Stocks were rather flat today after a big rally last week. Today, the S&P 500 was down slightly, 0.3%, while the NASDAQ composite declined a bit as well (-0.7%).

Stocks were rather flat today after a big rally last week. Today, the S&P 500 was down slightly, 0.3%, while the NASDAQ composite declined a bit as well (-0.7%).

The S&P 500 closed at 3900, which is a good number. Bears think the market should be between 3000 and 3500. The recent trading range is 3600 to 4200, and this is right in the middle.

The current theme of the stock market is:

- Stocks were in a ferocious decline this month, then rallied last week as key commodity prices such as oil, wheat, and copper declined.

- Professional investors understand a recession is coming, but it could be short lived as a decline in prices and softening demand for purchasing (Target and Walmart had bad quarters) could mean lower inflation and perhaps the Federal Reserve lowering interest rates.

Tweet of the Day

Food Inflation Relief Is Within Sight as Crops and Crude Pull Back

–

Improving supply outlook is pushing down lofty grain prices.https://t.co/0hGbJOFMtj via @business— Ophir Gottlieb (@OphirGottlieb) June 27, 2022

Chart of the Day

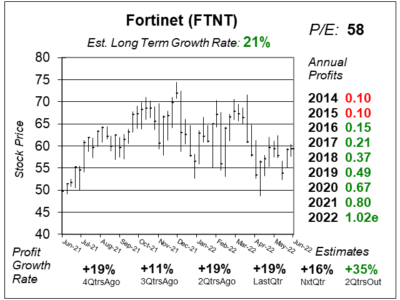

Today’s chart is of Fortinet (FTNT) which is seeing demand outstrip supply for its cybersecurity hardware and software.

Today’s chart is of Fortinet (FTNT) which is seeing demand outstrip supply for its cybersecurity hardware and software.

FTNT’s business is great, but the stock’s P/E is a little high (considering we are in a Bear Market and valuations have gotten reduced). I remember when this stock had a P/E in the 30s back in 2020, which you can see here.

Notice in this chart that profit growth is expected to accelerate to 35% two qtrs from now. That might cause the stock to rally.

My Fair Value on FTNT is 55 x 2022 earnings estimates of $1.02 = $$56 a share.

With the stock at $59, I think the FTNT is fairly valued here.

Fortinet is on the radar for the Growth Portfolio. I’d like to buy the stock on the next stock market dip.

I like the steady growth the company has been delivering over the years, and the Estimated Long Term Growth Rate is above 20% a year (21%).