It looks like inflation has just peaked and is heading lower, and that could be great news for stocks.

It looks like inflation has just peaked and is heading lower, and that could be great news for stocks.

Overall, it looks as though inflation could decline from 8.2% to around 4.5% by mid 2023.

In this image is monthly CPI data going back to the beginning of 2021. I highlighted the good numbers in green, and the bad ones in red.

Notice:

- In the 2022 column, note inflation has been tame the past three months (Jul-Sep). We may be in a new era of lower inflation.

- If lower inflation continues, starting next month, “tame” inflation figures will be compared against high figures from 2021. So if Oct 2022’s CPI is low, inflation could decline by a half-percent of more, as the +9% number drops off the year-over-year (YOY) total.

- Look at those big figures from Oct 2021 – March 2022. YOY infation could decline each month through March.

- But the kicker is those May/June fugures. Once those 1.0% and 1.3% figures fall off the YOY figure, we could be at ~4.5% annual inflation.

In the end, what’s bee causing the stock market selloff is high inflation. Now with inflation set to come down in miid-November, stocks are set to rally.

Today we’ll look at where the market could be headed, and some stocks from my Conservative Growth Portfolio. Some stocks have been good, some have been bad. It’s the blend that makes it a diversified portfolio.

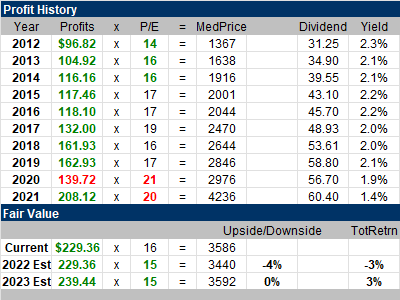

Here’s a table of the S&P 500 done on September 30th. Investors feel the S&P 500 index is the best baramoter for the American stock market (not the Dow Jones Industrial Average).

Here’s a table of the S&P 500 done on September 30th. Investors feel the S&P 500 index is the best baramoter for the American stock market (not the Dow Jones Industrial Average).

This table shows what the median price of the “stock market” in prior years during the past decade (MedPrice).

Also, the S&P 500’s profits are shown in the (Profits).

Stock markets are often guaged on the number of years of profits the index is selling for (P/E).

In the last decade, the “stock market” often sold for ~17x profits, or a P/E of 17. I usually have my Fair Value P/E between 17 and 19.

Today, we are in a Bear Market with high inflation within a recession, thus the P/E should be lower. My “bearish” estimate is the market should have a P/E of 15.

It seems like the stock market is fairly valued here, and could hang around this level into 2023. So I don’t see an undervalued stock market. I think it’ll be a stock pickers market.

Now let’s look at some stocks in my Conservative Growth Portfolo. Some have been good recently, some have been bad, but I think they’re all great long-term investments. These are the stocks to collect.

I’m a collector of stocks. I think holding good stocks for the long-tem is the best way to grow your money.

I’m a collector of stocks. I think holding good stocks for the long-tem is the best way to grow your money.

Some of these stocks we’re looking at have had tough times. People want to sell. But when you look at these ten-ear charts, it brings the investment into a better perspective.

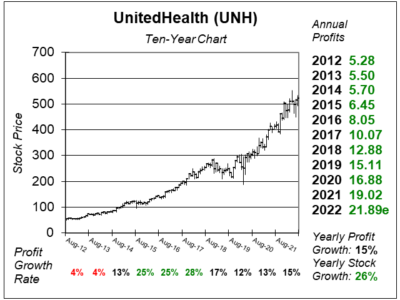

One stock that has continued to perform well through the downturn is UnitedHealth (UNH), the largest health insurer in America.

UNH is part of my Conservative Growth Portfolio. It’s been a good stock for a while.

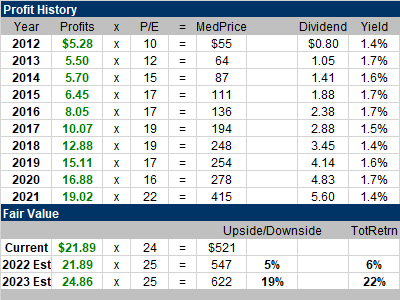

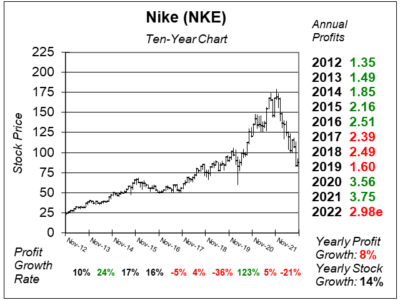

A lot of the market’s selloff is due to COVID-19. Take Nike (NKE) for example. Here’s our recent NKE ten-year with the profit history table.

A lot of the market’s selloff is due to COVID-19. Take Nike (NKE) for example. Here’s our recent NKE ten-year with the profit history table.

During the past two years, companies were having supply-chain and logistics issues. Nike had factories in China, and some were shut down for periods due to COVID.

Also, shipments to the US were taking a while to arrive. Sneaker stores had to order inventory months in advance.

Today, factories are operating again and logistic issues have aleviated. So those sneaker stores might have been getting old orders and new orders delivered at the same time. Then these stores wouldn’t need to order new inventory.

Last qtr, Nike had inventory spike 44% and management cut prices to sell it, resulting in lower profits. The stock fell on the news. I see this as a short-term issue, and stock is a deal here.

NKE is part of my Conservative Growth Portfolio It’s been a bad stock the past year.

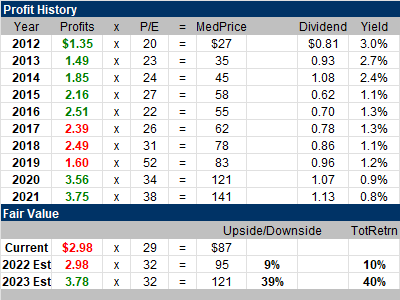

Dollar General (DG) is a safe stock for a recession. People are trying to save money as high inflation is really hurting the lower-middle class.

Dollar General (DG) is a safe stock for a recession. People are trying to save money as high inflation is really hurting the lower-middle class.

Founded in 1939, Dollar genral operates 18,000 locations throguhout the US. The stores sell food, snacks, beauty supplies, clothes, housewares and seasonal items at low prices.

DG is evolving from a dollar store to a local Walmart mini-me. Management has been renovating locations to make them newer and more efficient like building distribution centers, adding coolers for more frozen food, introducing fresh produce, and putting in self-checkout machines.

DG is part of my Conservative Growth Portfolio. It’s been a good stock.

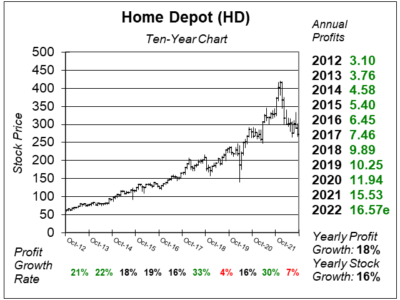

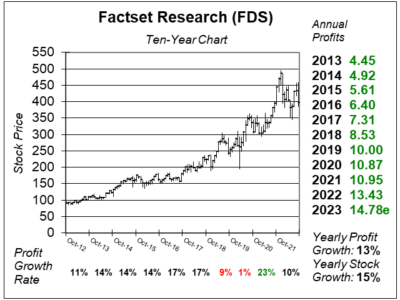

Home Depot (HD) is feeling the effects of the recession, as transactions declined last qtr. But ticket size rose due to price increases.

Home Depot (HD) is feeling the effects of the recession, as transactions declined last qtr. But ticket size rose due to price increases.

Last qtr, each of the company’s 19 regions delivered growth versus last year. Business was strong in all departments. The company continued to see strong demand for home improvement projects, with growth from both Pro and DIY customers. Pro demand is very strong, but there was some “seasonal weakness” in DIY.

HD stock has gotten clobbered. Would you sell it here? Looking at the ten-year chart, I say buy.

HD is part of my Conservative Growth Portfolio. It’s been a bad stock recently.

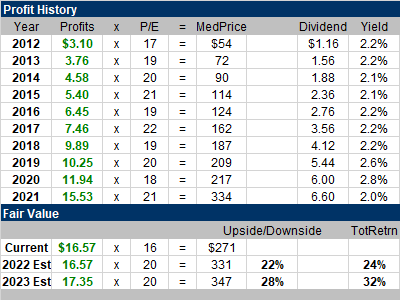

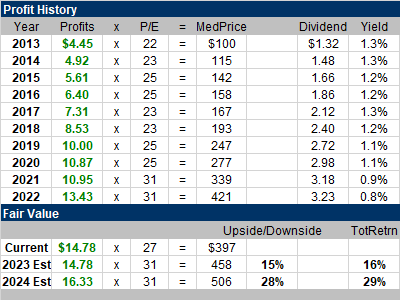

FactSet Research (FDS) offers a financial software platrofm that investment guys like me use to get info and data from.

FactSet Research (FDS) offers a financial software platrofm that investment guys like me use to get info and data from.

FDS is a high quality stock with 41 consecutive years of revenue growth. Profits have grown every-single year since the company went public in 1996.

The secret to the recipe of growth-every-year is the company sells its software on a subscription basis (which gives it a steady stream of revenues each quarter) and passes along small fee increases each year.

Thus, 5% or so user growth combined with 5% price increases and stock buybacks have made 12% profit growth possible in the past. In my book, 12% profit growth might lead to 12% stock growth (annually).

FDS is part of my Conservative Growth Portfolio. It’s been a flattish stock the past year.

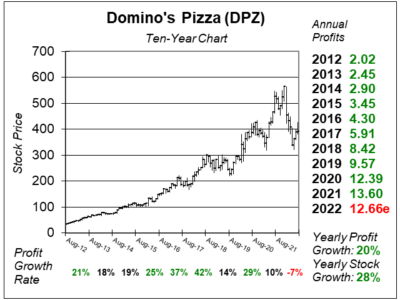

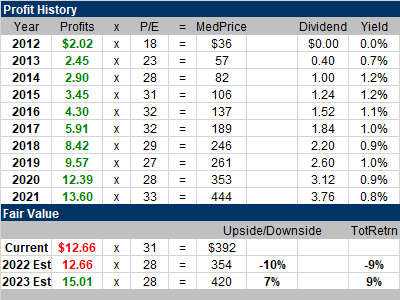

Domino’s (DPZ) was getting a lot of delivery orders during COVID-19. Profits were great in 2020 and 2021.

Domino’s (DPZ) was getting a lot of delivery orders during COVID-19. Profits were great in 2020 and 2021.

Now in 2022, people are eating in restaurants again. So DPZ’s revenue and profits are suffering, as is the stock.

This chart/table is from August when the shares were $392. Today, the stock is $324. Would you sell it now? I wouldn’t.

Think long-term. Soon robots will be making pizzas with automomous vehicles delivering them. Domino’s already has driverless vehicles on the road, which you can see here.

DPZ is part of my Conservative Growth Portfolio. It’s been a poor-performer stock the past year.