |

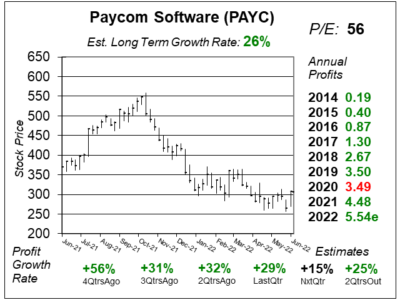

Paycom Software (PAYC) is showing me multiple reasons why the stock may have bottomed. First, the stock seems to have bottomed in the one-year chart. PAYC looks dead-in-the-water as it fell from a high of around $550 last year, and is now just flatlining around $300. Second, the company is still growing strong. Last qtr Paycom delivered 29% profit growth on 30% revenue growth. Third, the P/E ratio is low. Well, low by Paycom’s standards. The 56 P/E would be high for a normal stock, but this is the lowest P/E in one of my research reports since the stock had a 52 P/E in November 2019. Paycom Software (PAYC) is showing me multiple reasons why the stock may have bottomed. First, the stock seems to have bottomed in the one-year chart. PAYC looks dead-in-the-water as it fell from a high of around $550 last year, and is now just flatlining around $300. Second, the company is still growing strong. Last qtr Paycom delivered 29% profit growth on 30% revenue growth. Third, the P/E ratio is low. Well, low by Paycom’s standards. The 56 P/E would be high for a normal stock, but this is the lowest P/E in one of my research reports since the stock had a 52 P/E in November 2019.

Paycom Software offers a complete cloud-based HR program for small and medium sizes businesses (50-10,000 employees) that human resource personnel can log into online to process payroll and benefits for employees. This software makes it easy to do talent acquisition and background checks, to payroll and time-off requests, as well as compliance tasks such as government registrations, benefits administration, COBRA and retirement. The company finished 2021 with 33,875 clients, up 9% from 2020. Competitors include (ranked by highest avg client size): Workday, Ceridian, Ultimate Software, Paycom, Paylocity, ADP and Paychex (source: Paylocity). Paycom has a new app called BETI which allows employees to do, review, and check their payroll. This is great because someone can adjust their tax deductions, move funds in their 401k, or adjust their healthcare without taking time from the HR department. The company also has an app called Manager-on-the-Go, which gives managers 24/7 accessibility to manager side functionality of Paycom’s existing mobile app. In last qtr’s earnings call,CEO Chad Richison said that they have only tapped 5% of Total Addressable Market in the US and there is still a long runway for growth in the future. Paycom has a nice expansion model:

Paycom used to be a “rapid grower”, which in my eyes is a company growing profits at 65% a year or more. Now, I think this is a 30%-35% grower. The stock currently has an Estimated Long-Term Growth Rate of 26%. I’m impressed with Paycom’s stock buyback plan. From 2016-2021 management bought back $488 million in stock. Last qtr, the company has $361 million in cash and $29 million in debt. PAYC is part of the Growth Portfolio. Higher interest rates also help profits, as the company holds payroll funds for 2-3 days before checks are delivered, in addition to holding client taxes that are set to be paid. |

One Year Chart |

This chart pattern is one of the most positive I’ve seen all quarter. It seems like there is no where to go but up as sellers may have been exhausted. This chart pattern is one of the most positive I’ve seen all quarter. It seems like there is no where to go but up as sellers may have been exhausted.

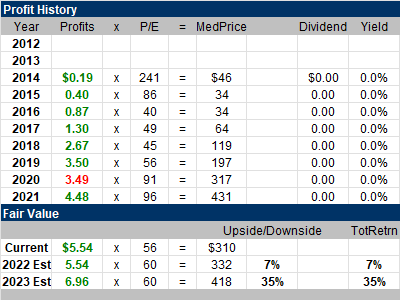

Annual Profits used to grow exceptionally well. Then 2020 saw layoffs at customer businesses, which lead to lower profits. The company got back on track in 2021, and is now expected to grow profits 25% in 2022. The P/E is 56, this qtr. This figure was 59 last qtr. My Fair Value is a 60 P/E. The Est. LTG is 26%, up from 25% last qtr. The Est. LTG was between 25% and 27% before pandemic period. But I feel PAYC can grow profits faster than that. |

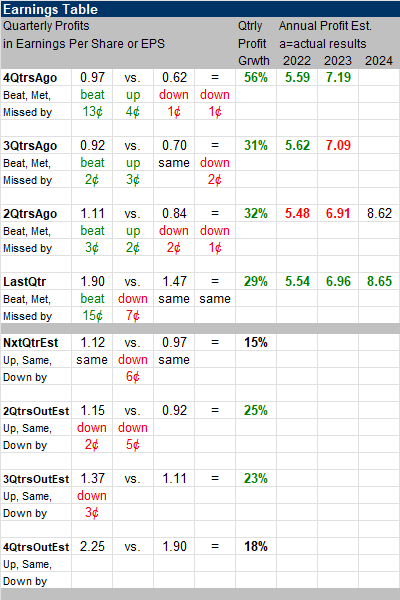

Earnings Table |

Last qtr, Paycom Software delivered 29% profit growth and beat expectations of 19%. Revenue increased 30%, year-over-year. Recurring revenue represented 98% of company sales and it grew 30%. Adjusted gross profit margin was 86.6%. Last qtr, Paycom Software delivered 29% profit growth and beat expectations of 19%. Revenue increased 30%, year-over-year. Recurring revenue represented 98% of company sales and it grew 30%. Adjusted gross profit margin was 86.6%.

Revenue growth was boosted by rapid acceleration in recurring sales due to strong employee usage for their easy-to-use employee products, better seasonal forms, filings, and adjustments sales, and new business wins. Management said the key growth drivers were their success in attracting new clients into the platform and increasing employee usage of their products. Annual Profit Estimates increased across the board, this qtr. For 2022, management expects revenue to grow 26%. Qtrly Profit Estimates are for 15%, 25%, 23%, and 18% profit growth the next 4 qtrs. Management said that macro pressures could be the reason to the lowering of analysts’ estimates but, in contrast, they raised their own guidance. |

Fair Value |

From 2016 Q2 to 2020 Q1 (pre-COVID) PAYC had an average P/E of 57 according to my one-year charts. My Fair Value P/E remains at 60 this qtr because profit estimates declined. From 2016 Q2 to 2020 Q1 (pre-COVID) PAYC had an average P/E of 57 according to my one-year charts. My Fair Value P/E remains at 60 this qtr because profit estimates declined.

Paycom has room to increase profit estimates. In 2020 Q3, 2022 estimates were $6.21. If the company makes $6.12 this year and gets a 57 P/E, it would be a $351 stock (hypothetically). |

Bottom Line |

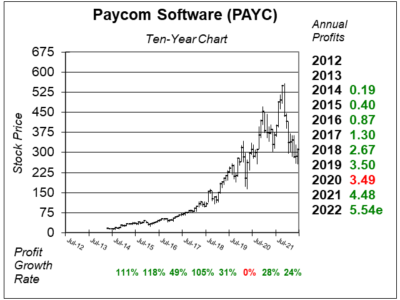

Paycom Software (PAYC) used to have a perfect ten-year chart. Unfortunately it was too perfect, and the stock proceeded to crash after going on a parabolic run higher last year. The stock certainly looks good now. Paycom Software (PAYC) used to have a perfect ten-year chart. Unfortunately it was too perfect, and the stock proceeded to crash after going on a parabolic run higher last year. The stock certainly looks good now.

Paycom is giving me many signals its bottoming. It looks like its back to being a stock that compounds in value every few years. But a recession could lead to layoffs, which could hurt company revenue and cause analysts to lower profit estimates. PAYC moves up from 22nd to 17th in the Growth Portfolio Power Rankings. I’ve owned the stock for clients since November 2016 when I bought in around $43. |

Power Rankings |

Growth Stock Portfolio

17 of 24Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |