Stock (Symbol) |

Cloudfare (NET) |

Stock Price |

$40 |

Sector |

| Technology |

Data is as of |

| August 12, 2020 |

Expected to Report |

| November 5 |

Company Description |

Cloudflare, Inc. is a Web infrastructure and Web security company. The Company has built a global cloud platform that delivers a range of network services to businesses of all sizes and geographies. The Company provides businesses a unified control plane to deliver security, performance, and reliability across their on-premise, hybrid, cloud, and Software-as-a-Service (SaaS) applications. The Company’s product offerings are classified under performance and reliability, advanced security, Cloudflare for Developers, video streaming and delivery, and domain registration. The Company serves various industries including gaming, SaaS, eCommerce, media and entertainment, public sector, public interest groups, and state and local government. Source: Thomson Financial Cloudflare, Inc. is a Web infrastructure and Web security company. The Company has built a global cloud platform that delivers a range of network services to businesses of all sizes and geographies. The Company provides businesses a unified control plane to deliver security, performance, and reliability across their on-premise, hybrid, cloud, and Software-as-a-Service (SaaS) applications. The Company’s product offerings are classified under performance and reliability, advanced security, Cloudflare for Developers, video streaming and delivery, and domain registration. The Company serves various industries including gaming, SaaS, eCommerce, media and entertainment, public sector, public interest groups, and state and local government. Source: Thomson Financial |

Sharek’s Take |

Cloudflare (NET) is one of the new hot-stocks of the new Bull Market, and the future is bright for this upstart. It’s one network for virtual private networks, firewalls, content delivery systems, and wide area networking. The Internet needs to be secure, reliable and fast. It’s come a long way over the years: Cloudflare (NET) is one of the new hot-stocks of the new Bull Market, and the future is bright for this upstart. It’s one network for virtual private networks, firewalls, content delivery systems, and wide area networking. The Internet needs to be secure, reliable and fast. It’s come a long way over the years:

I believe edge computing is the next-big thing in technology, as it makes computing so much faster because of the shorter travel distance. Cloudflare has an “edge” in this space as its had an edge computing offering in the market for nearly 3 years and it offers different services, so companies can get everything from one vendor (and train employees just one system). Cloudflare for Teams is hot right now as it helps companies assist with employees working from home, and Cloudflare Workers allows programmers to deploy code that runs seamlessly across the world. Cloudflare works with 16% of the Fortune 1000 (up from 13% last qtr). Competitors include Akami, Amazon, and Microsoft but Cloudflare continues to work with all these companies as some clients want to work with multiple vendors. Predictable bills like Cloudflare provides are also important, and competitors often send surprise large-usage bills to other customers. Cloudflare is as much as 75% less expensive than the AWS Lambda security software (which uses containers that take time to load). Here are some highlights from last qtr, with percentage growth year-over-year:

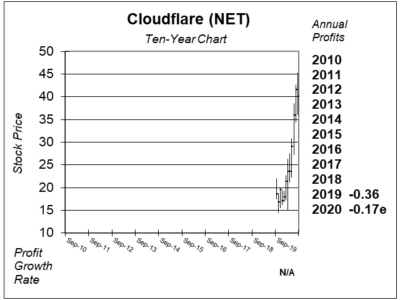

Cloudflare is a recent IPO with less than a year of trading history. The company isn’t making a profit, and profits aren’t even on the horizon. There is not an Estimated Long Term Growth Rate either. But big investors have been taking positions. I’ve been following NET a lot on the news, and I think this is the best cybersecurity stock to own. And on the file storage side of the business, edge computing is growing so rapidly in popularity that other cybersecurity companies may — or will — be left behind. I think Palo Alto is already left behind, and although Zscaler and Crowdstrike are hot now, they need to keep improving to keep up with Cloudflare. Cloudstrike stock has been acting ill, but Zscaler’s been strong. NET was added to the Growth Portfolio last qtr, and this qtr I will add it to the Aggressive Growth Portfolio. I think Cloudflare, Fastly and NVIDIA are the leaders in this new era of computing. |

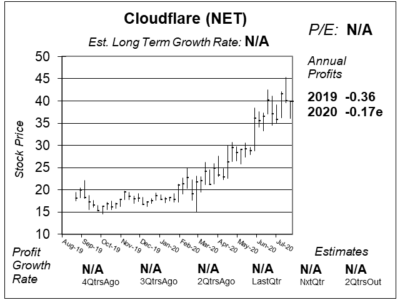

One Year Chart |

But the stock broke out from $32 to $35 on June 17th (not earnings related) and the stock hasn’t looked back since. I think we’re lucky to be able to buy while the stock is still in range. Many software stocks have made parabolic moves and are now too-high-to-buy. NET looks good here around $40. But the stock broke out from $32 to $35 on June 17th (not earnings related) and the stock hasn’t looked back since. I think we’re lucky to be able to buy while the stock is still in range. Many software stocks have made parabolic moves and are now too-high-to-buy. NET looks good here around $40.

There are no profits to show, and that means there’s no P/E ratio. There isn’t an Est. LTG either. |

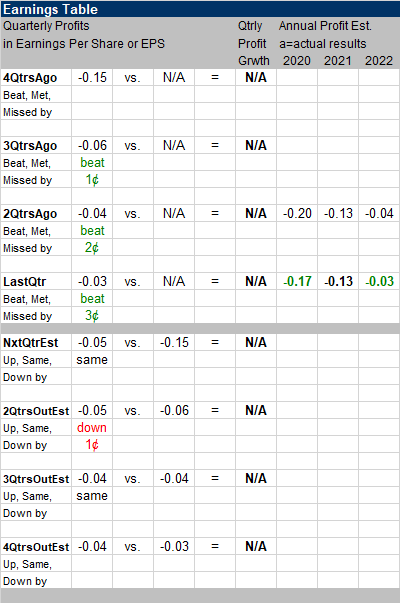

Earnings Table |

Last qtr NET reported a loss of 3 cents a share, which beat estimates of a loss of 6 cents. Revenue increased 48% for the 2nd straight qtr. Last qtr NET reported a loss of 3 cents a share, which beat estimates of a loss of 6 cents. Revenue increased 48% for the 2nd straight qtr.

Annual Profit Estimates increased slightly this qtr, but losses are still expected. Qtrly profit Estimates are for losses in each of the next 4 qtrs. |

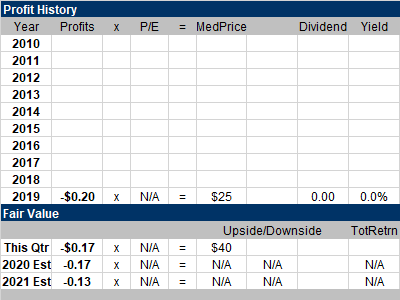

Fair Value |

I don’t have a Fair Value for this stock as it isn’t profitable yet. The company is expected to make a profit in 2023. Estimates for that year are $0.15. I don’t have a Fair Value for this stock as it isn’t profitable yet. The company is expected to make a profit in 2023. Estimates for that year are $0.15.

The company is expected to do $400 million in sales this year, and the market cap is $12 billion. It sells for 30x expected sales, which is high. |

Bottom Line |

Cloudfare (NET) has a perfect combo of performance solutions with network security that give the company a compelling niche in the world of cloud computing. It also seems cheaper than AWS. Cloudfare (NET) has a perfect combo of performance solutions with network security that give the company a compelling niche in the world of cloud computing. It also seems cheaper than AWS.

I think Cloudflare, Fastly and NVIDIA are the top three stocks to own in this revolutionary computing era. NET moves up from 35th to 14th in the Growth Portfolio Power Rankings. Today I will add the stock to the Aggressive Growth Portfolio, where it will rank 14th of 22 stocks. |

Power Rankings |

Growth Stock Portfolio

14 of 47Aggressive Growth Portfolio 14 of 22Conservative Stock Portfolio N/A |