Stock (Symbol)

|

Palo Alto Networks (PANW)

|

Stock Price

|

$138

|

Sector

|

| Technology |

Data is as of

|

| January 14, 2017 |

Expected to Report

|

| Feb 28 |

Company Description

|

PANW security platform consists of three elements: its Next-Generation Firewall, its Advanced Endpoint Protection, and its Threat Intelligence Cloud. The Company’s Next-Generation Firewall delivers application, user, and content visibility and control, as well as protection against network-based cyber threats integrated within the firewall through its hardware and software architecture. Its Advanced Endpoint Protection prevents cyber-attacks that aim to exploit software vulnerabilities on a range of fixed and virtual endpoints and servers. The Company’s Threat Intelligence Cloud provides central intelligence capabilities, security for software as a service (SaaS) applications, and automated delivery of preventative measures against cyber-attacks. The Company’s PAN-OS operating system contains App-ID, User-ID, site-to-site virtual private network (VPN), remote access secure sockets layer (SSL) VPN, and Quality-of-Service (QoS). Source: Thomson Financial PANW security platform consists of three elements: its Next-Generation Firewall, its Advanced Endpoint Protection, and its Threat Intelligence Cloud. The Company’s Next-Generation Firewall delivers application, user, and content visibility and control, as well as protection against network-based cyber threats integrated within the firewall through its hardware and software architecture. Its Advanced Endpoint Protection prevents cyber-attacks that aim to exploit software vulnerabilities on a range of fixed and virtual endpoints and servers. The Company’s Threat Intelligence Cloud provides central intelligence capabilities, security for software as a service (SaaS) applications, and automated delivery of preventative measures against cyber-attacks. The Company’s PAN-OS operating system contains App-ID, User-ID, site-to-site virtual private network (VPN), remote access secure sockets layer (SSL) VPN, and Quality-of-Service (QoS). Source: Thomson Financial |

Sharek’s Take

|

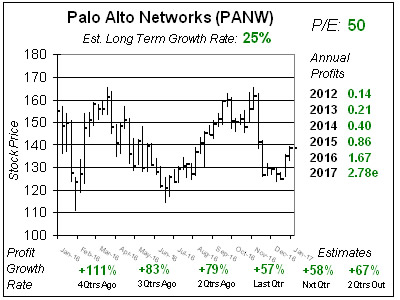

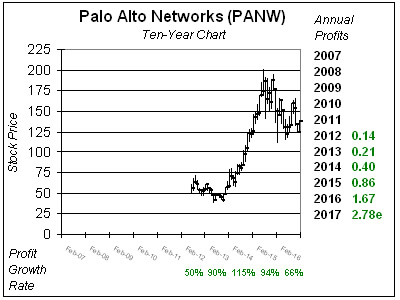

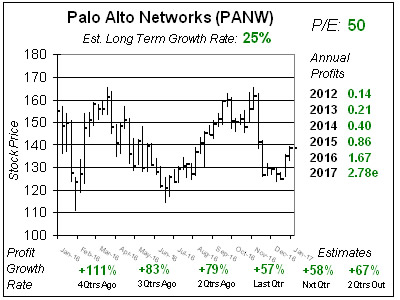

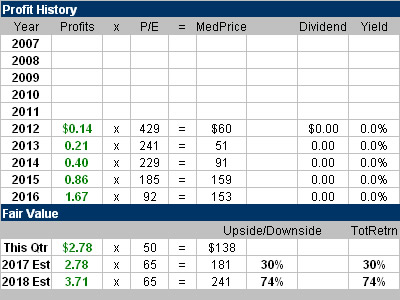

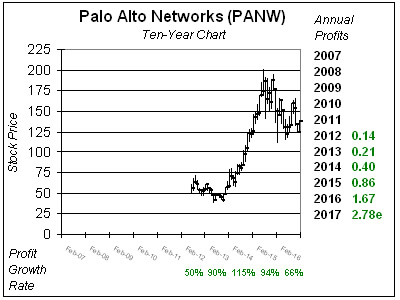

Palo Alto Networks (PANW) is in my opinion the premier cyber-security stock to own. That being said, why is the stock still well off its All-Time high of $200? PANW has a case of the shrinking P/E ratio. Since I started following the stock in 2015 Q2, the P/E has gone from 114 to 108, 109, 93, 48, 54 and now 50 (each qtr). Still, the company continues to deliver record results. Profits the last 9 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42, 0.50 and $0.54. Record profits every 3 months! Why has the P/E fallen so much? Perhaps PANW wasn’t worth 100x earnings. Also, there hasn’t been a high-profile cyberattack since Sony in 2015. Still, companies need to invest in cyber security, and the market is set to climb 7% a year from 2016-2019. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. PANW could be the largest cyber-security company in the world in a few years. During past 4 years Palo Alto’s customers have gone from less than 10,000 to 15,000, 21,000, 28,000 and 35,000 last qtr. Profits are expected to climb 58%, 67%, 80% and 40% the next 4 qtrs, and I feel that kind of growth is worth 65x earnings. Now at just 50x earnings, I think PANW is a great value with 30% upside to 2017’s Fair Value and 74% upside to 2018’s. The company has a fiscal year ending of July 31st, so I’ll be looking at 2018 as early as this Summer. PANW’s delivered annual profits of $0.14, 0.21, 0.40, 0.86 and $1.67 with future estimates of $2.78, 3.71 and $4.83. These numbers are on par with some of the greatest stocks of All-Time! So although this stock still is well off its highs, that’s not Palo Alto’s fault. The stock just had a case of a shrinking P/E. Palo Alto Networks (PANW) is in my opinion the premier cyber-security stock to own. That being said, why is the stock still well off its All-Time high of $200? PANW has a case of the shrinking P/E ratio. Since I started following the stock in 2015 Q2, the P/E has gone from 114 to 108, 109, 93, 48, 54 and now 50 (each qtr). Still, the company continues to deliver record results. Profits the last 9 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42, 0.50 and $0.54. Record profits every 3 months! Why has the P/E fallen so much? Perhaps PANW wasn’t worth 100x earnings. Also, there hasn’t been a high-profile cyberattack since Sony in 2015. Still, companies need to invest in cyber security, and the market is set to climb 7% a year from 2016-2019. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. PANW could be the largest cyber-security company in the world in a few years. During past 4 years Palo Alto’s customers have gone from less than 10,000 to 15,000, 21,000, 28,000 and 35,000 last qtr. Profits are expected to climb 58%, 67%, 80% and 40% the next 4 qtrs, and I feel that kind of growth is worth 65x earnings. Now at just 50x earnings, I think PANW is a great value with 30% upside to 2017’s Fair Value and 74% upside to 2018’s. The company has a fiscal year ending of July 31st, so I’ll be looking at 2018 as early as this Summer. PANW’s delivered annual profits of $0.14, 0.21, 0.40, 0.86 and $1.67 with future estimates of $2.78, 3.71 and $4.83. These numbers are on par with some of the greatest stocks of All-Time! So although this stock still is well off its highs, that’s not Palo Alto’s fault. The stock just had a case of a shrinking P/E. |

One Year Chart

|

These numbers are all in green. Still, the stock has been back-and-forth for a year now. Yes, profit growth has slowed from triple-digit levels, but that’s bound to happen even with the best execution. Last qtr the company delivered 34% sales growth and 57% profit growth, which beat the 51% estimate. Estimates for the next 4 qtrs are 58%, 67%, 80% and 40% which are around what they were last qtr. Annual Profit Estimates fell slightly as the company said product sales would grow 12%-13% this year, below estimates of 22%. But PANW gets most of its revenue from services, which are contracts that provide recurring revenue for the future. I feel this Est. LTG of 25% is ridiculously low. The company continues to grow faster than 50% a year. These numbers are all in green. Still, the stock has been back-and-forth for a year now. Yes, profit growth has slowed from triple-digit levels, but that’s bound to happen even with the best execution. Last qtr the company delivered 34% sales growth and 57% profit growth, which beat the 51% estimate. Estimates for the next 4 qtrs are 58%, 67%, 80% and 40% which are around what they were last qtr. Annual Profit Estimates fell slightly as the company said product sales would grow 12%-13% this year, below estimates of 22%. But PANW gets most of its revenue from services, which are contracts that provide recurring revenue for the future. I feel this Est. LTG of 25% is ridiculously low. The company continues to grow faster than 50% a year. |

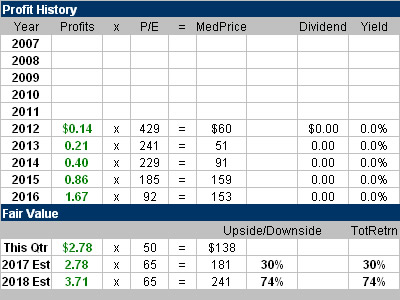

Fair Value

|

I’m adjusting my Fair Value P/E from 70 to 65 as growth has slowed from ~80% to ~60%. Still, there’s significant upside here and I feel a return to growth stocks is in store for 2017. But even if the P/E stays at 50, if the company makes $3.71 next year that would mean a $186 stock. And remember PANW’s fiscal year end is July 31st, so we will be looking at 2018’s figures starting this Summer. I’m adjusting my Fair Value P/E from 70 to 65 as growth has slowed from ~80% to ~60%. Still, there’s significant upside here and I feel a return to growth stocks is in store for 2017. But even if the P/E stays at 50, if the company makes $3.71 next year that would mean a $186 stock. And remember PANW’s fiscal year end is July 31st, so we will be looking at 2018’s figures starting this Summer.

|

Bottom Line

|

Although Palo Alto Networks’ stock is still well off its highs, it’s not the company’s fault. The past year-and-a-half investors were focused on conservative growth stocks that pay dividends, because interest rates were so low. Now with rates rising and conservative stocks having high valuations, growth stocks should now lead the stock market in 2017. Palo Alto has good upside to my Fair Value but the stock can be volatile. PANW ranks 19th of 34 stocks in the Growth Portfolio Power Rankings. I don’t have it in the Aggressive Growth Portfolio because the stock is too volatile for such a focused portfolio. Although Palo Alto Networks’ stock is still well off its highs, it’s not the company’s fault. The past year-and-a-half investors were focused on conservative growth stocks that pay dividends, because interest rates were so low. Now with rates rising and conservative stocks having high valuations, growth stocks should now lead the stock market in 2017. Palo Alto has good upside to my Fair Value but the stock can be volatile. PANW ranks 19th of 34 stocks in the Growth Portfolio Power Rankings. I don’t have it in the Aggressive Growth Portfolio because the stock is too volatile for such a focused portfolio.

|

Power Rankings

|

Growth Stock Portfolio

19th of 34

Aggressive Growth Portfolio

N/A

Conservative Stock Portfolio

N/A

|

Palo Alto Networks (PANW) is in my opinion the premier cyber-security stock to own. That being said, why is the stock still well off its All-Time high of $200? PANW has a case of the shrinking P/E ratio. Since I started following the stock in 2015 Q2, the P/E has gone from 114 to 108, 109, 93, 48, 54 and now 50 (each qtr). Still, the company continues to deliver record results. Profits the last 9 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42, 0.50 and $0.54. Record profits every 3 months! Why has the P/E fallen so much? Perhaps PANW wasn’t worth 100x earnings. Also, there hasn’t been a high-profile cyberattack since Sony in 2015. Still, companies need to invest in cyber security, and the market is set to climb 7% a year from 2016-2019. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. PANW could be the largest cyber-security company in the world in a few years. During past 4 years Palo Alto’s customers have gone from less than 10,000 to 15,000, 21,000, 28,000 and 35,000 last qtr. Profits are expected to climb 58%, 67%, 80% and 40% the next 4 qtrs, and I feel that kind of growth is worth 65x earnings. Now at just 50x earnings, I think PANW is a great value with 30% upside to 2017’s Fair Value and 74% upside to 2018’s. The company has a fiscal year ending of July 31st, so I’ll be looking at 2018 as early as this Summer. PANW’s delivered annual profits of $0.14, 0.21, 0.40, 0.86 and $1.67 with future estimates of $2.78, 3.71 and $4.83. These numbers are on par with some of the greatest stocks of All-Time! So although this stock still is well off its highs, that’s not Palo Alto’s fault. The stock just had a case of a shrinking P/E.

Palo Alto Networks (PANW) is in my opinion the premier cyber-security stock to own. That being said, why is the stock still well off its All-Time high of $200? PANW has a case of the shrinking P/E ratio. Since I started following the stock in 2015 Q2, the P/E has gone from 114 to 108, 109, 93, 48, 54 and now 50 (each qtr). Still, the company continues to deliver record results. Profits the last 9 qtrs have gone from $0.15 to $0.19, 0.23, 0.28, 0.35, 0.40, 0.42, 0.50 and $0.54. Record profits every 3 months! Why has the P/E fallen so much? Perhaps PANW wasn’t worth 100x earnings. Also, there hasn’t been a high-profile cyberattack since Sony in 2015. Still, companies need to invest in cyber security, and the market is set to climb 7% a year from 2016-2019. Right now Cisco is a much larger player in the cyber-security space but Palo Alto is growing by leaps-and-bounds and Cisco is growing its cyber business moderately. PANW could be the largest cyber-security company in the world in a few years. During past 4 years Palo Alto’s customers have gone from less than 10,000 to 15,000, 21,000, 28,000 and 35,000 last qtr. Profits are expected to climb 58%, 67%, 80% and 40% the next 4 qtrs, and I feel that kind of growth is worth 65x earnings. Now at just 50x earnings, I think PANW is a great value with 30% upside to 2017’s Fair Value and 74% upside to 2018’s. The company has a fiscal year ending of July 31st, so I’ll be looking at 2018 as early as this Summer. PANW’s delivered annual profits of $0.14, 0.21, 0.40, 0.86 and $1.67 with future estimates of $2.78, 3.71 and $4.83. These numbers are on par with some of the greatest stocks of All-Time! So although this stock still is well off its highs, that’s not Palo Alto’s fault. The stock just had a case of a shrinking P/E.