Stock (Symbol) |

Nike (NKE) |

Stock Price |

$52 |

Sector |

| Retail & Travel |

Data is as of |

| October 16, 2016 |

Expected to Report |

| Dec 20 – 27 |

Company Description |

NIKE, Inc. is engaged in the design, development, marketing and selling of athletic footwear, apparel, equipment, accessories and services. The Company sells its products to retail accounts, through NIKE-owned retail stores and Internet Websites (which the Company refers to as its Direct to Consumer or DTC operations), and through a mix of independent distributors and licensees throughout the world. The Company focuses its NIKE Brand product offerings in eight key categories: Running, Basketball, Football (Soccer), Men’s Training, Women’s Training, Action Sports, Sportswear and Golf. The Company also markets products designed for kids, as well as for other athletic and recreational uses, such as cricket, lacrosse, tennis, volleyball, wrestling, walking and outdoor activities. The Company’s portfolio brands include the NIKE Brand, Hurley and Converse. Source: Thomson Financial NIKE, Inc. is engaged in the design, development, marketing and selling of athletic footwear, apparel, equipment, accessories and services. The Company sells its products to retail accounts, through NIKE-owned retail stores and Internet Websites (which the Company refers to as its Direct to Consumer or DTC operations), and through a mix of independent distributors and licensees throughout the world. The Company focuses its NIKE Brand product offerings in eight key categories: Running, Basketball, Football (Soccer), Men’s Training, Women’s Training, Action Sports, Sportswear and Golf. The Company also markets products designed for kids, as well as for other athletic and recreational uses, such as cricket, lacrosse, tennis, volleyball, wrestling, walking and outdoor activities. The Company’s portfolio brands include the NIKE Brand, Hurley and Converse. Source: Thomson Financial |

Sharek’s Take |

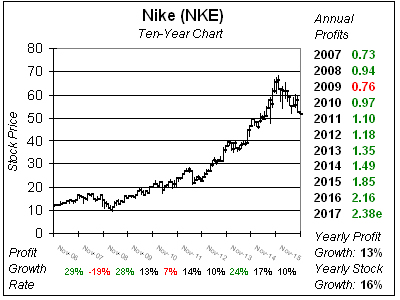

Nike (NKE) is losing ground to Adidas because Adidas has better looking sneakers. I went looking for a new set of sneakers a couple months ago, and at the store I was not impressed with the Nike styles. I even thought they were cheap. The swoosh seemed to be painted on and although the shoes were lightweight, they didn’t seem sturdy. Then last week I walked into another store and saw the Adidas lineup. Boy, was I impressed. Real running shoes. Throwback sneakers. Wool sneakers with the logos sewn in. Adidas on top of its game right now, and is gaining market share at the expense of Nike. NKE in turn has been coming down during the last year, but that’s OK because the stock was too high a year ago. During the past 30 years NKE’s stock has gone from fifty cents to more than 50 dollars. Around a year ago the stock was $65 and had a P/E of 30 as profits had just grown 24% in the latest fiscal year (ending May 2015). A P/E of 30 was hard to sustain, as NKE had a P/E of around 20 earlier in the decade. Now the stock has come down to where the P/E is 22, but profit growth has slowed too — and I’m blaming Adidas. Profits grew just 9% next qtr and are expected to climb just 8% on average the next 4 qtrs. I’ve been waiting patiently for this stock to pull back further, and it’s almost in my buy range. I do think NKE is worth a P/E of 22, but am waiting for a little better price as (1) the stock is trending down (2) the retail sector is weak (3) Adidas taking market share and (4) NKE just started its new fiscal year and I feel the stock could sell for 22x earnings and hang around here for another 6 months. Nike (NKE) is losing ground to Adidas because Adidas has better looking sneakers. I went looking for a new set of sneakers a couple months ago, and at the store I was not impressed with the Nike styles. I even thought they were cheap. The swoosh seemed to be painted on and although the shoes were lightweight, they didn’t seem sturdy. Then last week I walked into another store and saw the Adidas lineup. Boy, was I impressed. Real running shoes. Throwback sneakers. Wool sneakers with the logos sewn in. Adidas on top of its game right now, and is gaining market share at the expense of Nike. NKE in turn has been coming down during the last year, but that’s OK because the stock was too high a year ago. During the past 30 years NKE’s stock has gone from fifty cents to more than 50 dollars. Around a year ago the stock was $65 and had a P/E of 30 as profits had just grown 24% in the latest fiscal year (ending May 2015). A P/E of 30 was hard to sustain, as NKE had a P/E of around 20 earlier in the decade. Now the stock has come down to where the P/E is 22, but profit growth has slowed too — and I’m blaming Adidas. Profits grew just 9% next qtr and are expected to climb just 8% on average the next 4 qtrs. I’ve been waiting patiently for this stock to pull back further, and it’s almost in my buy range. I do think NKE is worth a P/E of 22, but am waiting for a little better price as (1) the stock is trending down (2) the retail sector is weak (3) Adidas taking market share and (4) NKE just started its new fiscal year and I feel the stock could sell for 22x earnings and hang around here for another 6 months. |

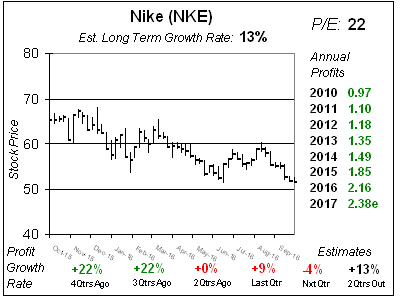

One Year Chart |

Folks, this is not a good looking chart. And although gamblers would think its a good idea to buy now as NKE is hitting support levels, the trend is your friend and that trend is down. Last qtr NKE delivered 9% profit growth on 8% sales growth. The company beat the street by 17 cents, but estimates were lowered 16 cents the prior two qtrs. 2017 profit estimates ticked down from $2.40 to $2.38. Qtrly Estimates were slashed across the board and profit growth is now expected to be -4%, 13%, 22% and 1% the next 4 qtrs. Don’t get too excited about that 22% qtr as it has easy comparisons from the year-ago period when profits were flat. Folks, this is not a good looking chart. And although gamblers would think its a good idea to buy now as NKE is hitting support levels, the trend is your friend and that trend is down. Last qtr NKE delivered 9% profit growth on 8% sales growth. The company beat the street by 17 cents, but estimates were lowered 16 cents the prior two qtrs. 2017 profit estimates ticked down from $2.40 to $2.38. Qtrly Estimates were slashed across the board and profit growth is now expected to be -4%, 13%, 22% and 1% the next 4 qtrs. Don’t get too excited about that 22% qtr as it has easy comparisons from the year-ago period when profits were flat. |

Fair Value |

NKE has an Estimated Long Term Growth Rate of 13% a year in addition to a dividend just north of 1%. Although the sneaker industry is typically dependent on a strong economy, this stock has grown profits in nine of the last ten years and I think that’s remarkable. My Fair Value is 22x earnings, or $52 which is where the stock is now. I think this would be a good buy if it got down to 20x earnings or $48 a share. NKE has an Estimated Long Term Growth Rate of 13% a year in addition to a dividend just north of 1%. Although the sneaker industry is typically dependent on a strong economy, this stock has grown profits in nine of the last ten years and I think that’s remarkable. My Fair Value is 22x earnings, or $52 which is where the stock is now. I think this would be a good buy if it got down to 20x earnings or $48 a share. |

Bottom Line |

Nike is a high-quality company that’s given its investors steady growth for decades. The company continues to put out cutting-edge designs, but the styles aren’t as good as Adidas are to be honest with you. Also, the angle of the chart had increased recently and I think the stock needs to return to the norm, which is the previous trend higher. Put a ruler (or the edge of your phone) up on the chart and follow the angle from Nov 09 – Nov 11 and you can see the stock perhaps should be around $50. I like this stock a lot — especially for conservative growth accounts — but am holding out for a little better price of below $50 a share. Nike is a high-quality company that’s given its investors steady growth for decades. The company continues to put out cutting-edge designs, but the styles aren’t as good as Adidas are to be honest with you. Also, the angle of the chart had increased recently and I think the stock needs to return to the norm, which is the previous trend higher. Put a ruler (or the edge of your phone) up on the chart and follow the angle from Nov 09 – Nov 11 and you can see the stock perhaps should be around $50. I like this stock a lot — especially for conservative growth accounts — but am holding out for a little better price of below $50 a share. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |