Stock (Symbol) |

Global-E Online (GLBE) |

Stock Price |

$37 |

Sector |

| Technology |

Data is as of |

| February 22, 2022 |

Expected to Report |

| May 16 |

Company Description |

Global-E Online Ltd is an software publisher Israel-based company. It develops cross-borded e commerce plaform Globale which provides localized experinece for merchants and shopers. The platform is built for internationan shoppers to buy seamlessly online and for merchants to sell from, and to, anywhere in the world. Source: Thomson Financial. Global-E Online Ltd is an software publisher Israel-based company. It develops cross-borded e commerce plaform Globale which provides localized experinece for merchants and shopers. The platform is built for internationan shoppers to buy seamlessly online and for merchants to sell from, and to, anywhere in the world. Source: Thomson Financial. |

Sharek’s Take |

Global-E Online (GBLE) is one speculative stock that’s a tough one to hold in a Bear Market for growth stocks. What makes Global-E speculative is the company barely makes a profit (in EPS) and is a very recent IPO, so it doesn’t have a lot of institutional backing that’s been holding the stock for years. Global-E helps e-commerce stores to expand internationally, including following local regulations, offering payment options, and even customer service in the local language. Business is strong, but the stock is not as there are little profits here. Global-E Online (GBLE) is one speculative stock that’s a tough one to hold in a Bear Market for growth stocks. What makes Global-E speculative is the company barely makes a profit (in EPS) and is a very recent IPO, so it doesn’t have a lot of institutional backing that’s been holding the stock for years. Global-E helps e-commerce stores to expand internationally, including following local regulations, offering payment options, and even customer service in the local language. Business is strong, but the stock is not as there are little profits here.

The Global-E platform enables global direct-to-consumer cross-border ecommerce. For merchants, the company removes complexities to doing business Internationally, including calculating import duties and collection, foreign sales tax, and tax recovery for returned goods. At IPO, the company had more than 400 merchants on its platform. The shopper’s experience is localized with the look and interactions of that country’s natural flow when making online purchases, including local messaging in over 25 languages and purchases in more than 100 currencies and 150 payment methods. Prices that shoppers pay include shipping costs, import duties, taxes, and multi-language customer service. In April, Global-E entered into “and exclusive services and partnership” agreement with Shopify to offer customers cross-border solutions on the Shopify platform. Shopify has also taken a stake in the Global-E. Last qtr, the company continued to launch new merchants across main markets such as Givenchy, Sephora Asia, Sennheiser, Boucheron, and Camper. The company also established strategic partnership with Australia Post and offered multi-local support features with the launch of Jabra, a global consumer electronics brand, and Leeds United, a UK football club. Stats from last qtr include:

Revenue growth by merchant outbound region last qtr:

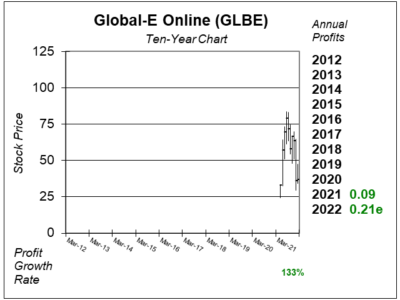

GBLE has had Gross Merchandise Value climb from $6 million in 2015 to $109 million in 2017, $211 million in 2018, $383 million in 2019, and $774 million in 2020. This is clearly one of the fastest growing publicly-traded companies in the world, but I’m concerned that small companies like this will be hurt with the stock market sending speculative stocks lower. Thus, I will sell GLBE from the Aggressive Growth Portfolio. |

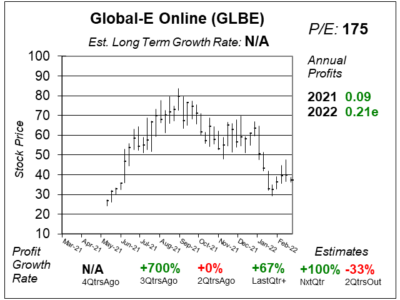

One Year Chart |

This stock was a high-flyer last year, and has since come back down to reality. I think the overhead supply will keep the stock in check for sometime. This stock was a high-flyer last year, and has since come back down to reality. I think the overhead supply will keep the stock in check for sometime.

There is no Est. LTG, and the P/E is high due to expected profits of just $0.210 a share this year. Profit growth is mixed as the company is making pennies per share in profits. |

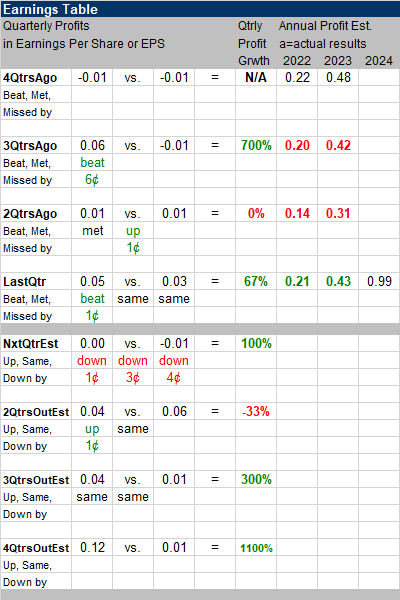

Earnings Table |

Last qtr, Global-E Online delivered profit growth of 67% share and beat analysts’ estimates of 33%. Revenue grew 54%, which is decelerating groth from 77% the prior qtr. Last qtr, Global-E Online delivered profit growth of 67% share and beat analysts’ estimates of 33%. Revenue grew 54%, which is decelerating groth from 77% the prior qtr.

Annual Profit Estimates increased in a big way. Qtrly Profit Estimates are for 100%, -33%, 300% and 1100% profit growth the next 4 qtrs. |

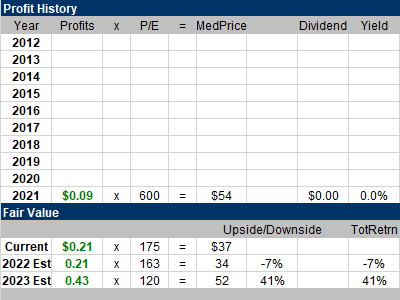

Fair Value |

The last two qtrs, GLBE has sold for 30x and 46x annual revenue estimates. This qtr the stock is selling for 13x sales, and I’m taking my Fair Value down from 35x to 12x sales: The last two qtrs, GLBE has sold for 30x and 46x annual revenue estimates. This qtr the stock is selling for 13x sales, and I’m taking my Fair Value down from 35x to 12x sales:

Current: 2022 Est: 2023 Est: |

Bottom Line |

Global-E Online (GLBE) stock went on a nice (parabolic) run last year and has since turned down. But with little profits it’s hard to get a firm grasp on what the stock its truly worth. Global-E Online (GLBE) stock went on a nice (parabolic) run last year and has since turned down. But with little profits it’s hard to get a firm grasp on what the stock its truly worth.

Although the qtr was good, the stock still seems to be stuck in a category with other high-flying growth stocks that sell off hard when the market goes down. GLBE will be sold from the Aggressive Growth Portfolio. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio N/A |