The stock market is flashing signs we are in a NEW Bull Market.

The stock market is flashing signs we are in a NEW Bull Market.

One signal that’s pointing to more gains ahead is the abundance of new 52-week highs lading stocks are hitting. And in some cases, the stocks are not just hitting new highs, but they are moving much higher.

Here’s five stocks that look like the early leaders of a new Bull Market. All charts and data are from our 2023 Q1 research reports:

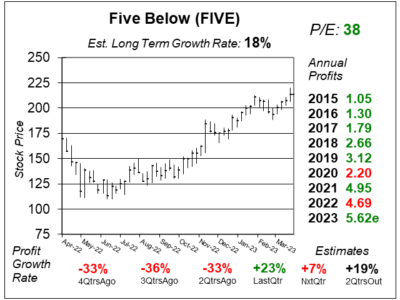

Five Below (FIVE) is a dollar-store concept for kids and teens, that sells merchandise such as toys, games, party items, sports gear, clothes, candy & electronics for between $1 and $5.55 each. This company has the fastest dollar-store concept of all the dollar stores (including Dollar Tree and Dollar General).

Five Below (FIVE) is a dollar-store concept for kids and teens, that sells merchandise such as toys, games, party items, sports gear, clothes, candy & electronics for between $1 and $5.55 each. This company has the fastest dollar-store concept of all the dollar stores (including Dollar Tree and Dollar General).

During the past nine years (2014-2022), Five Below has grown its store count from 366 to 437, 522, 625, 750, 900, 1020, 1190, and to 1340.

FIVE has an Estimated Long Term Growth Rate 18% per year, but I think this is more of a 25% grower long-term. Five Below is part of the Growth Portfolio. The P/E of 38 is high, so I think the stock is overvalued after a sweet run higher.

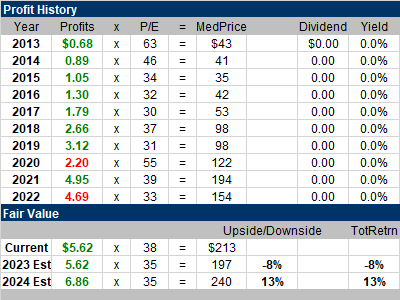

Booking (BKNG) is setting up like a future stock market leader as profits are rolling in. BKNG had proof downturn during the COVID-19 outbreak. 2020-2022 profits were down compared to the record high of 2019. But the past two quarters have seen the company hit record highs in profits (for the qtr ending in Sept. and Dec.).

Booking (BKNG) is setting up like a future stock market leader as profits are rolling in. BKNG had proof downturn during the COVID-19 outbreak. 2020-2022 profits were down compared to the record high of 2019. But the past two quarters have seen the company hit record highs in profits (for the qtr ending in Sept. and Dec.).

Profit growth was 56% in the quarter. Revenue was up a solid 36% from a year ago, but would have been up 49% if it not for the strong US dollar and currency exchange. Also, management isn’t seeing any evidence of consumers trading down to lower hotel star ratings.

BKNG is part of my Conservative Growth Portfolio. The stock looks like a leader in what might be a new Bull Market.

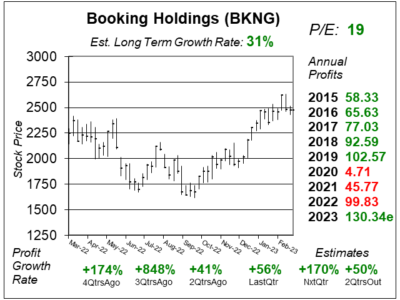

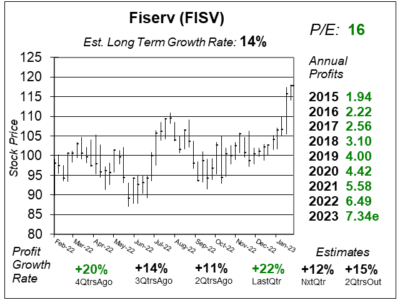

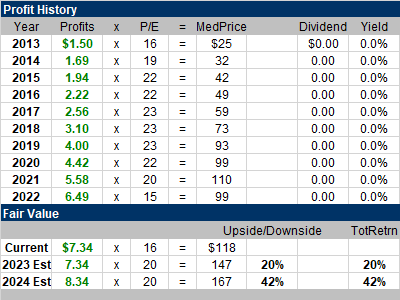

Fiserv (FISV) just delivered an impressive quarter, as the company grew profits 21% on just a 9% rise in revenue.

Fiserv (FISV) just delivered an impressive quarter, as the company grew profits 21% on just a 9% rise in revenue.

And the reason profits grew faster than sales is the company winded down its integration expenses from 2019’s merger with First Data.

Last qtr, expenses declined 7% year-over-year. Higher revenue and lower expenses is a powerful combination. Margins jumped in every company segment. Investors were impressed, and sent the stock to a 52-week high.

FISV is part of the Conservative Growth Portfolio. With a P/E of only 16, the stock seems like a bargain even as its around All-Time highs. The margin story looks to continue into the upcoming quarters, so this stock could have room to run higher.

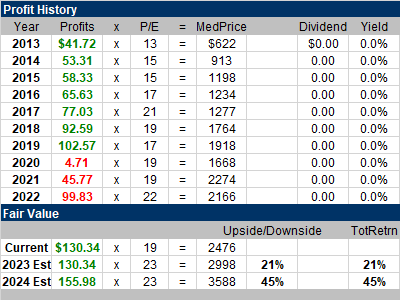

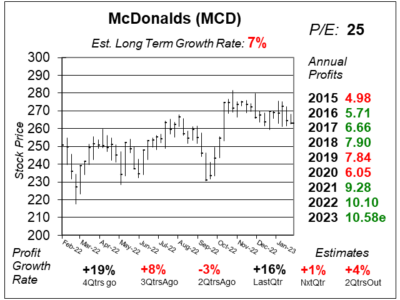

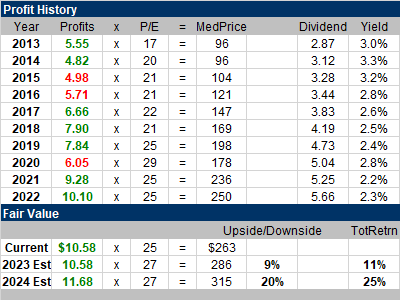

Since this McDonald’s (MCD) chart and table were created in February, the stock has jumped from $263 to $295. Whew. These stocks are acting so well, its tough to keep up.

Since this McDonald’s (MCD) chart and table were created in February, the stock has jumped from $263 to $295. Whew. These stocks are acting so well, its tough to keep up.

McDonald’s currently is in its Accelerating the Arches endeavor, which is made up of 3 pillars:

- Maximize Marketing

- Commit to the Core (menu items)

- Double Down on the 3Ds’s of Digital, Delivery, and Drive-thru.

MCD is one of the safest stocks in the world but it’s a slow grower. The Estimated Long Term Growth Rate is 7% and stock also yields just over 2%. But that Est. LTG seems low. I personally think this company is a 10% profit grower.

McDonald’s is part of the Conservative Growth Portfolio. The company has good momentum here, thus I’m a fan of the stock.

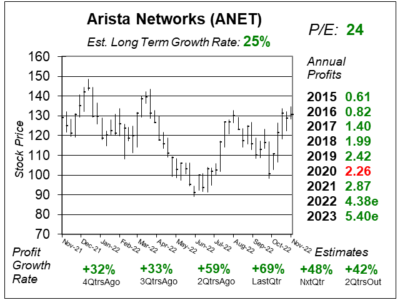

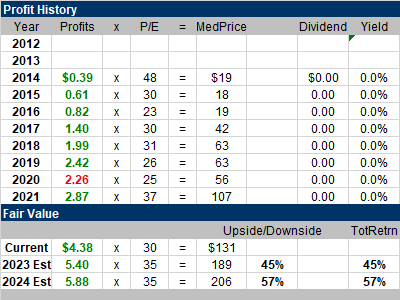

Arista Networks (ANET) makes network switches that help computer servers communicate in datacenters. Competitors include Cisco Systems and Juniper Networks. Since 2016, ANET has outsold Cisco when it comes to small and large internet firms upgrading to 100-gigabit Ethernet switches.

Arista Networks (ANET) makes network switches that help computer servers communicate in datacenters. Competitors include Cisco Systems and Juniper Networks. Since 2016, ANET has outsold Cisco when it comes to small and large internet firms upgrading to 100-gigabit Ethernet switches.

Arista could be the prime beneficiary of the advance in Artificial Intelligence (AI) because that means more data flowing. Cloud titans (Meta, Microsoft, etc.) was Arsita’s largest vertical last qtr.

Arista management said AI is very important to Cloud Titans, but is still a very small portion of use cases so far. The CEO added “We’re just beginning”.

ANET is my of the largest positions in the Growth Stock Portfolio and Aggressive Growth Portfolio.