Stock (Symbol) |

Chart Industries (GTLS) |

Stock Price |

$223 |

Sector |

| Industrials & Energy |

Data is as of |

| October 31, 2022 |

Expected to Report |

| February 22 |

Company Description |

Chart Industries, Inc. is a manufacturer of engineered cryogenic equipment servicing multiple market applications in the industrial gas and energy industries. Chart Industries, Inc. is a manufacturer of engineered cryogenic equipment servicing multiple market applications in the industrial gas and energy industries.

Its segments include Cryo Tank Solutions, Heat Transfer Systems, Specialty Products and Repair Service & Leasing. Its Cryo Tank Solutions segment supplies bulk, microbulk and mobile equipment used in the storage, distribution, vaporization, and application of industrial gases and certain hydrocarbons. Its Heat Transfer Systems segment supplies engineered equipment and systems used in the separation, liquefaction, and purification of hydrocarbon and industrial gases. Its Specialty Products segment supplies products used in specialty end-market applications, including hydrogen, liquid natural gas, biofuels, CO2 Capture, food and beverage, aerospace, lasers, cannabis and water treatment, among others. Its Repair, Service & Leasing segment provides installation, service, repair, maintenance, and refurbishment of cryogenic products. Source: Refinitiv. |

Sharek’s Take |

As its ticker suggests, Chart Industries (GTLS) makes “gas to liquid systems”. The company manufactures equipment for the liquefaction, transportation, storage, and regasification of gasses, including liquefied natural gas (LNG). And liquefied natural gas export is a big deal right now with the Ukraine/Russia war causing energy disruptions throughout Europe and Asia. China is the world’s top LNG buyer, and will obtain product from Venture Global LNG, which is building a huge export plant in Louisiana. Venture Global is a customer of Chart Industries. In addition, GTLS is a benefactor of the clean energy movement here in the US. The Inflation Reduction Act includes $370 billion for renewable energy. This legislation rewards natural gas companies for addressing methane leaks and fines those who do not. That requires equipment, which Chart can supply. As its ticker suggests, Chart Industries (GTLS) makes “gas to liquid systems”. The company manufactures equipment for the liquefaction, transportation, storage, and regasification of gasses, including liquefied natural gas (LNG). And liquefied natural gas export is a big deal right now with the Ukraine/Russia war causing energy disruptions throughout Europe and Asia. China is the world’s top LNG buyer, and will obtain product from Venture Global LNG, which is building a huge export plant in Louisiana. Venture Global is a customer of Chart Industries. In addition, GTLS is a benefactor of the clean energy movement here in the US. The Inflation Reduction Act includes $370 billion for renewable energy. This legislation rewards natural gas companies for addressing methane leaks and fines those who do not. That requires equipment, which Chart can supply.

Chart Industries is a manufacturer of cryogenic equipment. Cryogenic equipment is used to store substances at very cold temperatures, including liquefied natural gas, hydrogen, CO2 capture, and water. The gas is cooled at -162 degrees celsius, shrinking its volume 600x (source: Shell). Once a gas is liquefied, it uses less space and is easier to transport and store. Chart has 25 global manufacturing locations and 2500 customers, primarily large producers of liquefied natural gas (LNG), chemicals and industrial gasses. Clients include ExxonMobil, Air Products, Samsung, Plug Power and Chick-fil-A. Here’s a breakdown segment growth as of last qtr (with % of revenue):

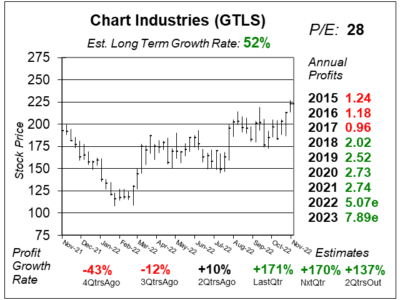

Chart Industries has momentum right now, in its business and its stock price. But the company is cyclical, and needs big LNG projects to keep the momentum going. In the 2015 annual report, management said low oil prices hurt demand for LNG projects. GTLS stock dropped from $24 to $18 that year. Big profits are expected in the coming years. EPS is expected to double in the next two years. The stock has an optimistic Estimated Long-Term Growth Rate of 52% per year and a reasonable P/E of 28. GTLS will be added to the Aggressive Growth Portfolio today. |

One Year Chart |

This stock broke out to a new All-Time high yesterday. Volume was high. That’s bullish! This stock broke out to a new All-Time high yesterday. Volume was high. That’s bullish!

The P/E is 28 and that’s using 2023 profit estimates, as we are in the company’s fiscal Q4 right now. I think the valuation is reasonable. Profits are expected to double in two years, and that would normally justify a high P/E of 40 or more. But this is a cyclical stock, and I don’t think a P/E of 30+ would be prudent. The Est. LTG of 52% is a profit growth estimate, not stock growth. Qtrly profits have gone from bad to great. And triple-digit growth is expected the next two qtrs. That’s positive. |

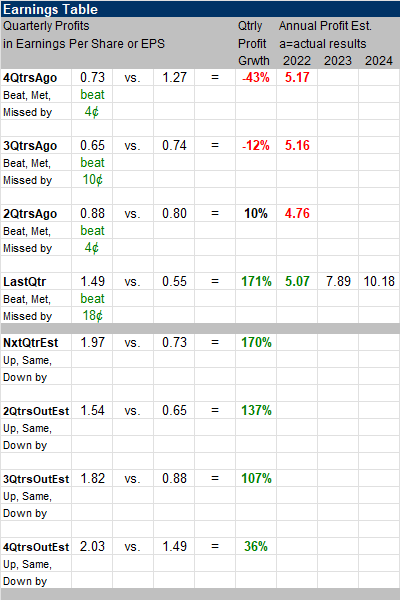

Earnings Table |

Last qtr, Chart Industries delivered 171% profit growth. Profit was $1.49 per share vs. $0.55 a year ago In the prior 3 years, Q3 profits were $0.74, $0.77 and $0.63. So this might be a new era of higher profitability for the company. Revenue grew 26%. Last qtr, Chart Industries delivered 171% profit growth. Profit was $1.49 per share vs. $0.55 a year ago In the prior 3 years, Q3 profits were $0.74, $0.77 and $0.63. So this might be a new era of higher profitability for the company. Revenue grew 26%.

Annual Profit Estimates for 2022 have hovered around $5 the past four qtrs. Note 2024 profit estimates are for ~$10 in profits. Qtrly Profit Estimates look great with 170%, 137%, 107%, and 36% growth expected the next 4 qtrs. These are great growth rates. Next qtr revenue growth is expected to be 35%, which would be accelerating growth from the 26% reported last qtr. That’s good. |

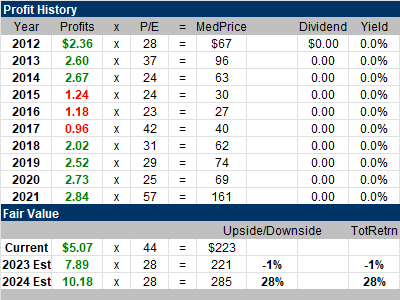

Fair Value |

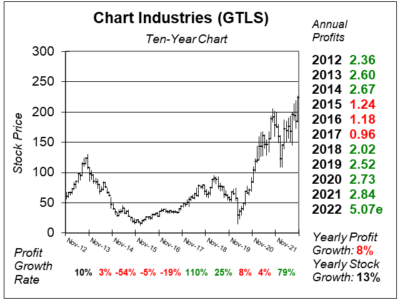

Notice this stock has not had consistent profit growth throughout the years. Still, the company has garnered a fairly high valuation during that time. Notice this stock has not had consistent profit growth throughout the years. Still, the company has garnered a fairly high valuation during that time.

My Fair Value P/E is 28. I think the stock is fairly valued. Note the stock currently has a P/E of 44 based on 2022 profit estimates. The P/E is 28 when we use 2023 estimates. |

Bottom Line |

Chart Industries (GTLS) has had an up-and-down stock history. This chart doesn’t look great, and exemplifies the chart-action of a cyclical stock. Chart Industries (GTLS) has had an up-and-down stock history. This chart doesn’t look great, and exemplifies the chart-action of a cyclical stock.

Right now, Chart has high momentum due to clean energy initiatives in the US and demand for LNG throughout Europe and Asia. But I think this is speculative investment because business is cyclical. GTLS will start at 9th in the Aggressive Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 9 of 17Conservative Stock Portfolio N/A |