Stock (Symbol) |

Global Payments (GPN) |

Stock Price |

$192 |

Sector |

| Financial |

Data is as of |

| July 1, 2021 |

Expected to Report |

| August 2 |

Company Description |

GPN provides payment and digital commerce solutions, including payment solutions for credit cards, debit cards, electronic payments and check-related services. GPN performs a series of services, including authorization, electronic draft capture, file transfers to facilitate funds settlement and certain exception-based, back office support services, such as chargeback and retrieval resolution. Source: Thomson Financial GPN provides payment and digital commerce solutions, including payment solutions for credit cards, debit cards, electronic payments and check-related services. GPN performs a series of services, including authorization, electronic draft capture, file transfers to facilitate funds settlement and certain exception-based, back office support services, such as chargeback and retrieval resolution. Source: Thomson Financial |

Sharek’s Take |

Global Payments FinTech space as its m Global Payments FinTech space as its m

Global Payments is on the cutting edge of small business software with its Global Payments Integrated platform, which makes it easy for retail customers to put point-of-sale software and payment processing all into one easy platform. The company enables merchants to accept credit cards, electronic payments, check and digital based payments at the point of sale, including mobile payments, gift cards and loyalty programs. Global Payments was originally spun off of National Data Corp in 2001 and was a primarily a software company that provided merchants access to credit card companies. Then, Global Payments expanded into the software by subscription model by acquiring software platforms that utilize credit cards (and charge users a monthly fee). GPN’s Merchant software can integrate with Amazon Web Services and Google. With AWS, Global Payment’s wireless point-of-sale terminals can send data right back to the cloud to approve the sale, then have the info kept in data storage with the ability to perform analytics at a later time. And the collaboration with Google will make retail advertising easier. Here’s a brief history of the company’s acquisitions:

Global Payments is a a little-known 20% growers. GPN has a solid Estimated Long Term Growth Rate of 19% per year, and the stock has a little dividend that’s currently 0.4%. This company also has a big stock buyback program. management has bought back $1 billion in stock since the end of last year, and the market cap is currently $57 billion. GPN is part of the Growth Portfolio. The stock has nice upside here. |

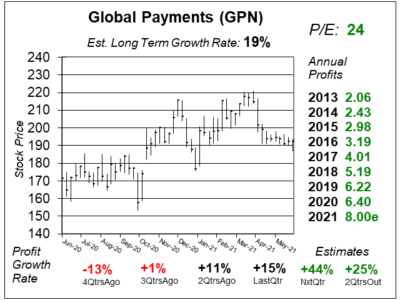

One Year Chart |

GPN sold off after earnings, but the numbers were fine. I just did a research report on another FinTech stock Fiserv, and that stock also peaked around the same time. I was thinking maybe its that the financial stocks sold off around then. But the charts of Paypal, Square, Visa and Mastercard all look good. I think GPN has done well during the last year, consiering profits were weak during the height of COVID. Now, profit growth is expected to be 20% or greater the next 4 qtrs. GPN sold off after earnings, but the numbers were fine. I just did a research report on another FinTech stock Fiserv, and that stock also peaked around the same time. I was thinking maybe its that the financial stocks sold off around then. But the charts of Paypal, Square, Visa and Mastercard all look good. I think GPN has done well during the last year, consiering profits were weak during the height of COVID. Now, profit growth is expected to be 20% or greater the next 4 qtrs.

The Estimated Long-Term Growth Rate of 19% is good. I consider this company to be a 20% grower profit-wise. The P/E of 24 is excellent. Global Payments is an undervalued growth stock. |

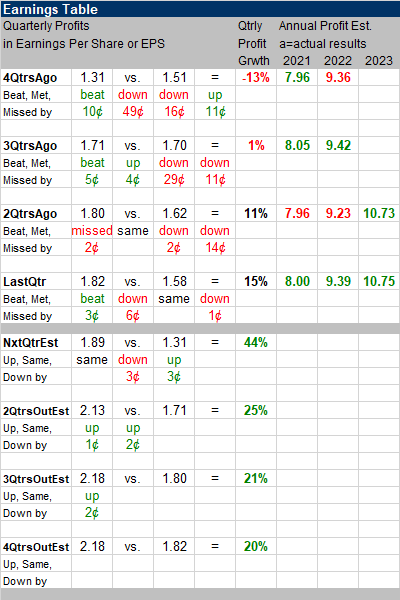

Earnings Table |

Profits increased 15% last qtr and beat estimates of 13%. Revenue growth was Profits increased 15% last qtr and beat estimates of 13%. Revenue growth was

Annual Profit Estimates are slightly higher than last qtr. In the earnings call, management stated it does not expect a recovery in its commercial card business in 2021 as it expects corporate travel to remain depressed. This affects the Issuer Solutions side of the business, which was 24% or company revenue last qtr and had -1% revenue growth year-over-year. The biggest division for GPN 63% of revenue with 4% growth last qtr. Business and Consumer Solutions is the 3rd division with 13% of total revenue and 19% growth. Qtrly profit Estimates of 44%, 25%, 21% and 20%. are very good. Note next qtr has easy comparisons from the year-ago period. |

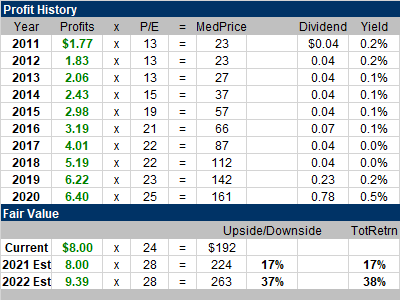

Fair Value |

Notice profits have grown every year during the past decade. That’s nice consistency. My notes show profit growth every year going back to 2005. Notice profits have grown every year during the past decade. That’s nice consistency. My notes show profit growth every year going back to 2005.

My 2021 Fair Value of $224 was almost reached in April, as the stock got just above $220. Now, there’s very good upside of 37% when we look to 2022. |

Bottom Line |

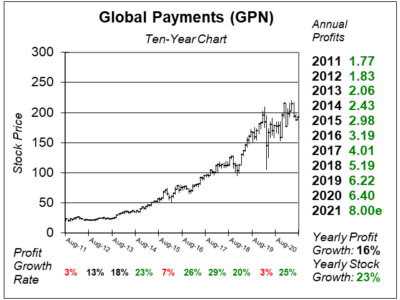

Global Payments (GPN) is like a combo of Visa and MasterCard for payment processing with a little Workday and ServiceNow for the business management software. I love the curve of this ten-year chart. Global Payments (GPN) is like a combo of Visa and MasterCard for payment processing with a little Workday and ServiceNow for the business management software. I love the curve of this ten-year chart.

This is one of the most underappreciated stocks of the past decade. With an estimated long-term growth rate of 19% a year and a P/E of 24, I feel the stock can continue to deliver 20% returns to investors into the future. GPN will stay at 31st in the Growth Portfolio Power Rankings. |

Power Rankings |

Growth Stock Portfolio

31 of 39Aggressive Growth Portfolio N/AConservative Stock Portfolio N/A |