Stock (Symbol) |

Global-E Online (GLBE) |

Stock Price |

$73 |

Sector |

| Technology |

Data is as of |

| August 29, 2021 |

Expected to Report |

| November 15 |

Company Description |

Global-E Online Ltd is an software publisher Israel-based company. It develops cross-borded e commerce plaform Globale which provides localized experinece for merchants and shopers. The platform is built for internationan shoppers to buy seamlessly online and for merchants to sell from, and to, anywhere in the world. Source: Thomson Financial. Global-E Online Ltd is an software publisher Israel-based company. It develops cross-borded e commerce plaform Globale which provides localized experinece for merchants and shopers. The platform is built for internationan shoppers to buy seamlessly online and for merchants to sell from, and to, anywhere in the world. Source: Thomson Financial. |

Sharek’s Take |

Global-E Online (GBLE) helps ecommerce stores to expand Internationally, including following local regulations, offering payment options, and even customer service in the local language. The stock is one of the market’s hottest, and is breaking out today. GLBE closed at $73 on Friday, and is $80 today (Monday). Global-E Online (GBLE) helps ecommerce stores to expand Internationally, including following local regulations, offering payment options, and even customer service in the local language. The stock is one of the market’s hottest, and is breaking out today. GLBE closed at $73 on Friday, and is $80 today (Monday).

The Global-E platform enables global direct-to-consumer cross-border ecommerce. For merchants, the company removes complexities to doing business Internationally, including calculating import duties and collection, foreign sales tax, and tax recovery for returned goods. At IPO, the company had more than 400 merchants on its platform. The shopper’s experience is localized with the look and interactions of that country’s natural flow when making online purchases, including local messaging in over 25 languages and purchases in more than 100 currencies and 150 payment methods. Prices that shoppers pay include shipping costs, import duties, taxes, and multi-language customer service. New launches last qtr include Tag Heuer, Sephora, and Rimowa, which are all part of LVMH. Expansions of existing merchants into new markets last qtr include La Perla, which added more markets and went live with La Perla Beauty, its sister brand. Clobal-E launched its first Asia Pacific based merchant last qtr, Theory Hong Kong. The company also opened a new office in Tokyo. In April, Global-E entered into “and exclusive services and partnership” agreement with Shopify to offer customers cross-border solutions on the Shopify platform. Shopify has also taken a stake in the Global-E. Stats from last qtr include:

Revenue growth by merchant outbound region last qtr:

GBLE has had Gross Merchandise Value climb from $6 million in 2015 to $109 million in 2017, $211 million in 2018, $383 million in 2019 and $774 million in 2020. This is clearly one of the fastest growing publicly-traded companies in the world. Investors are loving the stock. But profits are around $0 right now, so this is a speculative investment. GLBE was added to the Aggressive Growth Portfolio last qtr at ~$44. |

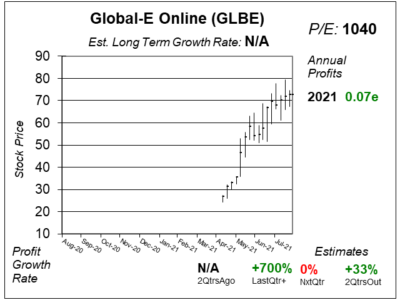

One Year Chart |

The shares opened at $24 in May and was $73 when I did these charts/tables last night. Then BOOM the stock jumped to $80 today (with the market set to close within an hour). Today is a breakout day, a perfect time to buy. Keep in mind this is a speculatie stock. The shares opened at $24 in May and was $73 when I did these charts/tables last night. Then BOOM the stock jumped to $80 today (with the market set to close within an hour). Today is a breakout day, a perfect time to buy. Keep in mind this is a speculatie stock.

There is no Est. LTG, and the P/E is high due to expected profits of just $0.02 a share this year. Profit growth of 700% is misleading as the company had a slight loss a year ago, and that made comparisons easy. |

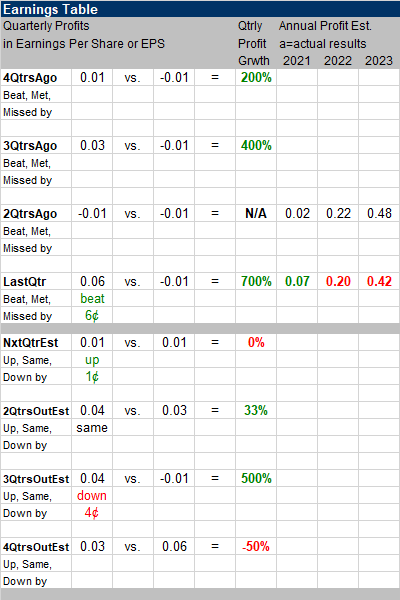

Earnings Table |

Last qtr, GBLE delivered a profit of $0.06, which bet estimates of $0.06. Profit growth was 700% as the company lost a penny in the year-ago period. Revenue grew 92%, which less than the 134% the company did 2QtrsAgo. Service fees (37% of revenue) increased 104%. Fulfillment services (63% of revenue) grew 86%. America continues to be a fast-growing market with 131% outbound revenues during the qtr, but it wasn’t as fast as the Europe, which delivered 218% growth. GMV rose 95%, which was decelerating growth from 135% 2QtrsAgo. Last qtr, GBLE delivered a profit of $0.06, which bet estimates of $0.06. Profit growth was 700% as the company lost a penny in the year-ago period. Revenue grew 92%, which less than the 134% the company did 2QtrsAgo. Service fees (37% of revenue) increased 104%. Fulfillment services (63% of revenue) grew 86%. America continues to be a fast-growing market with 131% outbound revenues during the qtr, but it wasn’t as fast as the Europe, which delivered 218% growth. GMV rose 95%, which was decelerating growth from 135% 2QtrsAgo.

Annual Profit Estimates increased slightly for 2021, but most of that gain is because the company beat the street lat qtr. 2022 and 2023 estimates fell back slightly. Qtrly Estimates are for the company to make slight profits in the upcoming qtrs. Qtrly gowth figures are erratic. And if GLBE continues to beat the street, triple-digit profit growth could continue. Note if the company beats the stret by just a penny next qtr, that would be 100% profit growth ($0.02 vs. $0.01). |

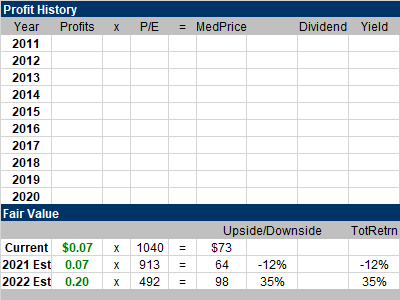

Fair Value |

My Fair Value of 30x annual revenue estimates last qtr was way off. The stock was selling for 30x revenue at the time and I felt that was fair. It wasn’t as the stock has soared since. My Fair Value of 30x annual revenue estimates last qtr was way off. The stock was selling for 30x revenue at the time and I felt that was fair. It wasn’t as the stock has soared since.

This qtr the stock is selling for 46x sales, and I’m taking my Fair Value up to 45x. Will that be enough? With the stock up another 10% today, it doesn’t look like it: Current (as of yesterday): 2021 Est: 2022 Est: |

Bottom Line |

Global-E Online could have great growth opportunity ahead as merchants expand Internationally. When I bought in originally, I was quite surprised with the low market cap of just $6 billion. Perhaps the growht opportunity in market cap is why the stock is climbing so rapidly. Global-E Online could have great growth opportunity ahead as merchants expand Internationally. When I bought in originally, I was quite surprised with the low market cap of just $6 billion. Perhaps the growht opportunity in market cap is why the stock is climbing so rapidly.

GLBE is breaking out today after a solid earnings report earlier this month. Since the stock is breaking out, I think it continues higher, but the valuation is getting high, so I don’t think this stock will go on a huge run at this time. GLBE is part of the Aggressive Growth Portfolio. The stock stays at 16th in the Power Rankings. |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio 16 of 36Conservative Stock Portfolio N/A |