Stock (Symbol) |

Livongo Health (LVGO) |

Stock Price |

$58 |

Sector |

| Healthcare |

Data is as of |

| May 28, 2020 |

Expected to Report |

| Sept 3 |

Company Description |

Livongo Health, Inc. is a consumer digital health company. Livongo Health, Inc. is a consumer digital health company.

The Company offers Enter Livongo platform, which leverages data science and technology, creates a personalized experience for people with chronic conditions. The Company focuses on developing an approach for diabetes management that combines technology with coaching. The Company’s Livongo platform offers a range of solutions, such as Livongo for Diabetes, Livongo for Hypertension, Livongo for Prediabetes and Weight Management and Livongo for Behavioral Health by myStrength. The Company uses a digital approach to delivering evidence-based interventions including cognitive behavioral therapy, acceptance and commitment therapy, positive psychology, mindfulness, and motivational interviewing to help resolve clinical conditions, build resiliency, manage stress, improve mood, sleep better, or simply find daily inspiration. Source: Thomson Financial |

Sharek’s Take |

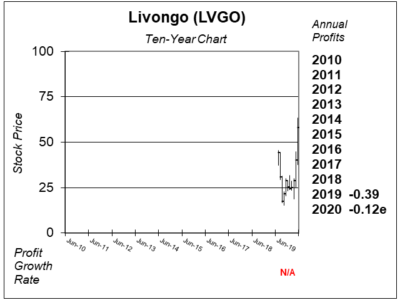

Livongo Health (LVGO) is one of the best performing stocks in 2020. It’s up 131% through May 28th. The reason is Livongo has a digital platform for people with chronic conditions to track their health. And staying healthy is of upmost importance during these Coronavirus times. Livongo Health (LVGO) is one of the best performing stocks in 2020. It’s up 131% through May 28th. The reason is Livongo has a digital platform for people with chronic conditions to track their health. And staying healthy is of upmost importance during these Coronavirus times.

Livongo says 147 million people in the U.S. have a chronic condition, including 31 million with Diabetes and 40 million with Hypertension. The company thinks that is a $47 billion market opportunity. Per year. That’s $900 per person per year with Diabetes and $468 per person per year with Hypertension. The new client (company or organization) signup process works like this. Livongo signs up a new client it begins enrolling members into the Livongo app, and enrollment ramps up 6-9 months following the launch. The client is then charged on a per member per month basis. Livongo has:

What impresses me most is the company’s strong member growth: 2018 Q1 69 Livongo hit the “tipping point” last qtr (Jan-March) as business started rolling in. Then in May the company signed up the State of Connecticut as a client, and is estimated to save the state $3 million per year. The program is a partnership with CVS Caremark. Connecticut’s state healthcare plan has more than 250,000 employees and retirees. More than 500 people signed up during the first two weeks. And in January the company partnered with Dexcom, a leader in glucose monitoring systems, to allow users to sync data between the two systems (Dexcom is also one of the hottest stocks this year). Livongo stock broke out on April 7th at $34 and is now $58 less than two months later. It’s one of the best in the market, and I wish I owned it earlier. But it’s a speculative stock with very little profits. I’m looking to add the stock to the Growth Portfolio. But I want the stock to dip or at least settle down before I invest. UPDATE 6/16/20: Today I’m buying LVGO at $67 for the Growth Portfolio and Aggressive Growth Portfolio today as the stock is breaking out to an All-Time high. I will sell Visa (V) in the Growth Portfolio and Ollie’s (OLLI) in the Aggressive Growth Portfolio to make room for LVGO. OLLI will remain in the Growth Portfolio. |

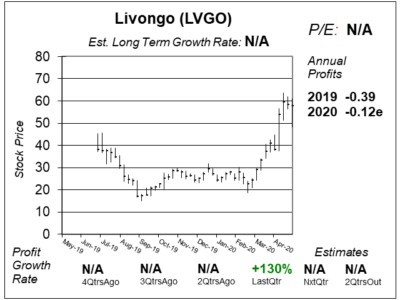

One Year Chart |

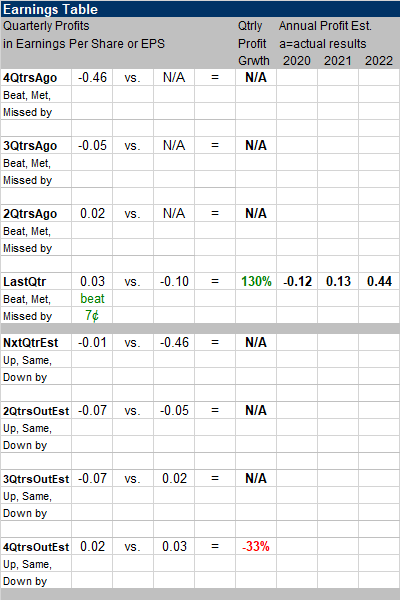

Data is sparse with this young company. LVGO reported earnings in May, which means there should be another qtrly release in February (3 months earlier). But the company didn’t show a February earnings report on its Investor Relations website. It only has qtrly reports from September, November and May. Thus, this 2QtrsAgo figure may be incorrect as I don’t have enough data to create the computation. Data is sparse with this young company. LVGO reported earnings in May, which means there should be another qtrly release in February (3 months earlier). But the company didn’t show a February earnings report on its Investor Relations website. It only has qtrly reports from September, November and May. Thus, this 2QtrsAgo figure may be incorrect as I don’t have enough data to create the computation.

LVGO broke out on April 7th at $34 after management stated revenues would come in above expectations. It broke out again on May 6th and closed at $48 in anticipation of earnings which were released after the market closed. During the past two weeks the stock has been around $57-$60, but it did decline to $48 briefly on Wednesday then closed the day at $53. This is a hot-stock, and opportunities to buy on a dip should be met with quick decision making. Therefore I’m writing this report now and will come back and update it if or when I do buy in. There isn’t an Est. LTG for this stock. And no P/E as the company is expected to lose money this year.

|

Earnings Table |

Last qtr was Livongo’s 2020 Q1. The company made a profit of $0.03 vs estimates of -$0.04. It was a fantastic beat. The Estimated Value of Agreements (formerly known as Total Contract Value) jumped to $89 million from $48 million in 2019 Q1 and $11 million in 2018 Q1. That’s incredible! Last qtr was Livongo’s 2020 Q1. The company made a profit of $0.03 vs estimates of -$0.04. It was a fantastic beat. The Estimated Value of Agreements (formerly known as Total Contract Value) jumped to $89 million from $48 million in 2019 Q1 and $11 million in 2018 Q1. That’s incredible!

This is my first qtr covering the stock, thus I don’t have a trend on Annual Profit Estimates. Notice profits are expected to climb to $0.44 in 2022. I also think the company will be profitable in 2020, as it was expected to have a loss last qtr and made a profit instead. Qtrly profit Estimates are for losses the next thee qtrs then a slight profit 4QtrsOut. I think the company will profit from here forward, but it might have to spend-to-grow and that could mean losses. |

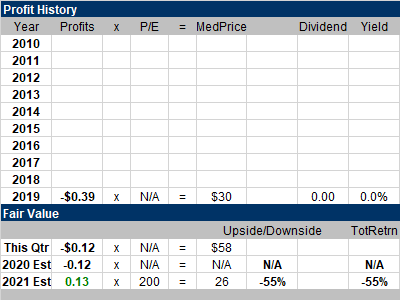

Fair Value |

My Fair Value P/E of 200 is as high as I wish to go, and it still puts a $26 Fair Value on the stock, which is around half where LVGO is now. That’s unlikely to happen. My Fair Value P/E of 200 is as high as I wish to go, and it still puts a $26 Fair Value on the stock, which is around half where LVGO is now. That’s unlikely to happen.

Thus, this stock shouldn’t be priced on a Profits x P/E = Stock Price basis. This is a speculative stock, and that means investments should be small. |

Bottom Line |

Livongo (LVGO) is a great story. The platform is part of the new-age of healthcare. Livongo (LVGO) is a great story. The platform is part of the new-age of healthcare.

What’s nice is we are now aware of the stock in its infancy. What’s not good is the stock just doubled in price, and seems too high to buy right now. LVGO is on the radar for the Growth Portfolio. UPDATE 6/16/20: Today I’m buying LVGO at $67 for the Growth Portfolio and Aggressive Growth Portfolio today as the stock is breaking out to an All-Time high. I will sell Visa (V) in the Growth Portfolio and Ollie’s (OLLI) in the Aggressive Growth Portfolio to make room for LVGO. OLLI will remain in the Growth Portfolio. LVGO will rank 12th in the Power Rankings for both portfolios. |

Power Rankings |

Growth Stock Portfolio

12 of 42Aggressive Growth Portfolio 12 of 21Conservative Stock Portfolio N/A |