Stock (Symbol) |

Lululemon Athletica (LULU) |

Stock Price |

$64 |

Sector |

| Retail and Travel |

Data is as of |

| August 23, 2011 |

Expected to Report |

| N/A |

Company Description |

lululemon athletica inc. is a designer and retailer of technical athletic apparel operating primarily in North America and Australia. The Company’s yoga-inspired apparel is marketed under the lululemon athletica brand name. The Company offers a range of performance apparel and accessories for women, men and female youth. Its apparel assortment, including items, such as fitness pants, shorts, tops and jackets, is designed for healthy lifestyle activities such as yoga, running and general fitness. Source: Thomson Financial lululemon athletica inc. is a designer and retailer of technical athletic apparel operating primarily in North America and Australia. The Company’s yoga-inspired apparel is marketed under the lululemon athletica brand name. The Company offers a range of performance apparel and accessories for women, men and female youth. Its apparel assortment, including items, such as fitness pants, shorts, tops and jackets, is designed for healthy lifestyle activities such as yoga, running and general fitness. Source: Thomson Financial |

Sharek’s Take |

Lululemon (LULU) is a must own stock for me. I have to take advantage of the drop in the stock to get in while LULU isn’t so expensive. Lululemon (LULU) is a must own stock for me. I have to take advantage of the drop in the stock to get in while LULU isn’t so expensive.

Earlier this quarter when I reviewed LULU stock, I said it was too high because LULU’s P/E Jumped from 44 to 58. The stock was $64. Now with the market in a correction and highly oversold), LULU’s stock is $51 and has a P/E of 46. This market correction is good. Its giving me chances to get the top stocks. I have a list of 20-25 stocks that I feel are the best growth stocks to own. We already have most of them, its time for me to get the rest. Today I will purchase Lululemon (LULU) in the Growth Portfolio and Aggressive Growth Portfolio. |

One Year Chart |

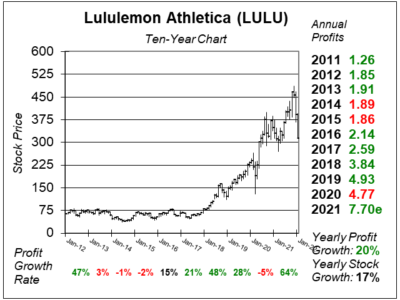

Note these charts and tables were doe on July 20th when the stock was $64. Today, LULU is $51. Note these charts and tables were doe on July 20th when the stock was $64. Today, LULU is $51.

LULU’s P/E jumped from 44 to 58 since last quarter. At that price, the stock had limited upside unless it knocks the cover off the ball in coming quarters. |

Earnings Table |

The trouble with that is LULU didn’t knock the cover off the ball last quarter, it only beat by 3 cents (after accounting for the recent stock split). Here’s the beat’s the last four quarters: The trouble with that is LULU didn’t knock the cover off the ball last quarter, it only beat by 3 cents (after accounting for the recent stock split). Here’s the beat’s the last four quarters:

4QtrsAgo $0.15 3QtrsAgo $0.18 2QtrsAgo $0.32 LastQtr $0.22 Last quarter was the smallest beat in more than a year, yet the stock’s P/E has inflated from 44 last quarter to 58 now. It seems to me the stock is ahead of itself, and has investors buying it who aren’t aware of these facts. The headlines read good news: inventory is low because people keep buying all that’s on the shelves. Same store sales rose 16%, which is awesome. The same store sales figure will add fuel to LULU’s fire. |

Fair Value |

LULU could be sitting at the same price a year from now if it gets a 45 P/E and estimates stay the same. I think a 45 P/E is fair, and last quarter the stock market thought a 44 one was fair. LULU could be sitting at the same price a year from now if it gets a 45 P/E and estimates stay the same. I think a 45 P/E is fair, and last quarter the stock market thought a 44 one was fair. |

Bottom Line |

Lululemon (LULU) is one of the best companies in the world. The stock is one of the top tier an investor can own. Lululemon (LULU) is one of the best companies in the world. The stock is one of the top tier an investor can own.Lululemon is a must own stock for me. Its one of the worlds fastest growing retailers and during 2009-present it has been a top-ten growth stock (imho). During the run I had few chances to get in because the P/E was too high. Today I will purchase Lululemon (LULU) in the Growth Portfolio and Aggressive Growth Portfolio. |