Stock (Symbol) |

Fortinet (FTNT) |

Stock Price |

$331 |

Sector |

| Technology |

Data is as of |

| December 20, 2021 |

Expected to Report |

| February 2 |

Company Description |

Fortinet, Inc. is a network security company. The Company provides cyber security solutions to a range of enterprises, service providers and government organizations across the world. Its network security solution consists of FortiGate physical, virtual machine and cloud platforms, which provide integrated security and networking functions to protect data, applications and users from network-and content-level security threats. The Company’s product offerings consist of its FortiGate product family, along with its FortiManager central management and FortiAnalyzer central logging and reporting product families. Its cybersecurity platform includes a range of products, which include its FortiMail e-mail security, FortiSandbox advanced threat protection (ATP), FortiWeb Web application firewall, FortiDDos and FortiDB database security appliances, as well as its FortiClient endpoint security software, FortiAP secure wireless access points and FortiSwitch secure switch connectivity products. Source: Thomson Financial Fortinet, Inc. is a network security company. The Company provides cyber security solutions to a range of enterprises, service providers and government organizations across the world. Its network security solution consists of FortiGate physical, virtual machine and cloud platforms, which provide integrated security and networking functions to protect data, applications and users from network-and content-level security threats. The Company’s product offerings consist of its FortiGate product family, along with its FortiManager central management and FortiAnalyzer central logging and reporting product families. Its cybersecurity platform includes a range of products, which include its FortiMail e-mail security, FortiSandbox advanced threat protection (ATP), FortiWeb Web application firewall, FortiDDos and FortiDB database security appliances, as well as its FortiClient endpoint security software, FortiAP secure wireless access points and FortiSwitch secure switch connectivity products. Source: Thomson Financial |

Sharek’s Take |

Fortinet (FTNT) has very strong business momentum right now, said its CEO in last qtr earnings call, as according to FortiGuard Labs, the number of unique ransomware detections per week increased more than 10x from July 2020 to June 2021. Last qtr, the company delivered billings growth of 42%. That’s exceptional. 2QtrsAgo the company had 35% billings growth, and that was the highest figure in five years. The increased need for cybersecurity is evident in Fortinet’s billings, which have increased from 20% to 27%, 35%, and 42% the past four qtrs. And large Enterprise customers are leading growth as Global G2000 billing growth climbed more than 50%, with accelerated growth in each of the last three qtrs. Fortinet (FTNT) has very strong business momentum right now, said its CEO in last qtr earnings call, as according to FortiGuard Labs, the number of unique ransomware detections per week increased more than 10x from July 2020 to June 2021. Last qtr, the company delivered billings growth of 42%. That’s exceptional. 2QtrsAgo the company had 35% billings growth, and that was the highest figure in five years. The increased need for cybersecurity is evident in Fortinet’s billings, which have increased from 20% to 27%, 35%, and 42% the past four qtrs. And large Enterprise customers are leading growth as Global G2000 billing growth climbed more than 50%, with accelerated growth in each of the last three qtrs.

Fortinet is a one-stop-shop that can handle all the cybersecurity needs for organizations. Many companies utilize multiple cybersecurity vendors to handle different tasks within the organization. Then the different systems have to be patched together to work together. Fortinet delivers hardware, software, and technical support for a range of offerings for cybersecurity. And now the company offers firewall-based Zero Trust Network Access. For those not familiar, Zero Trust is a concept that everyone (or everything) trying to connect to the company network must be verified before entering. The majority of Fortune 100 companies are Fortinet customers and the company even works with Interpol to identify cyber thieves around the world. The company derives its revenue from a mix of product sales, security subscription services, and technical support:

FTNT isn’t a flashy high-octane cyber stock like Zscaler, Crowdstrike or even Palo Alto Networks. Still, I like this stock as I think its one of the safest in the cybersecurity field due to its ballance. And Fortinet is no slouch with cybersecurity. In 2021, Gartner recognized Fortinet’s Secure SD-WAN as the leader in the 2021 Majic Quadrant for WAN Edge Infrastructure. The stock has an Estimated Long-Term Growth Rate of 17%, which seems too low to me. Although the company doesn’t pay a dividend, management does buy back stock, $109 million last qtr. Fortinet is currently one of the leading stocks in the Conservative Growth Portfolio. Government contracts, Zero Trust, and 5G give the company growth opportunity in the years ahead. |

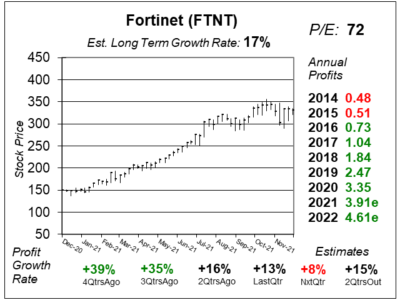

One Year Chart |

FTNT recently went from $125 to $300 within a year, and is now digesting those gains as it builds a new base. Also, the stock’s P/E has soared from 35 to 72 the last 4 qtrs, which was waranted as business is booming. Since I started following the stock, the P/E has gone from 52 to 39, 35, 49, 66, 77, and now 72. FTNT recently went from $125 to $300 within a year, and is now digesting those gains as it builds a new base. Also, the stock’s P/E has soared from 35 to 72 the last 4 qtrs, which was waranted as business is booming. Since I started following the stock, the P/E has gone from 52 to 39, 35, 49, 66, 77, and now 72.

Analysts have an Estimated Long-Term Growth Rate of just 17% a year on this stock. I think this company seems like a 25% to 30% profit grower. Qtrly profit growth and profit estimates are poor as the company has to spend on infrastructure to keep up with strong billings. |

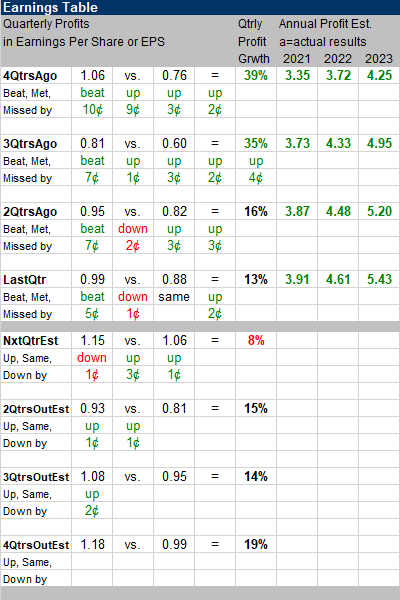

Earnings Table |

Last qtr, Fortinet reported 13% profit growth and surpassed expectations of 7% growth. Revenue increased 33%, which was accelerated growth from 30% 2QtrsAgo. Service revenue (FortiGuard and FortiCare) was 61% of company revenue and grew 24%. Product revenue (FortiGate and non-Fortigate hardware appliances) was 39% of revenue and achieved 51% growth which was the highest in FTNT’s 12 years as a public company. FortiGate entry-level posted 60% sales growth while high-end solutions delivered 57% sales growth. Sales performance was driven by very strong momentum and adoption of Secure SD-WAN, 5G hybrid SD-Branch, and cloud-based SASE solutions. The number of deals over $1 million increased over 70% to 83 with Secure SD-WAN deals more than doubling to 19. Last qtr, Fortinet reported 13% profit growth and surpassed expectations of 7% growth. Revenue increased 33%, which was accelerated growth from 30% 2QtrsAgo. Service revenue (FortiGuard and FortiCare) was 61% of company revenue and grew 24%. Product revenue (FortiGate and non-Fortigate hardware appliances) was 39% of revenue and achieved 51% growth which was the highest in FTNT’s 12 years as a public company. FortiGate entry-level posted 60% sales growth while high-end solutions delivered 57% sales growth. Sales performance was driven by very strong momentum and adoption of Secure SD-WAN, 5G hybrid SD-Branch, and cloud-based SASE solutions. The number of deals over $1 million increased over 70% to 83 with Secure SD-WAN deals more than doubling to 19.

Billings jumped 42% and exceeded record $1 billion mark for the first time. Utilities, manufacturing, transportation, construction and other sectors that haven’t consistently been in FTNT’s top five had combined billings growth of 68%. FortiGate billings represented 70% of company billings. Global G2000 billing growth climbed more than 50% with growth accelerating the past three consecutive qtrs. Annual Profit Estimates continue to climb. Qtrly Estimates show 8%, 15%, 14%, and 19% profit growth is expected the next 4 qtrs. I believe the company will continue to beat the street. For next qtr, management forecasts capital expenditures of around $180 million, much higher than last qtr’s $69 million. FTNT is investing in building out its facilities and operations infrastructure to support this accelerating growth. That’s why profit growth isn’t as much as revenue growth right now. |

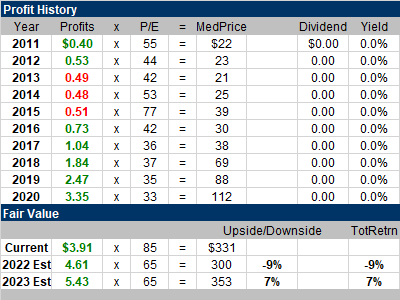

Fair Value |

Years-ago, Fortinet spent on adjusting its products for a cloud computing environment. This caused annual profits to suffer from 2013 to 2015. Now those investments are paying off. Profits hit new All-Time highs in 2016 and haven’t looked back since. Note, this stock was a great value in years past when the P/E was in the 30s. Now, investors see this excellent execution and have pushed the P/E higher. This was one of the best earnings calls I’ve seen this qtr. I’m blown away with all this great data, and had to edit some of it out to fit the article. My Fair Value P/E jumps from 60 to 85. Years-ago, Fortinet spent on adjusting its products for a cloud computing environment. This caused annual profits to suffer from 2013 to 2015. Now those investments are paying off. Profits hit new All-Time highs in 2016 and haven’t looked back since. Note, this stock was a great value in years past when the P/E was in the 30s. Now, investors see this excellent execution and have pushed the P/E higher. This was one of the best earnings calls I’ve seen this qtr. I’m blown away with all this great data, and had to edit some of it out to fit the article. My Fair Value P/E jumps from 60 to 85. |

Bottom Line |

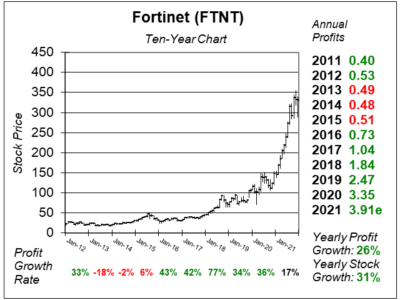

Fortinet (FTNT) has a nice ten-year chart. The last four years have been very good. But the arch has gotten higher in the last year as the P/E rose from 35 to 72 (on forward-year earnings estimates). You can view our one-year charts from FTNT here. Fortinet (FTNT) has a nice ten-year chart. The last four years have been very good. But the arch has gotten higher in the last year as the P/E rose from 35 to 72 (on forward-year earnings estimates). You can view our one-year charts from FTNT here.

With weekly randsomeware detections up 10x in a 12-month period, companies and governments alike are signing up for increased cybersecurity. FTNT’s management sees the current situation as a supply challenge, not a demand challenge, and that tells me business is booming. FTNT moves up from 12th to 9th in the Conservative Growth Portfolio Power Rankings. I should have also put the stock in the Growth Portfolio earlier, but I have Palo Alto Networks (PANW) and Cloudflare (NET) there instead. NET is also in the Aggressive Growth Portfolio, along with a slew of other cybersecurity stocks including Zscaler (ZS), Crowdstrike (CRWD), SentinelOne (S), and Okta (OKTA). |

Power Rankings |

Growth Stock Portfolio

N/AAggressive Growth Portfolio N/AConservative Stock Portfolio 9 of 37 |