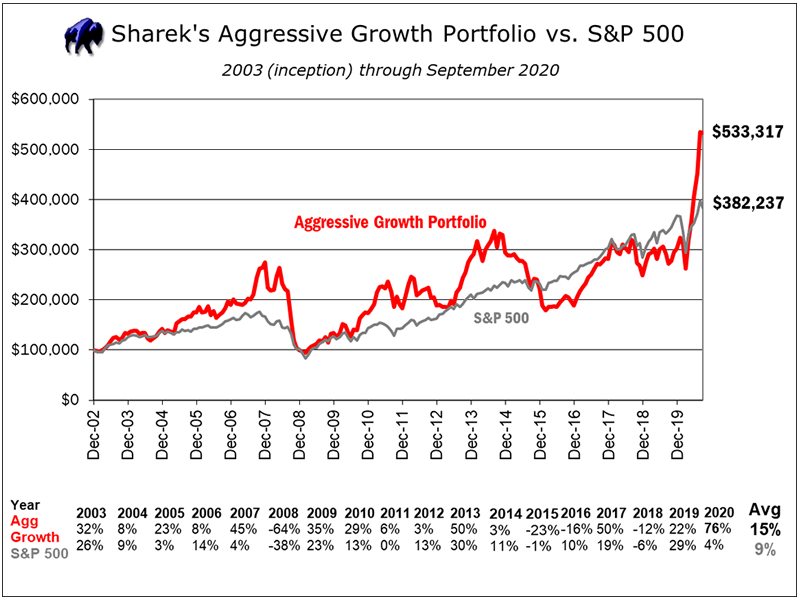

Growth of $100,000 Investment Since Inception

Objective & Strategy

Sharek’s Aggressive Growth Stock Portfolio invests in companies with Estimated Long Term Growth Rates of 15% or greater.

- Portfolio Style: Separately Managed Accounts

- Number of Positions: 15 to 25

- Equity Style: Large, Medium and Small Cap Growth

- Minimum Account Size: $50,000

- Annual Management Fee: 2% to 3%

- Incentive Fee: None

Top Holdings as of June 30, 2020

| Rank | Stock | % |

| 1 | Tesla (TSLA) | 9.6% |

| 2 | The Trade Desk (TTD) | 8.7% |

| 3 | Sea (SE) | 6.8% |

| 4 | Zoom Video | 6.7% |

| 5 | Amazon (AMZN) | 5.9% |

| 6 | Microsoft (MSFT) | 3.2% |

| 7 | NVIDIA (NVDA) | 2.8% |

| 8 | ServiceNow (NOW) | 6.8% |

| 9 | Adobe Systems (ADBE) | 3.7% |

| 10 | Livongo Health (LVGO) | 3.6% |

Sector Allocation as of June 30, 2020

| Technology | 52% |

| Retail & Travel | 17% |

| Cash | 16% |

| Industrials & Energy | 10% |

| Healthcare | 4% |

| Financial | 2% |

| Food & Necessities | 0% |

About David Sharek

David Sharek is stock portfolio manager for Shareks Stock Portfolios and founder of The School of Hard Stocks.

David’s flagship Growth Stock Portfolio has returned 13% per year since inception vs. 9% in the S&P 500 (2003-2019). He‘s had four years of +40% returns in his 17 years as a portfolio manager.

Sharek is author of the book The School of Hard Stocks — How to Get Your Portfolio Back to Even, which can be found on Amazon.