Stock (Symbol) |

Lululemon Athletica (LULU) |

Stock Price |

$309 |

Sector |

| Retail and Travel |

Data is as of |

| December 28, 2022 |

Expected to Report |

| March 28 |

Company Description |

lululemon athletica inc. is a designer, distributor and retailer of lifestyle inspired athletic apparel and accessories. lululemon athletica inc. is a designer, distributor and retailer of lifestyle inspired athletic apparel and accessories.

The Company’s segments include Company-operated stores and direct to consumer. Its apparel assortment includes items such as pants, shorts, tops, and jackets designed for a healthy lifestyle, including athletic activities such as yoga, running, training, and other sweaty pursuits. It also offers fitness-related accessories. Its Company-operated stores include approximately 600 stores in 17 countries. Its retail stores are located primarily on street locations, in lifestyle centers, and in malls. Its direct to consumer segment includes www.lululemon.com, other country and region-specific websites, and mobile applications, including mobile applications on in-store devices. The Company also conduct business through MIRROR, which offers in-home fitness through a workout platform; operate outlets and temporary locations. Source: Refinitiv |

Sharek’s Take |

| This Week, Lululemon (LULU) lowered gross profit margin estimates for this quarter, which spooked investors a bit. I think the issue is inventory levels jumped 85% last qtr, and lower margins might mean the company will have to discount some of that inventory. I think the inventory issue is due to supply chains improving, so overseas shipments are coming in quicker now. That’s good, as in mid-2021 was paying more expensive air freight to get merchandise. Ocean delivery times were 70 days last qtr. Also, inventory was light last year. So the company needs the extra stuff on the shelves. Management said traffic remains strong and revenue should climb a solid 26% this qtr, so I’m not concerned with this news.

Stats from last qtr include:

Lululemon is a Canadian designer, distributor, and retailer of high-quality athletic appeal and accessories, marketed under the Lululemon brand. The brand is known for its technically advanced fabrics, with a superior feel and fit. Apparel items include pants, shorts, tops and jackets designed for yoga, running, and training. During 2021 the company opened 57 new stores to bring its total to 574 stores worldwide. Plans are for 70 new stores this year, including 40 International stores. Highlights from recent qtrs include:

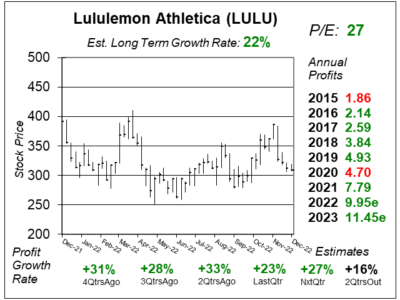

Management is optimistic about growth opportunities of Lululemon and laid out new growth plans called “Power of Three x2.” This calls for doubling revenue in five years from $6.25 billion in 2021 to $12.5 billion in 2026. Plans are for International revenue to quadruple from 2021 to 2026. LULU stock has been one of the best during the past decade, and analysts expect the growth to continue. Analysts give the stock an Estimated Long Term Growth Rate of 22% per year. The stock currently has a P/E of 27. The company’s financial position and balance sheet are strong with $353 million in cash, and management even buys back stock, which is rare for a growth stock. In 2021, management repurchased $813 million in stock. LULU is part of the Growth Portfolio. I will add the stock to the Aggressive Growth Portfolio tomorrow. I think its a 30% grower long-term. |

One Year Chart |

These chalets/tables were done on 12/28 when LULU was $309. Today, 1/12, the stock is $314. The report is so late as I was out sick with the flu. This stock hasn’t gotten hurt much from the lower profit margin news. These chalets/tables were done on 12/28 when LULU was $309. Today, 1/12, the stock is $314. The report is so late as I was out sick with the flu. This stock hasn’t gotten hurt much from the lower profit margin news.

This stock had a P/E of 62 when it was $465 in November 2021. That was too high, and the stock has since digested some of the prior gains. Now with a P/E of 27, the stock has gone from overvalued to undervalued. Note, since we are in LULU’s Q4, I calculated the P/E using 2023 profit estimates. Notice qtrly profit growth has been solid the past year. The Est. LTG is 22% this qtr, same as last qtr. I think LULU is a 30% grower. |

Earnings Table |

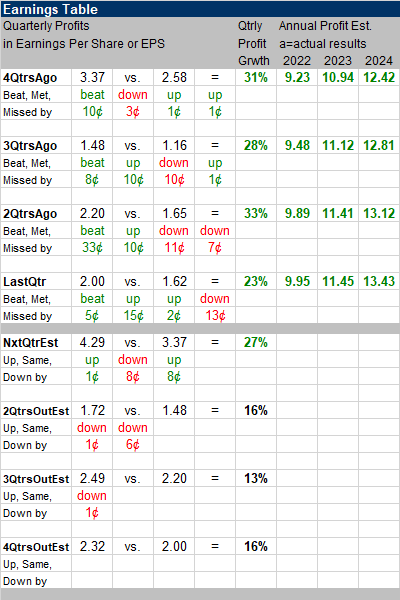

Last qtr, Lululemon recorded 23% profit growth and beat estimates of 20% growth. Revenue increased 28%, year-over-year. Gross margin declined to 55.9% from last year’s 57.2% mostly due to FX impacts and higher inventory costs. Here are the product category results during the period (3-year CAGR basis): Last qtr, Lululemon recorded 23% profit growth and beat estimates of 20% growth. Revenue increased 28%, year-over-year. Gross margin declined to 55.9% from last year’s 57.2% mostly due to FX impacts and higher inventory costs. Here are the product category results during the period (3-year CAGR basis):

Revenue growth was boosted by increase in customer traffic due to Black Friday and Thanksgiving holiday, improvements in supply chain, better inventory levels, positive customer response, and higher factory production efficiency. Annual Profit Estimates grew this qtr. Here’s some far-reaching estimates for the upcoming years: Quarterly Profit Estimates are for 27%, 16%, 13%, and 16% profit growth in the next four qtrs. On 12/28 analysts had next qtr revenue estimates of 28%. Today, 1/12, estimates are for 26% growth. |

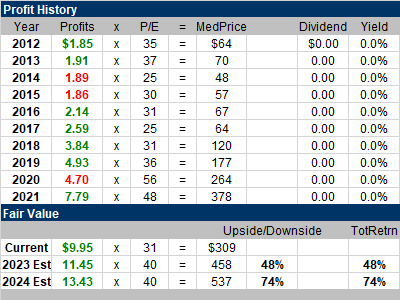

Fair Value |

My Fair Value is a P/E of 40. The stock seems undervalued, with HUGE upside when we look to 2024’s Fair Value of $537 a share. My Fair Value is a P/E of 40. The stock seems undervalued, with HUGE upside when we look to 2024’s Fair Value of $537 a share.

Lululemon has a fiscal year end of January 31. We refer to the fiscal yer end January 31, 2023 as “2022” as 11 months are in calendar year 2022. |

Bottom Line |

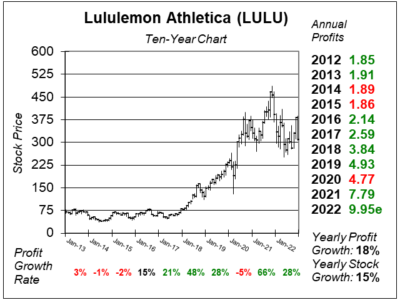

Lululemon (LULU) first gained notoriety when Oprah named its Relaxed Fit Pants as one of her Favorite Things in November 2010. That month the shares jumped from $22 to $27 and sent the stock on a run that went briefly past $80 in May 2012. After that, the stock based, and then declined in 2013-2014 after the company was forced to recall its black yoga pants because they were see-through in the crotch area. Profits then declined in 2014-2015. Profits returned to record highs in 2016-2017, and the stock finally broke past $80 in March 2018 — then doubled to $160 in just 6 months. Lululemon (LULU) first gained notoriety when Oprah named its Relaxed Fit Pants as one of her Favorite Things in November 2010. That month the shares jumped from $22 to $27 and sent the stock on a run that went briefly past $80 in May 2012. After that, the stock based, and then declined in 2013-2014 after the company was forced to recall its black yoga pants because they were see-through in the crotch area. Profits then declined in 2014-2015. Profits returned to record highs in 2016-2017, and the stock finally broke past $80 in March 2018 — then doubled to $160 in just 6 months.

Lululemon might have to cut prices to get rid of some inventory, but that’s just a short term issue. Rapid International expansion and new products like SenseKnit, Hike, and the sneaker lineup should keep growth humming along. LULU ranks 5th in the Growth Portfolio Power Rankings. I will also add the stock to the Aggressive Growth Portfolio, where the stock will rank 5th in this Power Rankings too. |

Power Rankings |

Growth Stock Portfolio

5 of 26Aggressive Growth Portfolio 5 of 23Conservative Stock Portfolio N/A |